Will Higher Software Revenues Aid IBM's Earnings in Q2?

International Business Machines Corporation IBM is scheduled to report second-quarter 2023 results on Jul 19, after the closing bell. In the to-be-reported quarter, the company is likely to have recorded higher revenues from the Software segment driven by innovative products and services.

Factors at Play

The Software segment includes Hybrid Platform & Solutions comprising software services, Red Hat, automation and data & AI businesses and Transaction Processing.

During the second quarter, IBM launched single frame and rack mount configurations of IBM z16 and IBM LinuxONE Rockhopper 4 to enhance data center’s productivity and support a dynamic IT ecosystem. With enhanced security capabilities, the single frame and rack mount configurations enable seamless deployment in new environments, significantly improving data center flexibility. The newly-introduced configuration consists of confidential computing, centralized key management and quantum-safe cryptography, which reinforce the cyber defense mechanism and protect confidential and sensitive data of consumers related to bank accounts, digital assets and medical records.

IBM also announced the launch of end-to-end quantum-safe technology to augment the security of crucial government and enterprise data. The quantum-safe technology is a comprehensive set of tools and capabilities combined with IBM's deep security expertise designed to protect systems against emerging vulnerabilities and potential future attacks. These are likely to have generated incremental revenues in the Software segment.

During the second quarter, IBM announced plans to replace around 8,000 jobs, with AI primarily replacing back-office functionalities in the human resource domain. In a relatively short time, AI can process large amounts of data and generate actionable insights faster and accelerate the decision-making process. Workflow automation can significantly minimize the probability of errors and reduce operational expenses. These initiatives are likely to be reflected in the upcoming segment results.

Key Developments in Q2

During the quarter, IBM inked a definitive agreement to acquire Apptio Inc., a prominent provider of financial and operational IT management and optimization software, for $4.6 billion. Apptio is a well-established, profitable leader in technology business management and FinOps, serving in excess of 1,500 clients, including more than half of the Fortune 100. The transaction, expected to close in the latter half of 2023, is likely to bolster IBM's IT automation capabilities, empowering enterprise leaders to generate incremental value across the technology domain.

Overall Expectations

The Zacks Consensus Estimate for revenues from Software is pegged at $6,352 million, implying a rise from $6,166 million reported in the year-ago quarter.

The Zacks Consensus Estimate for total revenues for the company stands at $15,566 million. It generated revenues of $15,535 million in the prior-year quarter. The consensus mark for earnings is currently pegged at $2.00 per share, indicating a decline from $2.31 in the year-earlier quarter.

Earnings Whispers

Our proven model does not predict an earnings beat for IBM this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here, as elaborated below.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is 0.00%, with both pegged at $2.00. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

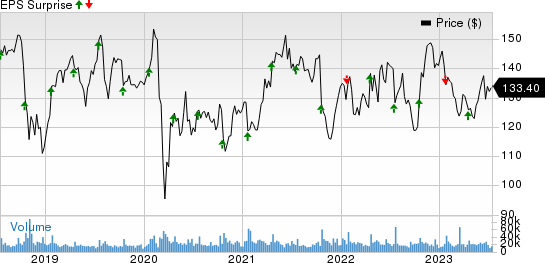

International Business Machines Corporation Price and EPS Surprise

International Business Machines Corporation price-eps-surprise | International Business Machines Corporation Quote

Zacks Rank: IBM currently has a Zacks Rank #3.

Stocks to Consider

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this season:

Intel Corporation INTC is set to release quarterly numbers on Jul 27. It has an Earnings ESP of +21.05% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Earnings ESP for T-Mobile US, Inc. TMUS is +11.77% and it carries a Zacks Rank of 2. The company is scheduled to report quarterly numbers on Jul 27.

The Earnings ESP for Meta Platforms, Inc. META is +6.56% and it carries a Zacks Rank of 2. The company is scheduled to report quarterly numbers on Jul 26.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report