Intel (INTC) to Expand Wafer Manufacturing Facility in Germany

Intel Corporation INTC has inked an agreement with the federal government of Germany to invest more than 30 billion euros to expand its upcoming semiconductor manufacturing facility in the European country. The project dubbed ‘Silicon Junction’ will witness the construction of two new Intel processor factories in Magdeburg, Germany.

The company acquired the land for the project in November 2022. The investment is likely to unlock a resilient semiconductor supply chain in Europe that is devoid of any dependence on countries like China for an uninterrupted production process. Intel intends to deploy more advanced Angstrom-era technology in these facilities than originally envisioned, helping it to better serve the Intel Foundry Services customers and its own production pipeline.

The first facility is expected to enter production in four to five years, subject to approval from the European Commission related to the federal government incentive package. The facilities are likely to be a boon for the region's economic development, generating employment opportunities and promoting the development of a broad ecosystem of suppliers and companies across the technology industry.

Last week, Intel announced that it will develop a state-of-the-art semiconductor assembly and test facility near Wroclaw, Poland, at an anticipated investment of about $4.6 billion to cater to the increased demand for advanced semiconductor solutions. It is likely to work in unison with its existing wafer fabrication facility in Leixlip, Ireland, and its planned wafer fabrication facilities in Magdeburg to help create a first-of-its-kind end-to-end leading-edge semiconductor manufacturing value chain in Europe.

Intel has been lately facing dwindling overall sales largely due to PC inventory correction and contraction in the server market. Revenues declined significantly in first-quarter 2023 owing to a challenging macroeconomic environment, uncertain business conditions and softening demand trends. Weakness in the end consumer and educational market demand is likely to remain an overhang on the company’s performance.

Consequently, top management has embarked on a massive investment roadmap by developing new manufacturing hubs and improving its operating technology to bring the company back to its growth trajectory.

Intel is betting big on the IoT business and is investing heavily to gain a higher market presence. While the focus was earlier on making the best computing chips and generating industry-leading margins from them, the company now prefers to focus on a product range targeting different market segments. Management believes that although the higher-end businesses in more developed economies continue to look up, the new strategy should help it get into many more device categories, where Intel products will likely keep enjoying a premium based on performance.

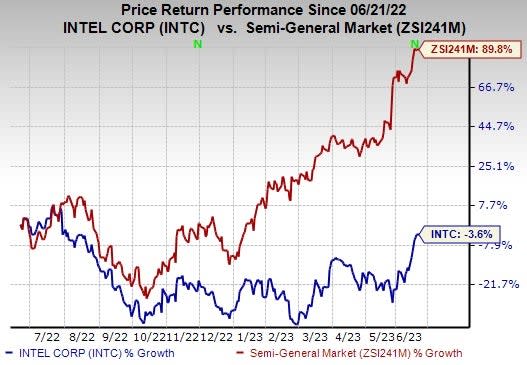

The stock has lost 3.6% over the past year against the industry’s growth of 89.8%.

Image Source: Zacks Investment Research

Intel currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

InterDigital, Inc. IDCC, sporting a Zacks Rank #1, delivered an earnings surprise of 170.89%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 579.03%. It has a long-term earnings growth expectation of 13.9%.

It is a pioneer in advanced mobile technologies that enables wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular and wireless 3G, 4G and IEEE 802-related products and networks.

Akamai Technologies, Inc. AKAM, sporting a Zacks Rank #1, delivered an earnings surprise of 4.9%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 10%.

Akamai is a global provider of a content delivery network and cloud infrastructure services. The company’s solutions accelerate and improve the delivery of content over the Internet, enabling faster response to requests for web pages, streaming of video & audio, business applications, etc. Akamai’s offerings are intended to reduce the impact of traffic congestion, bandwidth constraints and capacity limitations on customers.

Turtle Beach Corporation HEAR, carrying a Zacks Rank #2 (Buy), is another key pick. It develops, commercializes and markets gaming headset solutions for various platforms, including video game and entertainment consoles, handheld consoles, personal computers, tablets, and mobile devices under the Turtle Beach brand.

Turtle Beach is well positioned to benefit from quality products and enjoys a solid foothold in its served markets. Its headsets are suited for learning and working remotely via video or audio conferencing. It has a long-term earnings growth expectation of 16%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Turtle Beach Corporation (HEAR) : Free Stock Analysis Report