How the Hollywood Strikes Could Deal Another Blow to the Already Shrinking Linear TV Business | Charts

With Hollywood’s strikes still unresolved, media companies have wrapped up negotiations with advertisers that kicked off with a season of upfront presentations marred by the absence of talent and dogged by writers’ picket lines outside.

Linear TV, which has been struggling with a soft advertising market on top of audiences steadily eroded by cord-cutting, officially fell below 50% of viewership for the first time ever in July according to Nielsen — and new data shows that some advertisers are shifting their spend away from broadcast and cable to get the most bang for their buck.

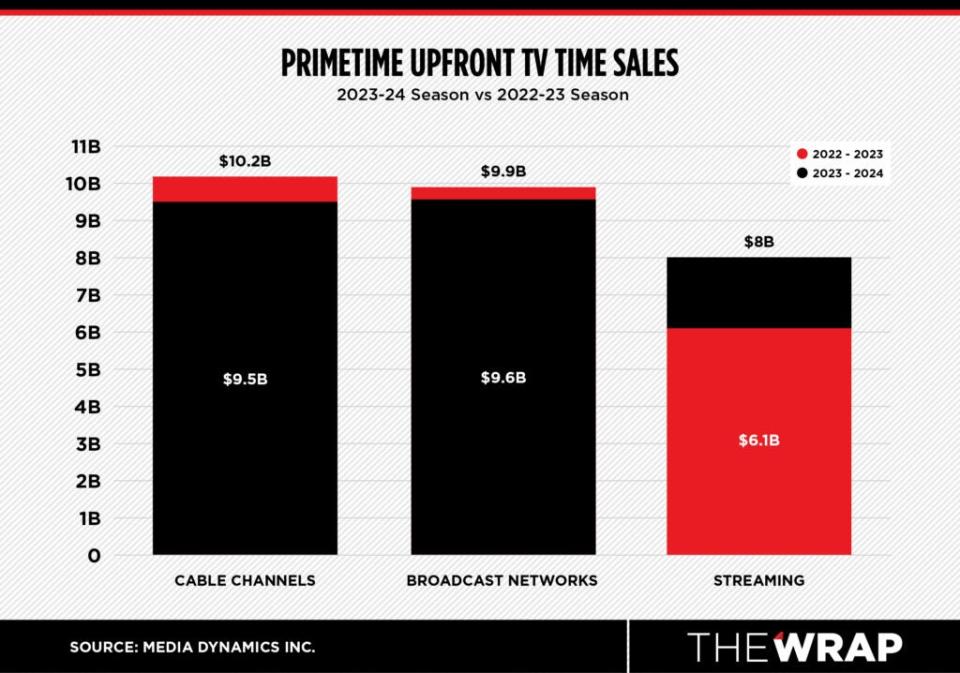

According to preliminary estimates from ad consulting firm Media Dynamics Inc., which tracks the upfronts, combined prime-time TV sales for the 2023-24 season for both linear and streaming grew 3% to $27.1 billion, compared to $26.3 billion last season. Advertisers placed another $10 billion to $12 billion for morning, daytime and late-night TV slots.

But the broadcast television networks and cable channels saw combined time sales decline 5% year over year to $19.1 billion from last season’s $20.1 billion. In aggregate, the broadcast TV networks were down about 3% in ad revenue, generating an estimated $9.6 billion compared to $9.9 billion last season.

Meanwhile, the cost per thousand or CPMs on 30-second spots for adults dropped 3% from $49.35 last season to $48.04 in the current upfront. Cable took a somewhat larger hit with a 7% decline in ad dollars ($9.5 billion) and a 5% reduction in adult CPMs ($22.14).

FAST and AVOD streaming services were a notable bright spot, with time sales increasing 31% from $6.1 billion last season to $8 billion. Their gains came at linear’s expense.

After over 100 days on strike, the WGA and AMPTP have returned to the negotiating table, though it’s unclear when a possible deal could be reached. Meanwhile, SAG-AFTRA passed the one-month mark in its strike, with no return to the negotiating table in sight.

The questions that haunt Madison Avenue now are: Will the strike further exacerbate linear advertising’s troubles? Or is this just a short-term blip that will resolve itself when the labor dispute ends?

The shift from linear

Despite the attractiveness of cable’s lower CPMs compared to broadcast TV and most ad-supported streaming services, MDI president Edward Papazian said that there was a feeling during the upfront that cable’s “continuing loss of reach was an issue that had to be dealt with,” especially by advertisers whose prime sales prospects were in the under-50 age category.

