Intel's (INTC) New GPUs Pose Threat to AMD's Market Share

Intel Corporation INTC recently re-entered the discrete graphics processing unit (GPU) market after a two-decade absence and captured 4% of the market in the third quarter of 2022, according to Jon Peddie Research (JPR), the industry's research firm for graphics.

Advanced Micro Devices AMD and Nvidia currently dominate the discrete GPU market, with Nvidia controlling the higher-end market and AMD the lower-end market, per a report from The Motley Fool.

Intel's expansion into the discrete GPU market could potentially hinder AMD's long-term growth as Intel targets many of the same lower-end PC gamers.

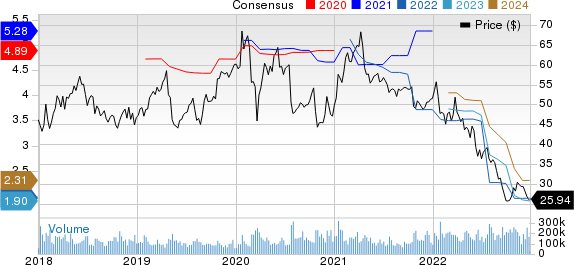

Intel Corporation Price and Consensus

Intel Corporation price-consensus-chart | Intel Corporation Quote

Intel's Xe discrete GPUs are a new generation of graphics processors introduced in late 2020 and early 2021. These GPUs were designed to challenge AMD's Radeon and Nvidia's GeForce in the high-end PC gaming market. Also, these GPUs are produced by Taiwan Semiconductor Manufacturing and are built using a 7nm process.

According to recent industry benchmarks, Intel's Arc A380 GPU has proven to deliver better performance than AMD's Radeon RX 6400 across a wide range of games.

This is significant because the RX 6400 is more expensive than the A380, which retails for around $140, while Nvidia's comparable GTX 1630 costs about $200. Hence, this may make the A380 an attractive option for consumers looking for good performance at a lower price point.

Intel's market share of discrete GPUs has increased, which is concerning as the overall GPU market has declined 42% year on year to 14 million units in third-quarter 2022. This is due to a shrinking PC market, and Intel, AMD, and Nvidia are all competing for a decreasing market.

Intel designs and manufactures computer chips and other electronic components. Its products are used in a wide range of devices, including personal computers, servers and mobile devices.

For 2022, the company expects non-GAAP revenues to be $63-$64 billion, down from prior expectations of $65-$68 billion, owing to challenging macroeconomic conditions with high uncertainty. Non-GAAP earnings are expected to be $1.95 per share, down from prior expectations of $2.30.

At present, INTC carries a Zacks Rank #3 (Hold). The stock has lost 49.9% in the past year compared with the sub-industry’s decline of 43.7%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Arista Networks ANET and Super Micro Computer SMCI, each presently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.37 per share, up 8.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have declined 18.4% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2023 earnings is pegged at $9.58 per share, rising 19.8% in the past 60 days.

Super Micro Computer’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 9.4%. Shares of SMCI have soared 83.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report