Hyatt (H) Announces Record-Breaking Global Unit Expansion

Hyatt Hotels Corporation H has set a new benchmark in global expansion by increasing its pipeline approximately 85% since 2017, reaching a record 129,000 rooms. This remarkable feat underscored not only the unwavering trust of hotel owners but also the resounding allure of the Hyatt brand.

Hyatt's president and CEO, Mark Hoplamazian, highlighted the company's strategic vision, which positioned it as a leader in the hospitality industry. This vision is evident in Hyatt's consistent efforts to enhance luxury options, triple resort offerings and quintuple lifestyle accommodations in recent years.

Aside from its expansion endeavors, Hyatt's acclaimed loyalty program, World of Hyatt, witnessed an exponential surge in membership, quadrupling since 2017 to an impressive 46 million global members. Furthermore, the program boasted a membership per hotel, which was 30% higher than its larger competitors, emphasizing exceptional appeal and effectiveness in fostering customer loyalty.

As Hyatt continues to chart new territories and redefine hospitality standards, investors stand to benefit from its unwavering commitment to organic growth and strategic acquisitions. With a steadfast focus on creating exceptional guest experiences and maximizing value for stakeholders, the company remains poised to deliver sustainable long-term growth and value to its shareholders.

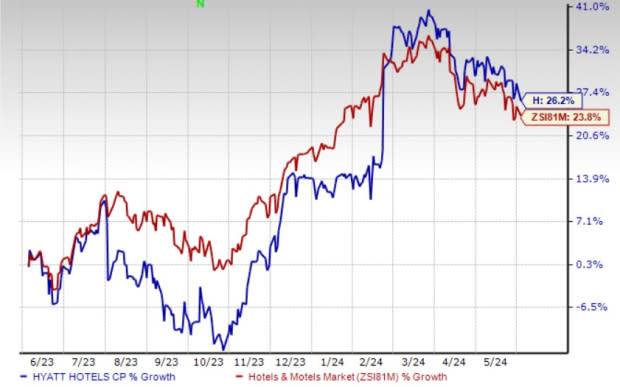

Image Source: Zacks Investment Research

Stock Performance

In the past year, H’s shares have risen 26.2% compared with the industry’s growth of 23.8%.

Hyatt is consistently trying to expand its presence globally. It also has plans to expand in Asia-Pacific, Europe, Africa, the Middle East and Latin America. Expansion in these markets would help the company gain market share in the hospitality industry, thereby boosting its business.

In the first quarter of 2024, 12 new hotels (or 2,425 rooms) joined Hyatt's system, thus taking the total hotel count to 1,341 hotels (or 323,405 rooms). Notable openings during the quarter included Thompson Houston, Secrets Tides Punta Cana, Secrets Playa Blanca, Costa Mujeres and multiple UrCove properties in China accompanied by Hyatt Regency Nairobi Westlands, its first hotel in Kenya.

In conclusion, Hyatt's record-breaking global expansion and steadfast commitment to excellence position it as a beacon of innovation and resilience in the hospitality landscape. As the company forges ahead with its ambitious growth trajectory, investors can rest assured that they are aligned with a visionary leader dedicated to shaping the future of hospitality.

Hyatt currently carries a Zacks Rank #3 (Hold).

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has risen 53.6% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has risen 57.1% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

AMC Entertainment Holdings, Inc. AMC currently sports a Zacks Rank of 1. AMC has a trailing four-quarter earnings surprise of 38%, on average. The stock has risen 46.2% in the past month.

The Zacks Consensus Estimate for AMC’s 2024 EPS implies growth of 70.5% from the year-ago level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report