The largest pay-TV providers in the U.S., representing about 96% of the market, lost about 1.73 million net video subscribers in the second quarter of 2023, just above the 1.725 million lost during the same period a year ago, according to Leichtman Research.

In those worst-case scenarios, brands will be building safeguards into their TV buys.”

Optimine CEO Matt Voda

Buyers were “determined not to pay anything approaching the huge CPM hikes that the sellers scored in the past two years,” Papazian added.

“I think that [the writers’ strike] gave the buyers additional ammo to counter the sellers’ efforts to gain CPM price increases,” he told TheWrap. “Why pay more for lower-quality program fare?”

Guideline, a firm that tracks about 90% of the U.S. agency market using billing data, estimates that digital advertising accounts for around 60% of ad spend in 2023. Meanwhile, linear TV accounts for about 34% of ad spend, compared to 50% just five years ago.

Though there’s concern about a prolonged strike’s effect on programming, particularly scripted shows, most brands are unlikely to change their spend decisions due to networks’ and streamers’ healthy backlog of content, Optimine CEO Matt Voda told TheWrap. But it isn’t too early for brands to begin game-planning for contingencies and scenarios later in 2024 and into 2025, where the effects of the strike might still be felt.

“In those worst-case scenarios, brands will be building safeguards into their TV buys that allow them to exit cleanly, or to reassess pricing assuming networks are forced into situations where they are not delivering new shows and programming,” he said.

The networks’ pitch

Despite that gloomy picture, the networks did their best to present this upfront season as a victory.

When asked to elaborate on the impact the strikes had on upfront negotiations, Paramount, Netflix and Fox declined to comment. Warner Bros. Discovery deferred to executives previous upfront remarks on its second quarter earnings call. Representatives for Disney did not immediately respond to TheWrap’s request for comment.

NBCUniversal said advertisers were committed to its fall schedule and total cash commitments were roughly in line compared to last year. In 2022, the company had its highest-grossing upfront in its history with $7 billion in commitments, according to AdWeek. The company touted sales strength tied to the Paris 2024 Olympic Games as well as interest across 13 product categories for the 50th anniversary season of “Saturday Night Live.” Peacock saw upfront commitments increase 30% compared to last year.

Paramount Global reported total commitments “up low to mid-single digits,” implying a modest percentage increase, with EyeQ, an ad-sales tool; Vantage, an ad-targeting tool; and its sports vertical seeing double-digit growth on a combined basis.

Disney ended negotiations with revenue and volume commitments “in line with the prior year” when it had $9 billion in ad commitments. Over 40% of total dollars committed went to streaming and digital, led by Disney+, ESPN+ and Hulu, and it saw single-digit increases in sports volume and pricing. Disney+’s ad tier has attracted 3.3 million users since its launch in December.

Fox wrapped its negotiations with price and volume growth at Fox News Media and Fox Sports. Additionally, Fox Entertainment increased upfront sell-out over last year, while Tubi, its ad-supported streamer, saw volume growth for the fourth consecutive year.

Warner Bros. Discovery CFO Gunnar Wiedenfels also touted “strong progress” on the company’s upfront deals, noting that linear volume is expected to be up, with “pricing on balance pretty consistent with the prior year.” He added that DTC volume is “up more than 50% in the marketplace in which CPMs were positioned to drive scale, for us as much as for the broader market.”

Advertisers will want to have more flexibility to tap into unsold inventory.”

Darrick Li, Guideline’s vice president of sales for North America media owners

Netflix, which is relatively new to the advertising business with a cheaper, ad-supported version of its service launched in November, closed its first-ever upfront negotiations with total commitments “in line with expectations,” an individual familiar with the matter told TheWrap. The company took share from traditional TV broadcasters as well as digital video platforms and filled nearly all inventory for 2023-2024. The streamer’s ad tier has grown to over 10 million monthly active users, doubling from the nearly 5 million MAUs disclosed at its presentation to advertisers in May.

Linear’s loss, connected TV’s gain

Darrick Li, Guideline’s vice president of sales for North America media owners, told TheWrap that while the ongoing shift in ad dollars from linear TV to digital isn’t surprising, there will “definitely” be a pullback in linear’s overall spend due to the strikes’ potential impact on programming inventory.

