Ingevity (NGVT), Ultrapolymers Tie-Up for Capa Bioplastics Sales

Ingevity Corporation NGVT has expanded its Capa caprolactone distribution network by selecting Ultrapolymers Group as the distributor for Capa Bioplastics in Europe. Ultrapolymers will use its expertise in sales and technical teams across Europe to increase the sales of Ingevity's Capa Bioplastics products.

The addition of a new distribution partner in Europe devoted to Ingevity's Capa biodegradable thermoplastics allows the company to better service its customers in the region. Ultrapolymers' network of compounders and converters, as well as its technical competence and customer service, are consistent with Ingevity's growth strategy in Europe.

Ingevity's array of Capa caprolactone bioplastics is in sync with Ultrapolymers' objective of providing customers with the most advanced, innovative and sustainable materials.

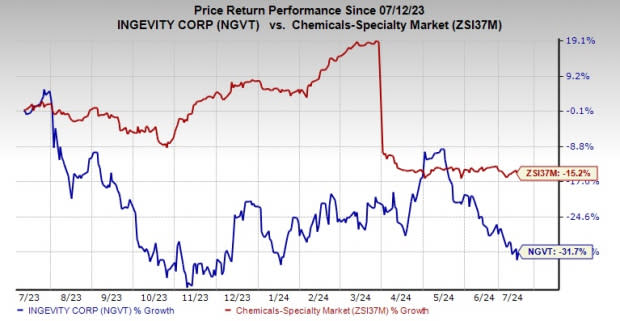

Shares of Ingevity have lost 31.7% over the past year compared with a 15.2% decline of its industry.

Image Source: Zacks Investment Research

Ingevity, in February 2019, completed the purchase of the Capa caprolactone division of Perstorp Holding AB for roughly $652.5 million. Capa is an international market leader in the manufacture and commercialization of caprolactone and high-value downstream derivatives. The division’s products are crucial components in coatings, adhesives, elastomers, bioplastics and resins.

The company, on its first-quarter call, said that it sees its sales for 2024 in the band of $1.4-$1.55 billion and adjusted EBITDA in the range of $365-$390 million.

Zacks Rank & Key Picks

Ingevity currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Carpenter Technology Corporation CRS, Eldorado Gold Corporation EGO and Kronos Worldwide, Inc. KRO.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). CRS beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 15.1%. The company's shares have soared 92.7% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Eldorado’s current-year earnings is pegged at $1.09 per share, indicating a year-over-year rise of 91.2%. EGO, a Zacks Rank #1 stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 430.7%. The company's shares have rallied roughly 56.2% in the past year.

Kronos Worldwide currently carries a Zacks Rank #1. KRO has a projected earnings growth rate of 297.7% for the current year. The company’s shares have rallied around 37% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Kronos Worldwide Inc (KRO) : Free Stock Analysis Report

Eldorado Gold Corporation (EGO) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report