Inter Parfums (IPAR) Rallies More Than 35% YTD: Here's Why

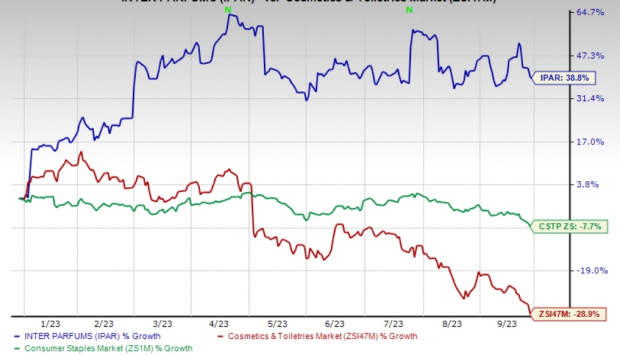

Inter Parfums, Inc. IPAR is in the limelight, with its shares up 38.8% year to date against the industry’s decline of 28.9%. The fragrance and related product company has also outperformed the Zacks Consumer Staples sector’s drop of 7.7% in the same time frame.

Inter Parfums’ success can be attributed to the robust demand for fragrances and its strategic focus on product launches and licensing agreements with renowned brands. These upsides are likely to help this Zacks Rank #2 (Buy) company continue blooming in the industry. Markedly, the Zacks Consensus Estimate for 2023 earnings per share (EPS) has jumped 4.1% to $4.55 in the past 60 days.

Expansion Moves on Track

Inter Parfums is staying on the course with its strategic product launches. The company anticipates gift sets to play a pivotal role in the third quarter of 2023. Management is diligently working on introducing extensions, including well-known brands like Ferragamo, Donna Karan/DKNY, and GUESS, for its U.S.-based operations.

In the European market, IPAR has plans to unveil new additions to the Karl Lagerfeld Les Parfums Matieres collection. The company is also set to debut a new member of the Van Cleef & Arpels Collection Extraordinaire and distribute the popular Abercrombie & Fitch Fierce fragrance in select markets.

Image Source: Zacks Investment Research

Inter Parfums has been actively expanding its horizons through new licenses and acquisitions. It recently announced its exclusive worldwide fragrance license for the prestigious Roberto Cavalli brand, effective from Jul 6, 2023.

Furthermore, the company's majority-owned subsidiary, Interparfums SA, signed a license deal with the renowned fashion sports brand, Lacoste, in December 2022. IPAR is gearing up to acquire the Lacoste fragrance business in January 2024, aiming to explore new growth avenues while leveraging its scale and robust market position.

In prior developments, Inter Parfums secured exclusive worldwide licenses for the Donna Karan and DKNY fragrance brands in July 2022 through a partnership with G-III Apparel Group. Additionally, in October 2021, it solidified an agreement with Salvatore Ferragamo S.p.A to hold the exclusive worldwide license for the production and distribution of Salvatore Ferragamo brand perfumes. The company has also reaped the benefits of its strategic collaborations with Origines-parfums and Moncler SpA.

A Look at Q2 & Ahead

Inter Parfums delivered impressive second-quarter 2023 results, with the top and bottom lines increasing year over year. Also, earnings surpassed the Zacks Consensus Estimate. The company has been reaping the benefits of favorable trends and momentum in the fragrance market. IPAR is growing its market share with innovative programs.

Following second-quarter numbers, management reaffirmed its 2023 net sales guidance and raised its earnings per share (EPS) guidance. It expects 2023 net sales to be $1.3 billion, implying 20% growth from the reported figure in 2022. The company raised its 2023 EPS guidance to $4.55 compared with $4.25 projected earlier. The outlook reflects growth of 20% from $3.78 reported in 2022.

Other Solid Consumer Staple Picks

e.l.f. Beauty ELF, a cosmetic and skincare product company, currently sports a Zacks Rank #1 (Strong Buy. ELF has a trailing four-quarter earnings surprise of 108.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here

The Zacks Consensus Estimate for e.l.f. Beauty’s current fiscal-year sales suggests growth of 64.6% from the corresponding year-ago reported figure.

MGP Ingredients MGPI, which produces and markets ingredients and distillery products, currently sports a Zacks Rank #1. MGPI has a trailing four-quarter earnings surprise of 18%, on average.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and EPS calls for growth of 5.8% and 10.4%, respectively, from the corresponding year-ago reported figures.

Flowers Foods FLO, a packaged bakery food product company, currently has a Zacks Rank #2. FLO has a trailing four-quarter earnings surprise of 7.6%, on average.

The Zacks Consensus Estimate for Flowers Foods’ current fiscal-year sales indicates growth of 6.7% from the year-ago reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report