Hilton (HLT) Stock Up 24% in a Year: Wil the Trend Last?

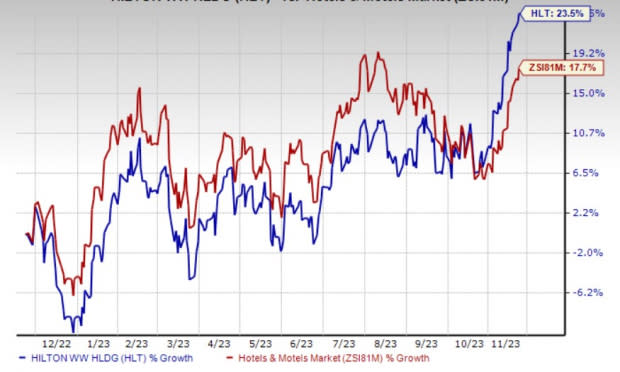

Shares of Hilton Worldwide Holdings Inc. HLT have appreciated 23.5% in the past year compared with the industry’s 17.7% growth. The company’s performance was attributable to the upward trend in travel and tourism. Hilton is benefiting from its focus on unit expansion, hotel conversions, strategic partnerships and loyalty programs.

The Zacks Rank #3 (Hold) company has an impressive long-term earnings growth rate of 16.2%. In the past 30 days, earnings estimates for 2023 have witnessed a upward revisions of 0.3% to $6.08 per share.

Growth Drivers

HLT is benefiting from pent up demand. Notably, a rise in leisure demand coupled with a rebound in corporate transient and group businesses are likely to benefit the company, going forward.

In a bid to maintain its position as the fastest-growing global hospitality company, Hilton is continuing to drive unit growth. During third-quarter 2023, it opened 107 new hotels. Room additions during the quarter totaled nearly 16,000, reflecting a rise of 22% year over year and 12% on a sequential basis.

During the third quarter of 2023, it unveiled properties, namely, the Tapestry portfolio (Bankers Alley Hotel in Nashville), Curio (in Savannah, GA) and Motto (in New York City).

Meanwhile, management has signed conversion deals with Curio and Tapestry, covering destinations like Galapagos Islands, San Sebastian Spain, Maui and Sonoma County, CA. Also, it has progressed with DoubleTree expansion, with new conversion properties across France, Germany and the Netherlands.

During the third quarter of 2023, Hilton reported solid conversions driven by strength in signings. It witnessed strong interest from developers concerning the premium economy conversion brand — Spark by Hilton.

With more than 400 deals in hand (in various stages of negotiation), management is optimistic in this regard and anticipates hotel openings in the upcoming periods. HLT expects positive development trends to continue on the back of new development and conversion opportunities.

The company is also gaining from a robust loyalty program. With membership levels increasing 19% on a year-over-year basis (as of third-quarter 2023), it continues to outline opportunities to engage its Honors members through enhanced partnerships and points redemption offerings. It intends to reach the pre-pandemic levels by driving customer engagement through new opportunities.

Image Source: Zacks Investment Research

Concerns

Hilton’s operations are pursuant to uncertainties in financial markets on account of liquidity constraints. Financing conditions in certain regions have been challenging due to a rise in interest rates. It is cautious in this regard as further challenges pave the path for inability to access cash and threat of new financing arrangements.

Zacks Rank

Hilton currently carries a Zacks Rank #3 (Hold).

Key Picks

Here, we present some better-ranked stocks from the Zacks Consumer Discretionary sector.

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1 (Strong Buy). RCL has a trailing four-quarter earnings surprise of 28.3%, on average. Shares of RCL have surged 79.6% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates a rise of 57.5% and 187.1%, respectively, from the year-ago levels.

DraftKings Inc. DKNG carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 13.2%, on average. Shares of DKNG have jumped 168.5% in the past year.

The Zacks Consensus Estimate for DKNG’s 2023 sales and EPS implies an improvement of 65.3% and 51.3%, respectively, from the year-earlier levels.

Skechers U.S.A., Inc. SKX carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 50.3%, on average. Shares of SKX have risen 34.4% in the past year.

The Zacks Consensus Estimate for SKX’s 2023 sales and EPS suggests an uptick of 8.2% and 44.1%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

DraftKings Inc. (DKNG) : Free Stock Analysis Report