Here's Why You Should Bet on ShockWave Medical (SWAV) Stock

ShockWave Medical, Inc. SWAV is well-poised for growth, backed by its research and development (R&D) efforts, and its focus on clinical studies.

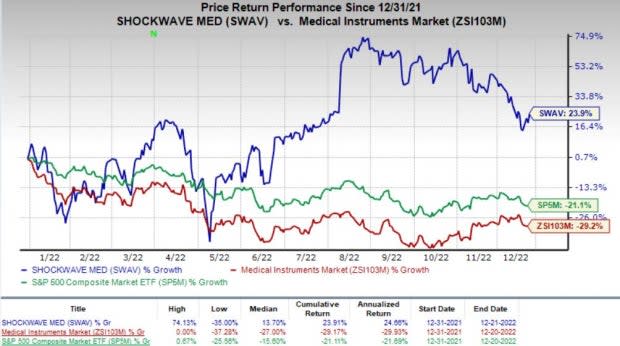

Shares of this presently Zacks Rank #2 (Buy) player have gained 23.9% against the industry’s decline of 29.2% so far this year. The S&P 500 Index has fallen 21.1% in the same time frame.

With a market capitalization of $7.65 billion, this medical device company is committed to developing and commercializing products created to change the way calcified cardiovascular disease is treated. ShockWave Medical’s earnings yield of 1.38% compares favorably with the industry’s (9.2%). Earnings beat estimates in each of the trailing four quarters, the average being 146.10%.

Image Source: Zacks Investment Research

What’s Driving Its Performance?

ShockWave Medical invests in R&D efforts to accelerate its IVL Technology, thus broadening and enhancing its existing product offerings. In the third quarter of 2022, SWAV incurred R&D expenses of $20.2 million, up 46.9% from the prior-year quarter’s figure.

For 2022, Shockwave Medical expects revenues in the range of $483-$488 million (up from the previously guided band of $465-$475 million), implying growth of 104-106% from the prior-year period’s level.

SWAV believes in its ability to rapidly develop innovative products owing to a dynamic product innovation process. The versatility and leveraging ability of its core technology and management philosophy are tailwinds that continue to improve the R&D process. Shockwave Medical recruited and retained engineers and scientists with substantial expertise in developing medical devices. SWAV’s pipeline of products in various stages of development is anticipated to provide additional commercial opportunities.

Since its inception, ShockWave Medical has been committed to generating clinical data to show the safety and effectiveness of its IVL Technology. These initial studies consistently highlighted low rates of complications irrespective of the type of vessel being examined. Apart from getting regulatory approvals or clearances, data from SWAV’s clinical studies strengthen its ability to drive the adoption of Intravascular Lithotripsy (IVL) Technology throughout multiple therapies in existing and new market segments.

ShockWave Medical’s past studies guided optimal IVL procedure technique and enriched the design of its IVL System and products in development. Management is optimistic about the continued clinical acceptance and penetration of IVL, as demonstrated by its strong results in the quarter under review as well as a higher outlook for revenues in 2022.

The company has ongoing clinical programs for several products and indications. On being successful, these will enable SWAV to expand the commercialization of its products into new geographies and indications.

Shockwave Medical received regulatory approval for the Shockwave C2 Coronary IVL Catheter in Japan earlier in 2022. Besides, SWAV announced the introduction and global availability of the Shockwave M5+ peripheral IVL catheter, post the receipt of the CE mark and the FDA clearance.

What’s the Downside?

Limited commercialization expertise and approved or cleared products pose a challenge to Shockwave Medical in evaluating its current business and determining its future financial growth.

Estimate Trend

For 2022, the Zacks Consensus Estimate for revenues is pegged at $487.4 million, indicating an improvement of 105.5% from the year-ago reported figure. The same for adjusted earnings per share stands at $2.93, suggesting growth of almost 1227% from the prior-year reported figure.

ShockWave Medical, Inc. Price

ShockWave Medical, Inc. price | ShockWave Medical, Inc. Quote

Other Key Picks

Some other top-ranked stocks from the broader medical space are Elevance Health ELV, Merit Medical Systems MMSI and HealthEquity HQY, each carrying a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Elevance Health’s earnings per share has risen from $28.97 to $29.02 for 2022 and from $32.58 to $32.63 for 2023 in the past 60 days. ELV has rallied 10.2% so far this year. Elevance Health delivered an earnings surprise of 4.11%, on average, in the last four quarters.

Estimates for Merit Medical Systems have improved from earnings of $2.47 to $2.57 for 2022 and $2.77 to $2.82 for 2023 in the past 60 days. MMSI stock has risen 13.1% so far this year. Merit Medical Systems delivered an earnings surprise of 25.35%, on average, in the last four quarters.

Estimates for HealthEquity’s earnings per share have increased from $1.28 to $1.29 for fiscal 2023 and from $1.76 to $1.79 for fiscal 2024 in the past 60 days. HQY has rallied 39.6% so far this year. HealthEquity’s earnings are anticipated to improve 26.3% over the next five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report