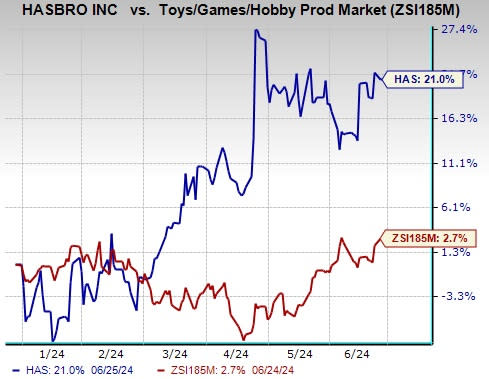

Hasbro (HAS) Gains 21% YTD: Will the Upward Trend Continue?

Hasbro, Inc.’s HAS shares gained 21% in the year-to-date period, outperforming the Zacks Toys - Games - Hobbies industry’s 2.7% growth.

This American multinational toy manufacturing and entertainment holding company is benefiting from strategic partnerships accompanied by its focus on its gaming and entertainment business. Its ongoing indulgence in enhancing its product portfolio has led to it providing diverse and expanded product offerings to its customers.

Consistent focus on product launches and a shift toward more technology-driven toys involve certain costs and expenses. These investments are likely to drive profits in the long term, however, they might prove to be detrimental in the near term. The company has been shouldering high expenses concerning freight, product costs, sales allowances, and various toy and gaming products closeouts. Also, product development costs are adding pressure on the bottom line. Nonetheless, the aforementioned tailwinds have been aiding Hasbro in tackling the negative impacts to a great extent.

The Zacks Consensus Estimate for the company's 2024 and second-quarter earnings has risen to $3.72 per share from $3.66, and 76 cents per share from 74 cents, respectively, in the past 30 days. The estimated figures indicate 48.2% and 55.1% growth from the respective prior year’s reported levels. HAS delivered a trailing four-quarter earnings surprise of 17.5%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper to understand the growth drivers of this Zacks Rank #3 (Hold) company.

Attractive Factors of the Stock

Strategic Partnerships: Hasbro intently focuses on investing in innovation, strategic partnerships or collaborations and other profitable sales-boosting initiatives. Regarding its focus on partnerships, within the first three months of 2024, Hasbro announced new licensing agreements with Resolution Games, renowned for the VR game Demeo, and Game Loft, the makers of Disney Dreamlight Valley. Both partnerships have been considered for game development under the Dungeons & Dragons universe.

Furthermore, the content delivered by the company from its partnership with Paramount has garnered exceptional responses from its customers, thus fostering its growth prospects. One of the examples is the TRANSFORMERS Franchise, in which Hasbro continues to release content in all forms of entertainment, including movies, television and digital expressions. In the first quarter of 2024, the TRANSFORMERS franchise experienced an increase in point-of-sale primarily driven by the success of the movie ‘Transformers Rise of the Beasts’. Also, the company announced the completion of new partnerships with LEGO, Converse and Black Milk Apparel, to celebrate Dungeons & Dragons’ 50th anniversary. Hasbro is also optimistic about its strategic relationship with Playmates to produce and distribute Power Rangers toys from 2025.

Solid Entertainment Business: Hasbro’s entertainment business also contributes to its growth trends. In partnership with Paramount, the company is set to release the star-studded animated film, Transformers 1, in theaters in September 2024. Also, during the first quarter, it announced a deal with Lionsgate and Margot Robbie's production company, Lucky Chap, to produce a live-action Monopoly movie. Deal with the CW was also highlighted for the creation of game shows around Trivial Pursuit and Scrabble. Hasbro is optimistic about its just-announced film and TV projects for Clue in collaboration with Sony.

The company remains optimistic that the aforementioned contents will drive revenues and boost operating profits in 2024. Furthermore, Hasbro intends to continue to grow its direct initiatives behind brands like Star Wars, Marvel, Transformers, MAGIC, GI Joe, D&D, and Power Rangers, which portray one of the best lineups of IP in the collectible space.

Focus on Gaming Business: Apart from its entertainment business, Hasbro’s gaming business is driving its top-line growth. The company has been witnessing strengths in demand for its gaming services on the back of its supreme gaming portfolio, and refining gaming experiences across a multitude of platforms like face-to-face gaming, tabletop gaming and digital gaming experiences in mobile. It stated that it has been investing in longer-term larger gameplay and also plans to introduce innovations into the gaming category in 2024.

The company's gaming category, which includes Magic: The Gathering, NERF, Peppa Pig, My Little Pony, Transformers, Play-Doh, LEGO as well as Hasbro products for the Marvel portfolio, is witnessing solid demand patterns. Hasbro remains optimistic that 2024 will be a big year for gaming, including adult party games, family card games, casual strategy, and mega-hits like Monopoly.

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has gained 58.9% in the past year. The Zacks Consensus Estimate for RCL’s 2024 sales and earnings per share (EPS) implies growth of 16.8% and 63.8%, respectively, from the year-ago levels.

PlayAGS, Inc. AGS presently sports a Zacks Rank of 1. AGS has a trailing four-quarter earnings surprise of 33.3%, on average. The stock has hiked 102.1% in the past year.

The consensus estimate for AGS’s 2024 sales and EPS implies growth of 6.5% and 3,000%, respectively, from the year-ago levels.

Adtalem Global Education Inc. ATGE currently sports a Zacks Rank of 1. ATGE has a trailing four-quarter earnings surprise of 18.8%, on average. The stock has surged 90.7% in the past year.

The Zacks Consensus Estimate for ATGE’s fiscal 2025 sales and EPS indicates an increase of 5.3% and 16.6%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE) : Free Stock Analysis Report

PlayAGS, Inc. (AGS) : Free Stock Analysis Report