International Paper (IP) Hits 52-Week High: What's Driving It?

Shares of International Paper IP scaled a new 52-week high of $46.10 on May 24, before ending the session slightly lower at $45.46. The stock has been climbing since the announcement of the DS Smith DITHF acquisition and an optimistic outlook for the second quarter of 2024. Additionally, reports that Suzano SUZ has approached IP with a potential all-cash offer (which was subsequently confirmed by SUZ on May 22) have further boosted the share price.

IP has a market capitalization of $15.8 billion and carries a Zacks Rank #3 (Hold), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

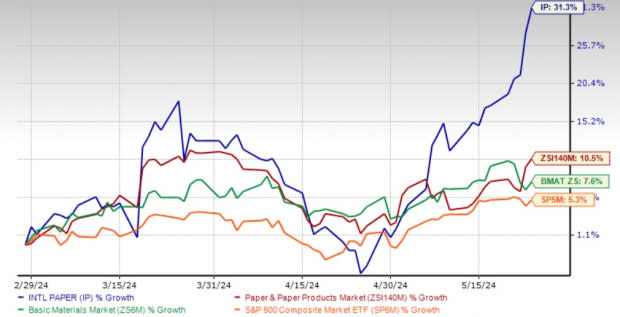

Shares of International Paper have gained 31.3% in the past three months compared with the industry’s 10.5% growth. The Basic Materials sector and S&P 500 have meanwhile moved up 7.6% and 5.3%, respectively, in the same timeframe.

Image Source: Zacks Investment Research

DS Smith Acquisition Deal

International Paper’s shares have gained 26.5% since its announcement on Apr 16 that it has entered into a deal to acquire DS Smith. The combination of International Paper and DS Smith will establish a global leader in sustainable packaging solutions that is well-positioned in attractive and growing markets. It will have a significantly stronger corrugated packaging business in Europe equipped with broader customer offerings.

The buyout is expected to be accretive to IP’s earnings in the first year of closure and provide at least $514 million of pre-tax cash synergies on an annual run-rate basis by the end of the fourth year following the close. The combined company will have a pro forma integrated revenues of approximately $28.2 billion and a combined adjusted EBITDA of approximately $4.1 billion.

Upbeat Q2 Outlook

International Paper reported first-quarter adjusted earnings of 17 cents per share, which slumped 68% year over year. Results were in line with expectations considering the seasonally low volumes, higher Old Corrugated Container costs and the lingering impact of the 2023 Sales Price Index declines. The winter storm in January and the Ixtac box plant fire also weighed on the results.

Despite these setbacks, the Industrial Packaging segment saw volumes of 3,991 thousand short tons, a 2% rise from the first quarter of 2023, primarily driven by a 36% year-over-year increase in containerboard volumes. The Global Cellulose Fibers segment’s volumes were 729 thousand metric tons, up 6% year over year.

The company observed stable to improving demand across all end-use segments. Demand in e-Commerce remained strong while Food and Beverage demand was relatively stable. The fresh food segment continued to benefit from the solid performance across the food service channel and a consumer shift toward make-at-home meals from processed food. The processed food segment, meanwhile, showed signs of improvement driven by promotional deals undertaken to improve sales.

For the Industrial Packaging segment, International Paper expects a sequential improvement in earnings in the second quarter driven by rising volumes, and price and mix due to the prior index movement in North America and higher export prices. For the Global Cellulose Fibers segment, the company expects price and mix to aid earnings by $15 million as a result of prior index movements and stable volumes.

Potential Offer From Suzano

Per reports, Suzano, the world’s largest pulp producer, had expressed verbal interest in an all-cash acquisition of International Paper for around $15 billion. Also, the pulp producer is in talks with potential lenders to finance the transaction, the terms of which would require International Paper to abandon the deal with DS Smith. In a filing dated May 22, Suzano confirmed its interest in International Paper’s assets but stated that no final decision had been made regarding the deal.

Rise in M&As in the Industry

Recently, there has been a surge in merger and acquisition activity within the Paper and Related Products industry as companies are positioning themselves to seize growth opportunities and enhance their packaging and sustainability offerings, among other strategic objectives. One example is the potential combination of International Paper and DS Smith, which has been mentioned above.

Additionally, WestRock’s WRK pending merger with Smurfit Kappa Group Plc will create one of the world’s largest paper and packaging companies with an unmatched geographic reach spanning 42 countries. With the two companies’ highly complementary portfolios and innovative sustainability capabilities as well as the massive geographic reach, the merged entity is likely to be the preferred packaging partner for companies and customers across the globe.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Paper Company (IP) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report

D S SMITH (DITHF) : Free Stock Analysis Report

Suzano S.A. Sponsored ADR (SUZ) : Free Stock Analysis Report