InterDigital (IDCC) Secures Patent License Deal From Google

InterDigital, Inc. IDCC has signed a significant patent license agreement with Google for an undisclosed amount. The new agreement covers a range of devices, including Pixel smartphones, Fitbit wearables and other consumer electronics, integrating InterDigital’s cellular wireless, Wi-Fi and HEVC video patented technologies.

The partnership is set to bolster InterDigital’s position in the tech industry. By licensing its innovative technologies to Google, the company ensures its continued influence and relevance in the rapidly evolving landscape of consumer electronics. The agreement also underscores the importance of InterDigital’s technologies across various consumer devices.

The relevance of this deal extends beyond the immediate benefits for both companies involved. For InterDigital, it signifies a robust validation of its R&D efforts and strengthens its market presence. For Google, the deal implies access to cutting-edge technology that can enhance its product offerings, from smartphones to wearables and beyond.

From an industry perspective, the partnership highlights the critical role of innovation and intellectual property in driving technological advancements. As the market for connected devices continues to grow, agreements like this demonstrate the essential nature of collaboration between tech giants and specialized R&D firms.

InterDigital’s commitment to licensing its broad portfolio of technologies to wireless terminal equipment makers, which allows it to expand its core market capability, is laudable. It has leading companies, such as Huawei, Samsung, LG and Apple, under its licensing agreements. Consequently, the company expects to generate solid recurring revenues from the patent licensing business in the forthcoming quarters as well.

IDCC’s global footprint, diversified product portfolio and ability to penetrate different markets are impressive. Apart from the company’s strong portfolio of wireless technology solutions, the addition of technologies related to sensors, user interface and video to its offerings is likely to drive significant value, considering the massive size of the market it licenses. Furthermore, the company remains committed to pursuing acquisitions to drive its product portfolio and boost organic growth.

The company is focused on pursuing agreements with unlicensed customers in the handset and consumer electronics markets. InterDigital aims to become a leading designer and developer of technology solutions and innovation for the mobile industry, IoT and allied technology areas by leveraging its research and development capabilities, technological know-how and rich industry experience. At the same time, it intends to enhance its licensing revenue base by adding licensees and expanding into adjacent technology areas that align with its intellectual property position.

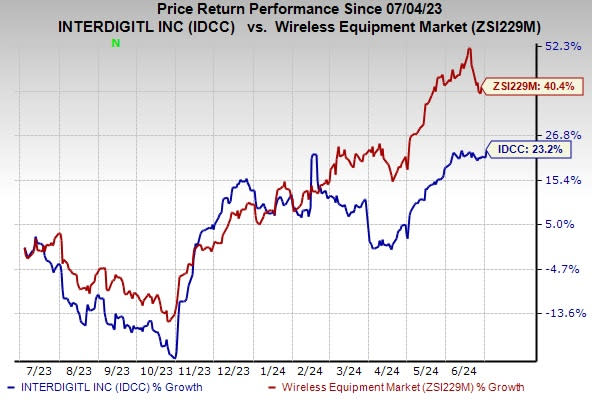

The stock has gained 23.2% over the past year compared with the industry’s growth of 40.4%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

InterDigital currently carries a Zacks Rank #5 (Strong Sell).

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy) at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experiences. Arista has a long-term earnings growth expectation of 15.7% and delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products. It is well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Ooma, Inc. OOMA offers cloud-based communications solutions, smart security and other connected services. Its smart software-as-a-service and unified-communications-as-a-service platforms serve as a hub for seamless communications and networking infrastructure applications. Currently, Ooma holds a Zacks Rank #2.

It delivered a trailing four-quarter average earnings surprise of 8.90%. In the last reported quarter, Ooma delivered an earnings surprise of 27.27%.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 at present, delivered an earnings surprise of 7.5%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 9.5%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products, and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ooma, Inc. (OOMA) : Free Stock Analysis Report