Hologic (HOLX) Moves Up 2% in a Week: Time to Consider Buying?

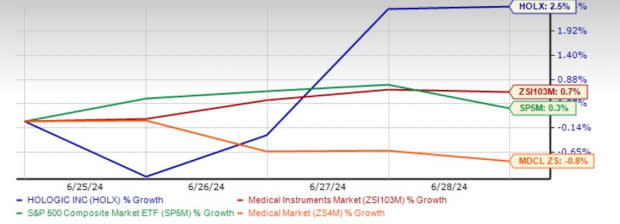

Hologic’s HOLX investors are enjoying some short-term gains from the stock of late. Shares of the MA-based women’s health-focused company have rallied 2.5% in the past week, outperforming the industry’s 0.7% growth. In the same timeframe, it rose above the sector and S&P 500’s 0.3% gain and 0.8% plunge, respectively.

HOLX One-Week Price Comparison

Image Source: Zacks Investment Research

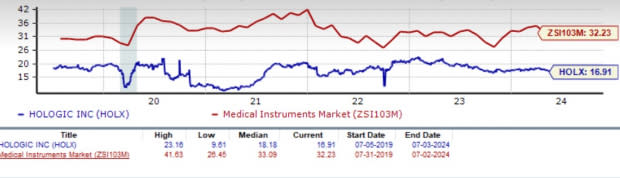

On Wednesday, Hologic closed the trading session 0.3% above its nine-day moving average, hinting signs of a positive trend in the long term.

HOLX Stock Trades Above 9-Day Average

Image Source: Zacks Investment Research

Not only this, year to date, the stock’s performance has remained upbeat compared to its peers like Becton, Dickinson and Company BDX and QIAGEN QGEN, both of whose shares have dipped 6% and 6.3%, respectively.

Despite any major development from the seasoned MedTech player, the recent uptick signals increasing investors’ sentiments surrounding the company’s upbeat fiscal 2024 outlook, followed by bullish consensus estimates.

HOLX expects adjusted EPS for fiscal 2024 in the band of $4.02-$4.12, with projected growth of 1.5-4% year over year. The Zacks Consensus Estimate for fiscal 2024 earnings is currently pegged at $4.08 per share, which indicates more than 3% year-over-year improvement.

Despite several challenges within the genomic research market, including workforce-related complications, the favorable estimates indicate that the positive market momentum might be sustained. The company has a unique mix of Diagnostics, Breast Health and Surgical products, each having multiple growth drivers promising robust growth potential.

This year, Hologic has been focused on improving the margins, and the progress is evident with each quarter. On top of this, the stock seems well-positioned to navigate through the current macroeconomic climate.

Strong Fundamentals Weigh In

Nearly two months ago, CEO Steve MacMillan impressed investors by announcing that the molecular diagnostics business, excluding COVID-19 testing revenues, has surged 10.7% despite last year’s tough comps. The growth reflects the success of expanding the Panther installed base and adding new tests over the years. Hologic is way ahead of its long-term target of 5% to 7% growth through 2025, with the Molecular franchise headed to grow beyond the 7% mark.

The success of the fairly new portfolio additions like the Aptima BV and CV/TV tests on the Panther system, the new respiratory suite of assays and Biotheranostics are nicely contributing to the U.S. Molecular Diagnostics business’ growth. Also, the overseas performance of the Genius digital cytology system is a great indicator of the product’s strong potential in the U.S. markets, where it secured FDA’s approval in early February.

The company's breast health portfolio now covers the entire continuum of care, from imaging to biopsy and surgical procedures. As a prominent figure in 3D mammography solutions, the company also stands to gain from USPSTC’s (the United States Preventive Services Task Force) latest recommendations to start breast cancer screenings at age 40 instead of 50.

In Surgical, the portfolio has also seen some promising growth in recent years, combining the company’s innovations with strategic acquisitions like Bolder Surgical. Both Myosure and the related Fluent fluid management system are driving forces behind the division’s growth. Meanwhile, at its core, Hologic’s financial resilience ensures investing in key initiatives and strategic buys, such as the recent $310 million deal to acquire Endo-Magnetics LTD to expand its interventional breast business.

Further International Expansion on the Horizon

Despite the international business rising above 40% since 2019, management considers this just the beginning. The company’s ability to capture untapped market opportunities and steady execution has led to impressive growth outside the domestic markets. For instance, worldwide Surgical sales increased 7.4% in the fiscal second quarter, reflecting continued market penetration and the benefits of the go-direct strategy in the Nordics.

Hologic not only aims to expand into new countries but also well-penetrated markets and product categories. Supported by reliable comprehensive data and strategic alliances, the company sees promising opportunities for long-term success in Europe and expansive markets like Asia Pacific.

Stock Trading Cheaper Than Peers

With a Value Score B, the company’s forward 12-month P/E of 16.9X is lower than both the industry average of 32.2X and its five-year median of 33.1X.

Price-to-Earnings Forward Twelve Months (F12M)

Image Source: Zacks Investment Research

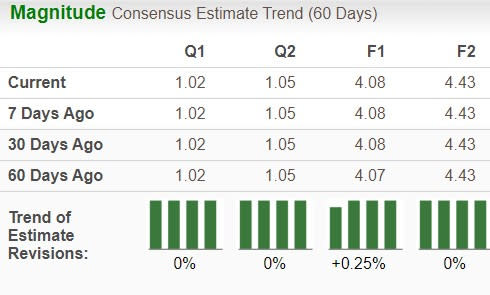

Estimate Movement

Estimates for Hologic’s fiscal 2024 earnings have remained constant at $4.08 in the past 30 days.

Image Source: Zacks Investment Research

Our Final Take

There is no denying that Hologic sits favorably in terms of core business strength, earnings prowess, robust financial footing and global opportunities. The Zacks Rank #2 (Buy) stock’s strong core growth prospects, along with attractive valuation, present a good reason for the existing investors to retain the shares for potential future gains. For those exploring to make new additions to their portfolios, the cheap valuation marks a good entry point at this moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

QIAGEN N.V. (QGEN) : Free Stock Analysis Report