Intel (INTC) Launches AI Chips to Drive Growth Momentum

In a concerted effort to regain its mojo, Intel Corporation INTC has launched AI chips for data centers and PCs. This marks one of the largest architectural shifts for the company in 40 years. The strategic decision is primarily aimed at gaining a firmer footing in the expansive AI sector, spanning cloud and enterprise servers to networks, volume clients and ubiquitous edge environments, in tune with the evolving market dynamics.

The company unveiled Intel Core Ultra featuring the neural processing unit, which enables power-efficient AI acceleration with 2.5x better power efficiency than the previous generation. With superior GPU and CPU capabilities, it is also capable of speeding up AI solutions.

Intel also launched the 5th Gen Intel Xeon processor family that delivers a 21% average performance gain for general compute along with 36% higher average performance per watt across a range of customer workloads. With built-in AI acceleration, optimized software and enhanced telemetry capabilities, the 5th Gen Xeon mainstream data center processor enables more manageable and efficient deployments of demanding network and edge workloads across diverse use cases.

The company further provided an update on the availability of Intel Gaudi3. These chips — known as AI accelerators — are slated to be released in 2024. The next-generation AI accelerator will likely help companies develop chatbots and other rapidly proliferating services for deep learning and large-scale generative AI models. With increasing demand for generative AI solutions, Intel expects to capture a greater pie of the accelerator market in 2024 with its suite of AI accelerators led by Gaudi.

The company remains on track with its 5N4Y (five nodes in four years) program in order to regain transistor performance and power performance leadership by 2025. After launching Intel 7, the company launched Meteor Lake in the third quarter – the 14th generation of processors and the first chip manufactured on the Intel 4 process, featuring a chiplet design (a 7nm build) and extreme ultraviolet lithography (EUV).

While Intel 3 is on track for overall yield and performance targets, Sierra Forest (SRF) is slated for release in the first half of 2024 with Granite Rapids (GNR) following shortly. Intel has also announced the launch of glass substrates for advanced packaging of chips. This industry-leading product is likely to be available for mass consumption in the second half of this decade as the company aims to deliver 1 trillion transistors on a package by 2030.

Intel is strategically investing to expand its manufacturing capacity to accelerate its IDM 2.0 (Integrated Device Manufacturing) strategy. In second-quarter 2023, the company inked an agreement with the federal government of Germany to invest more than 30 billion euros to expand its upcoming semiconductor manufacturing facility in the country. It is likely to work in unison with its existing wafer fabrication facility in Leixlip, Ireland and its planned wafer fabrication facility in Magdeburg, Germany, to help create a first-of-its-kind end-to-end leading-edge semiconductor manufacturing value chain in Europe. It also announced that it would develop a state-of-the-art semiconductor assembly and test facility near Wroclaw, Poland, to cater to the increased demand for advanced semiconductor solutions. These augur well for the long-term growth of the company.

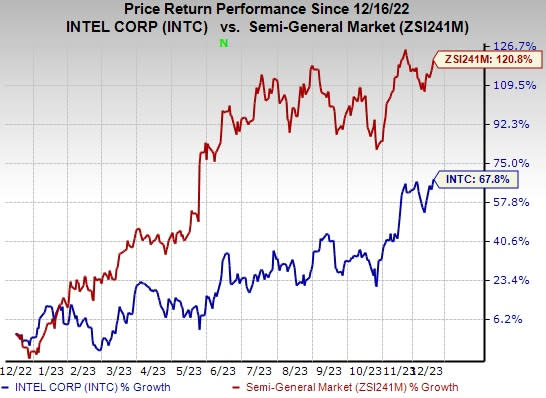

Shares of the company have gained 67.8% in the past year compared with the industry’s growth of 120.8%.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Intel presently has a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aviat Networks, Inc. AVNW, presently carrying a Zacks Rank #2, is a solid pick. Headquartered in Austin, TX, Aviat has been a global provider of microwave networking solutions. It offers public and private operators communications networks to cater to the accretive demand for IP-centric, multi-gigabit data services.

Backed by avant-garde technology, Aviat simplifies the entire lifecycle of designing, deploying and maintaining wireless transport networks with greater performance and reliability. The company is well-positioned to benefit from robust market dynamics, cost-reduction efforts, favorable customer mix and higher investments in innovative software solutions. A solid liquidity position and healthy balance sheet are likely to aid the company in executing key long-term strategic objectives.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architectures and enhance their cloud experiences. Arista has a long-term earnings growth expectation of 20.4% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC currently carries a Zacks Rank #2. It has a long-term earnings growth expectation of 24.8% and delivered an earnings surprise of 14%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Aviat Networks, Inc. (AVNW) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report