Intuit (INTU) Hosts Investor Day, Reiterates Q1 & FY24 Outlook

Intuit INTU reiterated its first-quarter and full-fiscal 2024 outlook in conjunction with the Investor Day presentation, which was held on Sep 28, 2023.

For the first quarter of fiscal 2024, Intuit continues to expect revenues to grow between 10% and 11% on a year-over-year basis. GAAP and non-GAAP earnings for the quarter are estimated in the range of 15-21 cents per share and $1.94-$2 per share, respectively.

For fiscal 2024, the business and financial management solution provider expects revenues in the band of $15.890-$16.105 billion, indicating year-over-year growth of 11-12%.

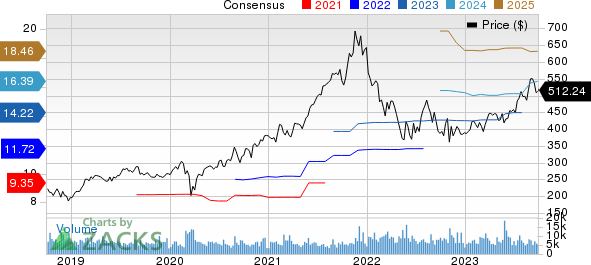

Intuit Inc. Price and Consensus

Intuit Inc. price-consensus-chart | Intuit Inc. Quote

The operating income, for fiscal 2024, is anticipated in the range of $3.615-$3.720 billion on a GAAP basis and $6.155-$6.260 billion on a non-GAAP basis. For fiscal 2024, GAAP earnings per share are expected in the range of $9.37-$9.67. Non-GAAP earnings are still projected between $16.17 per share and $16.47 per share, indicating a year-over-year increase of 12-14%.

Intuit anticipates revenue growth across all of its business segments during fiscal 2024. Sales at its Small Business and Self-Employed Group division are projected to increase in the 16-17% band, the Consumer Group business unit is likely to register 7-8% growth. ProTax Group revenues are expected to be up 3-4%, while Credit Karma Group revenues are expected to be down 3% to up 3% on a year-over-year basis.

In the Small Business and Self-Employed segment, INTU is benefiting from the robust growth in its online ecosystem revenues, which increased by 21% during the fourth quarter of 2023 and 30% during fiscal 2023. This growth is mainly driven by Quickbooks' online accounting revenues, which increased by 22% in the fourth quarter of 2023 and by 26% during fiscal 2023.

Quickbooks Online Services grew by 20% in the fourth quarter of 2023, driven by payroll, Mailchimp and payments. The growth in payroll can be attributed to an increase in the customer base and the customers’ shift toward high-end offerings. Mailchimp revenues surged due to higher effective prices and growth in paying customers. Meanwhile, the growth in payments was a result of an increase in the total payment volume per customer, driven by the expanding customer base.

In fiscal 2023, other segments like Consumer Group and ProTax Group earned revenues of $4.1 billion and $561 million, respectively. In Fiscal 2023, Consumer Group and ProTax Group revenues increased by 6% and 3%, respectively.

INTU is benefiting from strong momentum in solid professional tax revenues. The TurboTax Live offering is also driving growth in the Consumer tax business. Solid momentum in the company’s lending product, QuickBooks Capital, is a positive. Moreover, the company’s strategy of shifting its business to cloud-based subscription model will help generate stable revenues.

Nonetheless, challenging macroeconomic environment is likely to hurt small businesses, thereby posing risks for Intuit’s top-line growth. Additionally, higher costs and expenses due to increased investments in marketing teams are likely to continue impacting INTU’s bottom-line results in the near term.

Zacks Rank & Stocks to Consider

Currently, Intuit carries a Zacks Rank #3 (Hold). Shares of Intuit have returned 32.3% year to date.

Some better-ranked stocks in the broader technology sector include Splunk SPLK, Asure Software ASUR and NVIDIA Corporation NVDA, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SPLK's third-quarter fiscal 2024 earnings has been revised upward by 34 cents to $1.73 per share in the past 60 days. For fiscal 2024, earnings estimates have increased by a penny to $3.77 per share in the past 7 days.

Splunk’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 154.9%. Shares of SPLK have rallied 70.2% year to date.

The Zacks Consensus Estimate for Asure Software’s third-quarter 2023 earnings has been revised to a penny northward to 6 cents per share over the past 30 days. For 2023, earnings estimates have moved 3 cents north to 54 cents per share in the past 30 days.

Asure's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 676.4%. Shares of ASUR have gained 1.6% year to date.

The Zacks Consensus Estimate for NVIDIA's third-quarter fiscal 2024 earnings has been revised upward by 8 cents to $3.32 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by 21 cents to $10.67 per share in the past 30 days.

NVIDIA’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters, while missing on one occasion, the average surprise being 9.8%. Shares of NVDA have surged 195% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report