Here's Why Investors Should Avoid Papa John's (PZZA) for Now

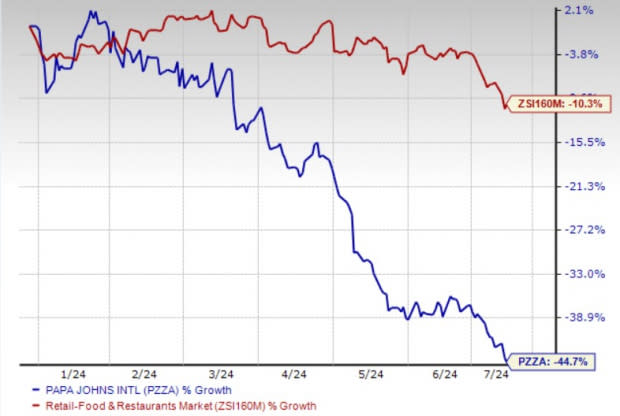

Papa John's International, Inc. PZZA has faced a turbulent 2024, with its stock down by a significant 44.7% year-to-date. This decline far outstrips the industry’s overall 10.3% drop, underscoring the challenges the company is grappling with in a difficult macroeconomic environment, waning consumer confidence and dismal comps growth.

Analysts are also losing confidence in Papa John's stock. In the past 60 days, the Zacks Consensus Estimate for earnings in 2024 and 2025 has been revised downward by 3.6% and 4.4% to $2.40 and $2.80, respectively.

Headwinds

The industry is grappling with challenges stemming from potential geopolitical events in an ever-changing global landscape. Papa John's closely monitors these situations and adapts its operations in affected regions accordingly. In the first quarter of fiscal 2024, the company’s international comparable sales were negatively impacted by ongoing conflict in the Middle East, resulting in a 2.6% year-over-year decline compared to a 5.8% drop in the prior-year quarter at international restaurants. The company remains vigilant regarding international comparable sales due to the unpredictable international environment.

Dismal comps performance has been hurting investors’ confidence. In the fiscal first quarter, total comparable sales lost 2% year over year compared with a 1.3% fall in the prior-year quarter. Domestic company-owned restaurant comps in the quarter under review declined 3% year over year against 3.4% growth in the year-ago quarter. At North America’s franchised restaurants, comps dropped 1.5% year over year compared with a 0.8% decline in the year-ago quarter.

The Zacks Rank #5 (Strong Sell) company's outlook for the rest of the year indicates a cautious approach, with North America's comparable sales experiencing a slight decline in the first four weeks of the second quarter. This trend may continue due to ongoing economic challenges and weakening consumer confidence. The company adjusted its full-year guidance to reflect this cautious outlook, anticipating North America's comparable sales to range from flat to a slight decline for the entirety of 2024.

Image Source: Zacks Investment Research

Conclusion

Given the array of challenges facing Papa John's—from weak comparable sales, geopolitical risks and a cautious outlook—investors have ample reason to be wary of its stocks. With analysts also scaling back their earnings expectations, the headwinds appear significant and persistent, making it a potentially risky bet for investors seeking stability and growth in their portfolios.

Key Picks

Some better-ranked stocks in the Zacks Retail-Wholesale sector are:

Brinker International, Inc. EAT has a trailing four-quarter earnings surprise of 213.4%, on average. EAT’s shares have surged 74% in the past year. Currently, EAT sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for EAT’s 2024 sales and earnings per share (EPS) indicates 5.2% and 43.1% growth, respectively, from the year-earlier actuals.

Wingstop Inc. WING currently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter negative earnings surprise of 21.4%, on average. The stock has surged 109% in the past year.

The Zacks Consensus Estimate for WING’s 2024 sales and EPS suggests a rise of 27.9% and 37.9%, respectively, from the year-ago levels.

El Pollo Loco Holdings, Inc. LOCO currently carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 19.4%, on average. LOCO’s shares have risen 9.6% in the past year.

The Zacks Consensus Estimate for LOCO’s 2025 sales and EPS indicates 3.8% and 9.9% growth, respectively, from the prior-year figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Papa John's International, Inc. (PZZA) : Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report