Gladstone (GAIN) Q4 Earnings Miss Estimates, Costs Rise

Gladstone Investment Corporation GAIN reported fourth-quarter fiscal 2021 (ended Mar 31) net investment income (NII) of 9 cents per share, which lagged the Zacks Consensus Estimate of 18 cents. Also, the bottom line compared unfavorably with 45 cents in the year-ago quarter.

Decent portfolio activity during the quarter and rise in investment income were tailwinds. However, results were hurt by higher expenses.

NII was $3.1 million, down 78.7% from the prior-year quarter.

In fiscal 2021, the company reported NII $17.9 million or 54 cents per share compared with $36.4 million or $1.11 in fiscal 2020. The Zacks Consensus Estimate was pegged at 68 cents.

Total Investment Income & Expenses Rise

Total investment income was $16.7 million, up 39.4% year over year. Also, the top line surpassed the Zacks Consensus Estimate of $13.8 million.

In fiscal 2021, the company reported total investment income of $56.6 million, down 8.6% from fiscal 2020. The top line beat the consensus estimate of $53.7 million.

Total expenses were $13.6 million against negative expenses of $2.8 million.

Total Portfolio Value & Balance Sheet

The fair value of Gladstone’s total investment portfolio was $633.8 million as of Mar 31, 2021. During the fiscal fourth quarter, the company invested $5.7 million in existing portfolio companies.

As of Mar 31, 2021, the company’s net asset value was $11.52 per share compared with $11.11 on Dec 31, 2020.

The company had $643.7 million in total assets and $151.4 million in total borrowings at the end of the quarter.

Our Take

Decent portfolio activities are expected to support Gladstone’s profitability. However, a tough operating backdrop poses a concern.

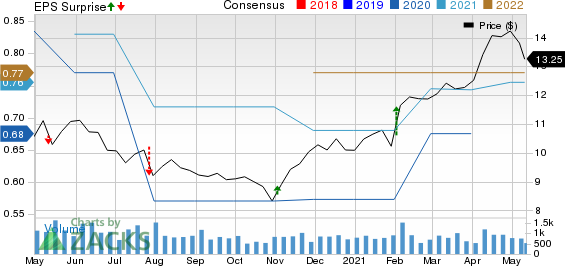

Gladstone Investment Corporation Price, Consensus and EPS Surprise

Gladstone Investment Corporation price-consensus-eps-surprise-chart | Gladstone Investment Corporation Quote

Currently, Gladstone carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Main Street Capital Corporation’s MAIN first-quarter 2021 NII of 58 cents per share surpassed the Zacks Consensus Estimate of 55 cents. Also, the bottom line rose 2% from the year-ago figure.

TriplePoint TPVG reported first-quarter 2021 NII of 29 cents per share. The bottom line plunged 29.3% from the year-ago quarter.

FS KKR Capital Corp. FSK reported first-quarter 2021 NII of 63 cents per share, which beat the Zacks Consensus Estimate of 61 cents. However, the bottom line compared unfavorably with 76 cents in the year-ago quarter.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gladstone Investment Corporation (GAIN) : Free Stock Analysis Report

Main Street Capital Corporation (MAIN) : Free Stock Analysis Report

TriplePoint Venture Growth BDC Corp. (TPVG) : Free Stock Analysis Report

FS KKR Capital Corp. (FSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research