ICICI Bank (IBN) Up as Q2 Earnings Rise on Higher Loan Demand

Shares of ICICI Bank IBN gained 3.5% since the release of its second-quarter fiscal 2023 (ended Sep 30) results. Net income was INR75.58 billion ($929 million), jumping 37% from the prior-year quarter.

Results were driven by a rise in net interest income (NII) and non-interest income, higher rates and growth in loans and deposits. Provisions also declined during the quarter. However, higher operating expenses posed as the undermining factor.

Net Interest Income & Fee Income Up, Expenses Rise

NII rose 26% year over year to INR147.87 billion ($1.8 billion). Net interest margin was 4.31%, up 31 basis points (bps).

Non-interest income (excluding treasury income) was INR51.39 billion ($632 million), up 17%. Fee income increased 18% to INR44.80 billion ($551 million). Fees from retail, business banking and SME customers constituted nearly 79% of total fees in the quarter.

In the reported quarter, IBN recorded a treasury loss of INR0.85 billion ($10 million) against a treasury gain of INR3.97 billion ($49 million) in the year-ago quarter.

Operating expenses totaled INR81.61 billion ($1 billion), rising 24%.

Loans & Deposits Increase

As of Sep 30, 2022, ICICI Bank’s total advances were INR9,385.63 billion ($115.4 billion), up 23% year over year. The growth was driven by a solid rise in demand for retail loans, which improved 25% and accounted for 54% of the total loan portfolio.

Total deposits grew 12% to INR10,900.08 billion ($134 billion).

Credit Quality Improves

As of Sep 30, 2022, net non-performing assets (NPA) ratio was 0.61%, down 38 bps year over year. Recoveries and upgrades (excluding write-offs and sale) of NPAs were INR37.61 billion ($462 million) in the quarter.

In the fiscal second quarter, there were net additions of INR6.05 billion ($74 million) to gross NPA. Gross NPAs additions were INR43.66 billion ($537 million), while gross NPA written-off was INR11.03 billion ($136 million).

Provisions (excluding provision for tax) plunged 39% from the prior-year quarter to INR16.44 billion ($202 million). This included an additional contingency provision of INR15.00 billion ($184 million) made on a prudent basis during the reported quarter. Thus, as of Sep 30, 2022, ICICI Bank held a total contingency provision of INR100 billion ($1.2 billion).

Capital Ratios Strong

In compliance with the Reserve Bank of India's guidelines on Basel III norms, ICICI Bank's total capital adequacy was 18.27% and Tier-1 capital adequacy was 17.51% as of Sep 30, 2022. Both ratios were well above the minimum requirements.

Our Take

ICICI Bank’s quarterly performance was impressive on a robust rise in demand for consumer loans. Growth in net interest income was a major tailwind, which is expected to keep supporting the company's financial performance. However, elevated expenses and macroeconomic concerns are major near-term headwinds.

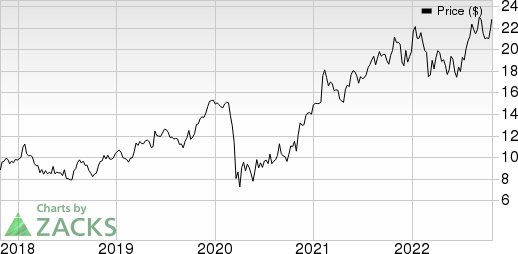

ICICI Bank Limited Price, Consensus and EPS Surprise

ICICI Bank Limited price-consensus-eps-surprise-chart | ICICI Bank Limited Quote

ICICI Bank currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

HSBC Holdings HSBC reported a third-quarter 2022 pre-tax profit of $3.1 billion, down 41.8% from the prior-year quarter.

Results reflected a rise in adjusted revenues. However, adjusted expenses increased from the year-ago quarter, which was a headwind for HSBC. The expected credit losses and other credit impairment charges (ECL) were a net charge in the quarter under review against a release in the prior-year quarter.

UBS Group AG UBS reported third-quarter 2022 net profit attributable to shareholders of $1.73 billion, down 37.6% from the prior-year quarter.

UBS’ performance was affected by a fall in revenues and a decline in total net credit loss releases. Nonetheless, operating expenses decreased from the prior-year quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UBS Group AG (UBS) : Free Stock Analysis Report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research