Infosys (INFY) to Streamline CIRCOR's IT Infrastructure

Infosys INFY recently announced that the global industrial product manufacturer, CIRCOR International, has selected it for accelerating the latter’s IT modernization journey. The company stated that the deal requires it to transform CIRCOR’s IT infrastructure, service desk and user support applications.

As part of the agreement, Infosys will help transform CIRCOR’s IT landscape and modernize its IT infrastructure by deploying SLA-based managed IT services and improving processes. The India-based IT services company will also modernize local data centers and cloud landscapes and bring agility to operations.

Additionally, Infosys will use ServiceNow as an IT service management platform to support CIRCOR's infrastructure, applications and operations. The IT modernization deal is expected to improve productivity and ensure significant cost-savings to CIRCOR.

Infosys has been reinforcing its digital-transformation capabilities to expand and solidify its position in the highly competitive environment. It enables its clients across more than 45 countries to create and execute strategies for their digital transformation. Such efforts in the digital-transformation business will aid the company in competing with peers like Accenture and Cognizant.

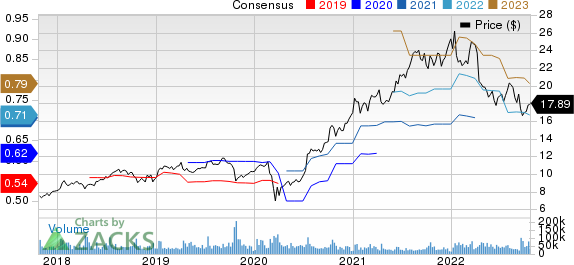

Infosys Limited Price and Consensus

Infosys Limited price-consensus-chart | Infosys Limited Quote

Last month, Infosys collaborated with Telenor Norway, a wholly owned telecommunications operator of Telenor, to accelerate the latter’s IT modernization journey in support of the 'Beyond Connectivity' program.

In the same month, Infosys collaborated with Bpost (Belgium Post), a postal operator and e-commerce logistics provider headquartered in Brussels, to provide cloud security solutions to identify and ensure rapid responses to suspicious security events.

Back-to-back contract wins are driving Infosys’ top line. In second-quarter fiscal 2023 results, the company’s revenues jumped 13.9% year over year to $4.56 billion.

However, Infosys’ near-term growth prospects are likely to be hurt as organizations are postponing their plans of investing in big and expensive technology products on growing global slowdown concerns amid the current macroeconomic challenges and geopolitical tensions.

Also, elevated operating expenses related to hiring employees, and sales and marketing strategies to capture more market share are likely to strain margins in the near term.

These, along with the rapid proliferation of customizable Internet-based software, have been hampering Infosys’ traditional outsourcing business. The challenges might weigh on the company’s profitability going ahead.

Zacks Rank & Key Picks

Infosys currently carries a Zacks Rank #4 (Sell). Shares of INFY have plunged 29.3% year to date (YTD).

Some better-ranked stocks from the broader Computer and Technology sector are Digi International DGII, Zscaler ZS and Baidu BIDU. Digi sports a Zacks Rank #1 (Strong Buy) at present, while Zscaler and Baidu each carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Digi’s first-quarter fiscal 2023 earnings has increased by 4 cents to 42 cents per share over the past 90 days. For fiscal 2023, earnings estimates have moved 6.2% up to $1.88 per share in the past 60 days.

DGII's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 28.6%. Shares of the company have increased 49.1% YTD.

The Zacks Consensus Estimate for Zscaler's first-quarter fiscal 2023 earnings has been revised 7 cents north to 26 cents per share over the past 60 days. For fiscal 2023, earnings estimates have moved a penny north to $1.18 per share in the past 30 days.

ZS’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 28.6%. Shares of the company have declined 53.2% YTD.

The Zacks Consensus Estimate for Baidu's fourth-quarter 2022 earnings has been revised 4 cents northward to $2.79 per share over the past seven days. For 2022, earnings estimates have moved downward by 11 cents to $9.05 per share in the past seven days.

Baidu's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 58.1%. Shares of BIDU have slumped 37.4% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Infosys Limited (INFY) : Free Stock Analysis Report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

Digi International Inc. (DGII) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research