Here's Why Maximus (MMS) is an Attractive Pick Right Now

Maximus, Inc. MMS is a leading operator of government health and human services programs globally. The company maintains solid relationships and a strong reputation with governments. Long-term contracts provide it with a steady flow of revenues, which increased 11.7% year over year in the second quarter of fiscal 2024.

Increased longevity and more complex health needs have increased the need for government social benefits and safety-net programs. This is likely to continue driving demand for MMS’ services.

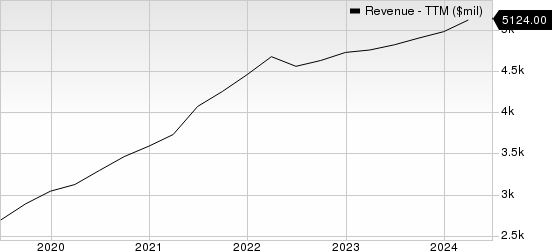

Maximus, Inc. Revenue (TTM)

Maximus, Inc. revenue-ttm | Maximus, Inc. Quote

Commitment to shareholder returns makes Maximus a reliable way for investors to compound wealth over the long term. During fiscal 2023, 2022, and 2021, the company paid cash dividends of $68.1 million, $68.7 million, and $68.8 million, respectively.

Let’s take a look at the factors that make the stock an attractive pick

Solid Rank and VGM Score: MMS currently sports a Zacks Rank #1 (Strong Buy) and a VGM Score of B. Our research shows that stocks with a Zacks Rank #1 or 2 (Buy), when combined with a VGM Score of A or B, offer the best investment opportunities. Thus, the company appears to be a compelling investment proposition at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions: Three estimates for fiscal 2024 have moved north in the past 60 days versus no southward revision, reflecting analysts’ confidence in the company. The Zacks Consensus Estimate for fiscal 2024 earnings has moved up 6.8% in the past 60 days.

Strong Growth Prospects: The Zacks Consensus Estimate for MMS’ fiscal 2024 earnings is pegged at $5.79, indicating 51.2% growth from the year-ago level. Earnings for fiscal 2025 are expected to increase 3.2% from the prior-year actuals.

Other Stocks to Consider

Some other top-ranked stocks in the broader Zacks Business Services sector are Barrett Business Services BBSI and Charles River Associates CRAI

Barrett Business Services has a Zacks Rank of 2 at present. BBSI has a long-term earnings growth expectation of 14%. It delivered a trailing four-quarter earnings surprise of 38.6%, on average.

Charles River Associates currently carries a Zacks Rank of 2. It has a long-term earnings growth expectation of 16%. CRAI delivered a trailing four-quarter earnings surprise of 19.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report