Hyatt Hotels' (H) Delays Q4 Earnings, Announces Q4 Highlights

Hyatt Hotels Corporation H has delayed the issuance of its fourth-quarter 2023 results, which was scheduled for Feb 15, 2024. The company has stated that they need more time to complete the accounting procedures related to the Unlimited Vacation Club deferred cost activity within its Apple Leisure Group segment.

Q4 & 2023 Highlights

The company announced its fourth-quarter and full-year 2023 highlights. System-wide comparable RevPAR demonstrated a 9.1% increase in the fourth quarter compared with the year-ago quarter. The metric rose 17.0% in 2023, surpassing forecasts.

In fourth-quarter and full-year 2023, comparable owned and leased hotels RevPAR rose 5.9% and 15.5% year over year, respectively. Comparable owned and leased hotels operating margins in fourth-quarter and full-year 2023 came in at 26.2% and 25.4% year over year, respectively.

Cash flow from operations reached $800 million in 2023, marking the highest figure in the company's history. Similarly, free cash flow amounted to $602 million in 2023, also setting a new record high for H. Net room growth for 2023 stood at 5.9%, consistent with the full-year forecast. The pipeline of executed management or franchise contracts comprised approximately 127,000 rooms.

The company’s board of directors also announced a dividend of 15 cents per share for first-quarter 2024. The dividend will be payable on Mar 12, 2024, to Class A and Class B stockholders of record as of Feb 28, 2024.

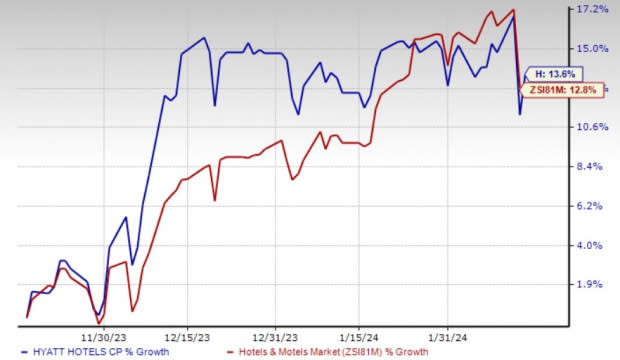

Shares of Hyatt Hotels have gained 13.6% in the past three months compared with the Zacks Hotels and Motels industry’s 12.8% growth.

Image Source: Zacks Investment Research

Zacks Rank

H currently carries a Zacks Rank #3 (Hold).

Key Picks

Here are some better-ranked stocks from the Zacks Consumer Discretionary sector.

H World Group Limited HTHT currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

It has a trailing four-quarter earnings surprise of 94.5%, on average. The stock has fallen 35.4% in the past year. The Zacks Consensus Estimate for HTHT’s 2024 sales and EPS indicates an improvement of 7.9% and 9.8%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL flaunts a Zacks Rank of 1 at present. It has a trailing four-quarter earnings surprise of 10.6%, on average. The stock has risen 57.8% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS implies growth of 8.7% and 18.8%, respectively, from the year-ago levels.

Acushnet Holdings Corp. GOLF currently carries a Zacks Rank of 2 (Buy). It has a trailing four-quarter earnings surprise of 49.9%, on average. The stock has risen 32.7% in the past year.

The Zacks Consensus Estimate for GOLF’s 2024 sales and EPS suggests growth of 2.5% and 5%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

H World Group Limited Sponsored ADR (HTHT) : Free Stock Analysis Report

Acushnet (GOLF) : Free Stock Analysis Report