Genuine Parts (GPC) to Report Q1 Earnings: What Awaits?

Genuine Parts Company GPC is slated to release first-quarter 2021 results on Apr 22, before the opening bell. The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at $1.21 per share and $4.28 billion, respectively.

This Atlanta-based automotive replacement parts supplier delivered better-than-expected earnings in the last reported quarter on higher-than-anticipated revenues and income from the Industrial Parts segment.

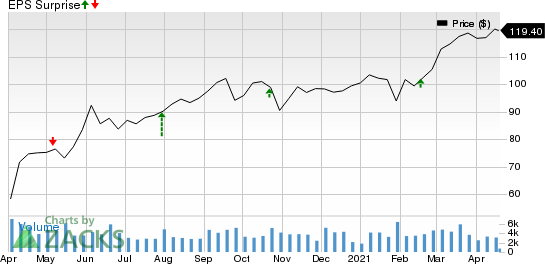

Over the trailing four quarters, Genuine Parts surpassed estimates on three occasions and missed on the other, with the average surprise being 9.9%. This is depicted in the graph below:

Genuine Parts Company Price and EPS Surprise

Genuine Parts Company price-eps-surprise | Genuine Parts Company Quote

Trend in Estimate Revisions

The Zacks Consensus Estimate for Genuine Parts’ first-quarter earnings per share has been unchanged in the past 30 days. The bottom-line projection indicates an improvement from the year-ago earnings of 92 cents per share. However, the Zacks Consensus Estimate for quarterly revenues suggests a year-over-year decline of 6% due to divestiture of the firm’s Business Products segment in 2020.

Earnings Whispers

Our proven Zacks model does not conclusively predict an earnings beat for Genuine Parts this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that is not the case here as elaborated below.

Earnings ESP: The company has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is on par with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Genuine Parts currently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors to Consider

Demand for vehicles in first-quarter 2021 had been strong amid preference for personal mobility, widespread vaccination drive, optimism around federal aid and the gradual reopening of activities. Consequently, demand for replacement parts is likely to have improved. Rising revenues from the Automotive Parts Group, the largest segment of Genuine Parts, is anticipated to have fueled the company’s total revenues during the quarter-to-be reported. The Zacks Consensus Estimate for this segment’s quarterly net sales is pegged at $2,691 million, suggesting an increase from $2,581.6 million recorded in first-quarter 2020.

However, the consensus mark for Industrial Parts unit revenues is pegged at $1,483 million, implying a decline from $1,509.8 million in the prior-year quarter. Further, Genuine Parts is likely to have bore the brunt of soaring costs owing to the development of technically-enhanced components. Further, high tariff charges on aluminum and steel sourced from outside the United States are likely to have increased manufacturing costs of replacement parts and components, thereby denting margins.

Stocks With Favorable Combinations

Here are a few auto stocks worth considering, as these have the right combination of elements to come up with an earnings beat this time around:

Tesla TSLA has an Earnings ESP of +12.06% and carries a Zacks Rank #3 at present. The electric vehicle behemoth is slated to announce first-quarter 2021 results on Apr 26.

Ford F has an Earnings ESP of +2.11% and carries a Zacks Rank #3 at present. The company is set to announce first-quarter 2021 results on Apr 28.

Oshkosh Corporation OSK has an Earnings ESP of +0.73% and carries a Zacks Rank #2 at present. The company is scheduled to announce second-quarter fiscal 2021 results on Apr 28.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research