HSBC Rides on Asia-Focused Strategy, Rates Amid Rising Costs

HSBC Holdings plc HSBC is well-positioned for growth on the back of its focus on the Asia region and improving operating efficiency through business restructuring. However, increased operating expenses and weak revenue growth are major near-term concerns.

HSBC has taken steps to improve its performance, with a focus on building operations in Asia. In this context, in October, the company announced a deal to acquire Citigroup's retail wealth management business in China. HSBC has also re-launched its private banking business in India after eight years. These along with past several initiatives, are likely to help the company strengthen its position in the region, which accounts for more than half of its operations.

In 2020, HSBC announced its transformation plan aimed at reshaping its underperforming businesses, simplifying complex organizations and reducing costs. As part of this plan, the company incurred total costs of $6.5 billion to achieve gross savings. It realized gross savings of $5.6 billion last year and expects an additional $1 billion of savings this year.

Moreover, HSBC entered an agreement to sell its Canada banking business in November 2022. The company exited the retail banking business in the United States and Greece. It is in the process of divesting retail banking operations in France and New Zealand, withdrawing completely from Russia.

HSBC has consistently rewarding shareholders, given the stable capital position and lower debt-equity ratio compared with the industry. The company expects a dividend payout ratio of 50% for 2023 and 2024 (excluding the impacts of acquisitions and disposals).

Subject to the completion of the sale of the banking business in Canada, it is also considering paying a special dividend of 21 cents per share. This year, the company has repurchased up to $4 billion worth of shares through September. In October, it announced plans for further share buyback of up to $3 billion, which is expected to be completed by Feb 21, 2024.

HSBC’s brand, capital strength, extensive global network and positioning enables it to continuously attract and retain clients. In sync with this, the company acquired the failed Silicon Valley Bank’s – SVB UK division – in March 2023.

Further, in June, HSBC Innovation Banking was launched, which included SVB UK, together with newly formed teams in the United States, Hong Kong and Israel. This newly formed unit is expected to deliver globally connected, specialized banking services to support innovation businesses and their investors.

Analysts seem bullish regarding HSBC’s earnings prospects. The Zacks Consensus Estimate for the company's 2023 earnings has been revised 5.1% upward over the past month. The company currently carries a Zacks Rank #3 (Hold).

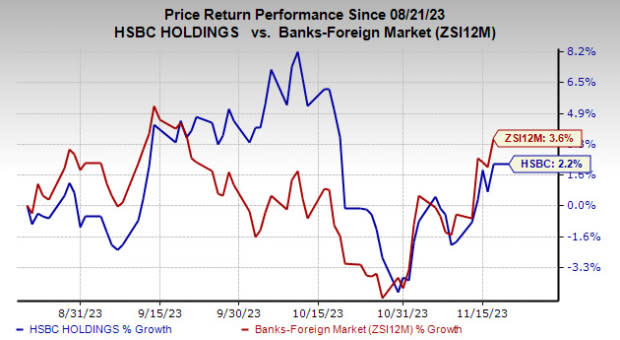

Over the past six months, shares of HSBC have gained 2.2% compared with the industry's rise of 3.6%.

Image Source: Zacks Investment Research

Overall costs are expected to remain high in the near term as HSBC focuses on growing market share in the U.K. and Asia, and strengthening digital capabilities globally. The company expects costs to grow 4% in 2023 (the acquisition of SVB UK and associated investment internationally is expected to increase operating expenses by 1%).

In addition, HSBC anticipates a potential increase in performance-related pay in the fourth quarter of 2023, which will lead to a further increase in operating expenses of around 1%.

The financial impacts of Brexit continue to weigh on HSBC's revenue growth. Despite the improving global interest rate environment, the company’s reported revenues declined, seeing a compound annual growth rate of 2.7% over the last three years ended 2022. The bank’s revenue outlook remains positive but faces headwinds from weakening loan demand, increasing macroeconomic ambiguity in some of its markets and inflation risks.

Stocks Worth Considering

A couple of better-ranked stocks from the foreign banking space are UniCredit UNCFF and Mitsubishi UFJ Financial Group MUFG.

UniCredit currently sports a Zacks Rank #1 (Strong Buy). Its earnings estimates for 2023 have been unchanged over the past month. In the past three months, UNCFF shares have rallied 17.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Mitsubishi UFG’s current-year earnings has been revised 4% upward over the past month. Its shares have gained 14.1% over the past three months. Currently, MUFG carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

UniCredit (UNCFF) : Free Stock Analysis Report

Mitsubishi UFJ Financial Group, Inc. (MUFG) : Free Stock Analysis Report