Interactive Brokers (IBKR) Experience $48M Loss on NYSE Glitch

Interactive Brokers IBKR encountered a critical issue on Jun 3 when Berkshire Hathaway Class A shares (BRK A) experienced a sharp decline from $622,000 to $185 because of a technical fault in the NYSE. The huge price plunge and technical problem led the NYSE to suspend the trading of BRK A stock quickly.

As the news of BRK A's unusual price drop swiftly spread on social networks, many clients of IBKR and its subsidiaries tried to capitalize on this ‘opportunity.’ They submitted buy orders during the trading halt, most anticipating their orders would be filled at nearly $185/share when trading resumed.

Without further notice and not correcting a significant order imbalance that had accumulated during the suspension, the stock exchange restarted trading the BRK A stock at $648,000 per share.

The price of BRK A soared to as high as $741,971.39 per share over the next 98 seconds. During this run-up, many IBKR clients who had placed market purchase orders during the trading halt were filled at different levels, with some even being filled at the peak price.

Interactive Broker moved quickly to bust the deals that had taken place at unusually high prices during the chaotic market that preceded the reopening of trading by submitting a clearly erroneous execution (CEE) petition to the NYSE and certain other U.S. exchanges.

The NYSE declined to take action on Interactive Brokers LLC's petition over clearly incorrect executions in consultation with other U.S. stock exchanges.

Hence, IBKR decided to assume a significant amount of these trades as a convenience to its customers. The company quickly submitted compensation claims to the NYSE, which fully rejected those claims. Consequently, the company experienced losses of nearly $48 million, which included losses on specific hedge agreements. The company noted that this will have no material impact on its financials.

IBKR is also assessing its options for recovering these amounts, including potential legal claims against the NYSE or connected companies.

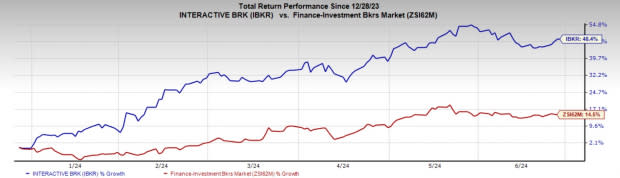

Image Source: Zacks Investment Research

In the past six months, shares of IBKR carrying a Zacks Rank of 2 (Buy) have rallied 48.4% compared with the industry’s growth of 14.5%.

Other Stocks Worth a Look

Some other top-ranked stocks are Robinhood Markets Inc. HOOD and BGC Group, Inc. BGC.

Robinhood Markets' earnings estimates for the current year have moved north by 93% in the past 60 days. The company’s shares have gained 69.3% in the past six months. At present, HOOD carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BGC Group’s 2024 earnings estimates have been revised upward by 1.1% in the past 60 days. The stock has gained 19.6% in the past six months. Currently, BGC also carries a Zacks rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BGC Group, Inc. (BGC) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report