“You’re going find more dollars allocated to” connected TV, Li said. “We’re going to still see a significant chunk of dollars, one in three, going to linear TV, but it may shift to unscripted programming and the media owners will need to do that to make commitments that they have with advertisers. I think you’re going see a lot of juggling in terms of program schedules, playing with the prime time daypart, to deliver on their commitments with the buy side.”

September, October and November, when remaining ad inventory will be bought in the scatter market, will be a “really revealing time” for how fast ad dollars shift, Li said.

“Advertisers will want to have more flexibility to tap into unsold inventory and place their investments closer to the air date to mitigate risk tied to a short runway of new programming as a result of the strikes,” he added. “Media owners may be amenable to this as being closer to the air date gives them a better understanding of the reach and target audience composition of their programming, which also reflects in a ‘scatter premium’ pricing.”

People have been saying it’s going to be over for the last 10, 20 years, that this is not a sustainable model, and yet it’s proven to be very resilient.”

Brad Adgate, independent media consultant

Li, who expects the shift in scatter versus upfront buying to be “less pronounced” when the new fall season begins, believes the biggest beneficiaries will be streaming services, live sports and digital audio.

Other areas that could see a boost include video services like TikTok and YouTube as well as Amazon and Apple’s growing advertising businesses, Brad Adgate, an independent media consultant and a former senior vice president of research at Horizon Media, told TheWrap.

Last month, Alphabet reported that YouTube’s advertising revenue grew 4% year over year to $7.7 billion for the second quarter of 2023. Meanwhile, Amazon reported that advertising services revenue grew 22% year over year to $10.6 billion.

A death knell for linear?

Linear has “passed the point of no return,” Macquarie media analyst Tim Nollen warned in a research note to clients Monday. The metrics are “all bad.” While he acknowledged that streaming’s growth has helped offset linear’s losses, DTC’s gains are not enough to make up for them, he added.

The firm estimates that the public pay TV operators that it covers reported an average 9.6% year-over-year drop in subscribers and 2.5% drop in affiliate fee revenues, while ad revenue across its media network coverage fell 13% on average in the second quarter, down from 8% in the first quarter, which included the Super Bowl.

“Even pricing does not drive upside; this revenue line is probably permanently negative,” he wrote. The only potential upside, he added, was “the return of college and NFL football.”

Despite the decades-long erosion of the linear TV audience, Adgate does not believe that the latest shift in ad dollars will result in linear TV’s abrupt collapse, arguing that marketers continue to spend billions of dollars on it even as its audience only gets older.

“This could just be a correction from the strong markets the last couple of years, so I’m not really completely and totally sold on this being the death of linear TV,” Adgate said. “People have been saying it’s going to be over for the last 10, 20 years, that this is not a sustainable model, and yet it’s proven to be very resilient.”

AVOD services are currently carrying fewer ads than linear, Dave Morgan, founder and CEO of the cross-channel advertising technology company Simulmedia, pointed out. Advertisers prematurely shifting spend to streaming will create “a lot of demand for a limited amount of streaming product,” he said.

“The [linear] audiences have been diminished, but still it’s unique in that there’s no other place you can get so many people so efficiently at a relatively low rate as cable TV,” he argued. “While every brand says they want to make sure they can get in front of tomorrow’s customers, virtually all the major categories that have been spent on TV are not luxury categories looking for young people. It’s cars, banks, insurance companies, pharmaceutical companies, package goods and those tend to be” geared towards consumers over 65 years old.

Morgan predicted that the legacy media will be less concerned about ad market softness in the third and fourth quarter, given the short-term cash flow benefits from the dual strikes’ effects on production. Instead, they will attempt to “reset pricing expectations with productions going forward.”

He expects a “robust” scatter market with higher pricing than the upfront, but warned that the total amount of spend on TV ads will likely decline for the fiscal year.

Insider Intelligence predicts that linear TV ad spend in the U.S. will decline from $61.3 billion this year to $56.8 billion in 2027, while CTV will grow from $25.1 billion to $40.9 billion in 2027. If there’s any cause for optimism, it’s the idea that the connected pie may be growing: The firm anticipates that total TV ad spend will grow from $86.4 billion in 2023 to $97.7 billion by 2027.

For all of TheWrap’s WGA strike coverage, click here.

The post How the Hollywood Strikes Could Deal Another Blow to the Already Shrinking Linear TV Business | Charts appeared first on TheWrap.