Here's Why AZUL Stock Should Continue to be in Your Portfolio

With growth score of A, Azul S.A. (AZUL) has outperformed its industry by growing 5.2% year-to-date compared to the industry’s 4% growth in the same time frame.

Let’s look at some other factors that make AZUL a stock to be kept intact in portfolios.

Improving air travel demand bodes well for AZUL, and the recently released air traffic data for March gives the same picture. The consolidated figures for revenue passenger kilometers, a measure of air traffic showed an increase of 8.1% compared to the year-ago reported figure. The company’s various codeshare agreements have helped increase international air traffic by 89.7% as compared to the year-ago figure. A 9.4% increase in capacity has resulted in the load factor (% of seats filled by passengers) being at 77.8% for the reported period.

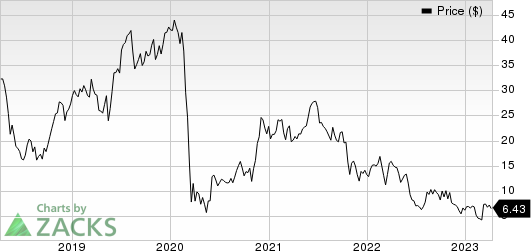

AZUL Price

AZUL price | AZUL Quote

For more efficient revenue management, Azul has recently partnered with FLYR Labs. Through FLYR the company will receive comprehensive data management and pricing capabilities which will in turn help it provide tailored offers to customers.

The company has also made efforts to strengthen its cash generation ability and capital structure. AZUL recently entered into a commercial agreement with the lessor whereby the lessors will reduce the company’s lease payments to get rid of Covid related deferrals and also reduce the gap between the agreed-upon market rate and AZUL’s contractual rates. In exchange, the lessors will be in receipt of tradeable notes with a maturity of 2030 and the company’s equity.

AZUL has been undertaking initiatives to reward its shareholders. The company’s board recently approved a repurchase agreement under which the company can repurchase its 1.3 million shares between Nov 7, 2022, and May 7, 2024. Efforts to modernize its fleet, characterized by fuel efficiency, also bode well for Azul.

AZUL currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Some Risks

The bottom line is threatened by escalating fuel prices. The increased prices are mainly due to the demand-supply imbalance.

AZUL’s current ratio of 0.32 for 2022 was lower than the previous year’s reported figure of 0.50. A current ratio of less than 1 implies that a company doesn’t have enough liquid assets to cover its short-term liabilities.

Stocks to Consider

Investors interested in the Zacks Airline industry may also consider the following stocks:

Copa Holdings CPA, sporting a Zacks Rank of 1, is benefiting from the improvement in air travel demand. In fourth-quarter 2022, passenger revenues increased 29.5%, owing to higher yields. CPA’s focus on its cargo segment is encouraging too. In fourth-quarter 2022, cargo and mail revenues grew 69%, owing to higher cargo volumes and yields. Copa Holdings’ fleet modernization and cost-management efforts are commendable. The above-mentioned tailwinds are likely to continue aiding this Latin American carrier. The Zacks Consensus Estimate for current-year earnings has been revised 10% upward over the past 60 days.

American Airlines AAL, having a Zacks Rank #2 (Buy), is seeing a steady recovery in domestic air travel demand. AAL has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for AAL’s current-year earnings has improved 19.1% over the past 60 days. AAL has surpassed the Zacks Consensus Estimate for earnings in three of the past four quarters and missed once.,the average beat being 7.79%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

AZUL (AZUL) : Free Stock Analysis Report