Here's Why Investors May Bet on McDonald's (MCD) Stock Now

McDonald's Corporation MCD is gaining from robust growth in comparable restaurant sales, expansion efforts, digital strategies, menu innovations and customer loyalty programs.

Recently, MCD reported second-quarter 2023 results, wherein both earnings and revenues surpassed the Zacks Consensus Estimate. The top and bottom lines increased 13.6% and 24.3% year over year, respectively.

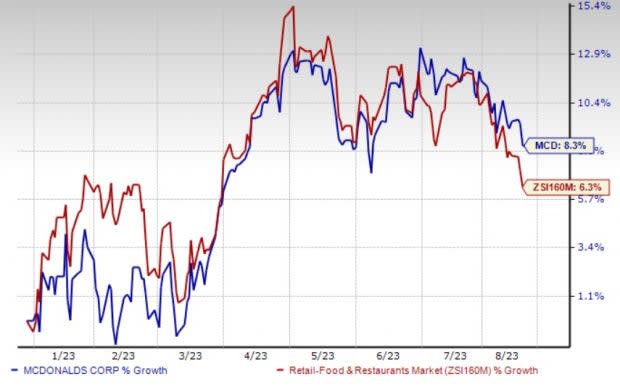

Further, analysts are very optimistic about the company’s solid prospects. In the past seven days, earnings estimate for 2023 has witnessed 0.3% upward revision to $11.49 per share. It has an impressive long-term earnings growth rate of 8.9%. So far this year, the stock has increased 8.3% compared with the industry’s growth of 6.3%.

Let’s delve deeper.

Growth Drivers

McDonald’s continues to impress investors with robust comps growth. In second-quarter 2023, global comps grew 11.7% compared with 10% in the prior-year quarter. This marks the ninth consecutive quarter of comps growth.

Image Source: Zacks Investment Research

Comps in the United States, international operated markets and international developmental licensed segment rose 10.3%, 11.9% and 14%, respectively. MCD gained from robust performance in most markets, led by the U.K. and Germany. McDonald’s’ comps in the quarter benefited from a menu price increase, positive guest counts and marketing initiatives. Also, continued digital and delivery growth contributed to the upside.

This Zacks Rank #2 (Buy) company believes that there is a huge opportunity to grow all its brands globally by expanding its presence in existing markets and entering new ones. Its expansion efforts continue to drive performance.

McDonald’s is planning to open more than 1,900 restaurants globally in 2023, including 400 openings in the United States and IOM segment and 1,500(including nearly 900 in China) inaugurations in the IDL market. It expects net restaurant unit expansion to contribute nearly 1.5% to 2023 systemwide sales growth in constant currencies.

McDonald's has been conducting trials of automated order-taking systems at selected drive-thru locations across the United States. It is actively expanding its mobile ordering and payment services, incorporating a fresh curbside check-in feature. A growing emphasis on delivery underscores MCD’s commitment to elevating customer satisfaction and convenience, a focus that extends to over 100 countries.

The company’s strategic collaborations with Uber Eats and DoorDash represents a notable step forward in its delivery initiatives. Particularly, within the past year, the proportion of delivery sales has doubled in key markets such as Australia, Canada and the United States.

Ever since the launch of loyalty program in the United States, MCD has been able to transform its offerings across drive-thru, takeaway, delivery, curbside pick-up and dine-in. Along with helping in to retain existing customers the program is expanding customer base. The company has already introduced a loyalty program in more than 50 markets, including the United States, Germany, Canada, U.K., Australia and France.

During second-quarter 2023, MCD introduced Frequent Fryer program. Following the launch, it reported a rise in digital acquisition and digital customer frequency. McDonald’s witnessed impressive customer engagement with over 52 million 90-day active members across its top six markets.

Other Key Picks

Below we present some other top-ranked stocks in the Zacks Retail-Wholesale sector.

BJ's Restaurants, Inc. BJRI sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 121.2%, on average. Shares of BJRI have increased 15.1% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BJRI’s 2023 sales and EPS indicates 5.6% and 423.5% growth, respectively, from the year-ago period’s levels.

Arcos Dorados Holdings Inc. ARCO currently carries a Zacks Rank #2. ARCO has a long-term earnings growth rate of 9.5%. The stock has gained 44.4% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2023 sales and EPS indicates 19% and 11.6% growth, respectively, from the year-ago period’s levels.

Chuy's Holdings, Inc. CHUY carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 26.6% on average. Shares of CHUY have increased by 61% in the past year.

The Zacks Consensus Estimate for CHUY’s 2023 sales and EPS indicate an increase of 9.5% and 32.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report