Honda Motor (HMC), Hanwa Partner for Battery Metals Sourcing

Honda Motor Company HMC recently announced that it has entered into a partnership with trading company Hanwa to facilitate stable procurement of battery materials, especially nickel, cobalt and lithium, essential components for EV batteries.

Japan-based Hanwa’s strength in resource procurement is noteworthy, and a leverage of the same will be fruitful for Honda. But, instead of banking on only Hanwa for procurement, Honda has stated that it will continue to rely on various other suppliers to maintain a stable flow of resources.

Honda is determined to expedite its EV efforts and make a mark in the EV space alongside top players. In that light, it has established several partnerships that show its push toward eventual electrification.

One such prominent partnership has been with General Motors GM. In April, Honda and GM announced a deal to work on solid-state batteries to develop a series of affordable EVs.

The project utilizes General Motor’s next-generation Ultium battery technology and aims to produce millions of lower-range EVs, including popular compact crossover vehicles, beginning in 2027.

The companies’ collaborative efforts in battery technology development are expected to reduce electrification costs for future vehicles, making them sustainable.

In August, it tied up with LG Energy Solutions to establish a joint venture company to manufacture lithium-ion batteries in the United States to power Honda and Acura EV models for the North American market.

With the agreement, the two companies will invest a whopping $4.4 billion, and the plant is expected to have an annual production capacity of nearly 40GWh.

Honda has ambitious EV plans to bolster its strength in the domain. It intends to introduce 30 EV models globally by 2030, with a sales volume of more than 2 million electric cars annually. The auto giant has also set its target to completely transition to battery electric vehicles and fuel cell electric vehicles by 2040 and aims to reach carbon neutrality by 2050.

To achieve the milestone of 2 million sales volumes by 2030, Honda is banking on three new all-electric vehicle platforms. The first will bean electric mini-utility vehicle, built on a new small EV platform and will make its debut inJapan in 2024. An electric model based on a new large platform will follow suit in North America in 2026. Both platforms will later be used for other models as well.

The third one will be the new global platform based on the Ultium technology, in a tie-up with GM.

All the partnerships, together with the latest with Hanwa, will propel Honda toward its set targets.

Honda has also laid out a long-term plan. Over the next 10 years, it intends to invest around 5 trillion yen (€36.5 billion) to enhance capabilities in electrification and software technologies. It wants the investment to remodel its portfolio in a way that steers it toward the flourishing software business and away from the one-off hardware sales business. These will allow Honda to generate revenues using the software over the lifespan of the electric car by bringing additional functions that can be integrated later or introducing certain subscription-based services.

Although Honda is yet to catch up with some of its peers in the race toward electrification, its dedicated and focused efforts will likely aid it in the long run.

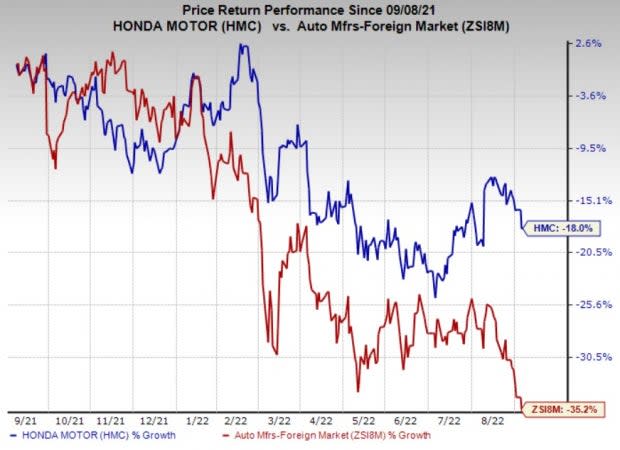

The stock has lost 18% over the past year compared with its industry’s 35.2% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

HMC carries a Zacks Rank #3 (Hold), currently.

Better-ranked players in the auto space include BorgWarner BWA and LCI Industries LCII, each carrying a Zacks Rank #2 (Buy), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BorgWarner has an expected earnings growth rate of 2.9% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 0.7% upward in the past 30 days.

BorgWarner’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. BWA pulled off a trailing four-quarter earnings surprise of 29.45%, on average. The stock has declined 13.7% in the past year.

LCI Industries has an expected earnings growth rate of 68.1% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 1.3% upward in the past 30 days.

LCI Industries’ earnings beat the Zacks Consensus Estimate in all the trailing four quarters. LCII pulled off a trailing four-quarter earnings surprise of 26.48%, on average. The stock has declined 13.7% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

LCI Industries (LCII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research