General Motors (GM) Q2 Earnings to Get a Boost From GMNA Unit

General Motors’ GM North America market — which accounts for the bulk of total automotive revenues — is likely to have fueled second-quarter 2023 earnings. The U.S. auto giant is set to release quarterly results tomorrow, before market open.

(Also read: General Motors Gears Up for Q2 Earnings: Things to Note)

Q1 Highlights of GM’s North America Market

General Motors North America (GMNA) segment generated first-quarter net revenues of $32,889 million, up from $29,456 million recorded in the corresponding period of 2022. Also, revenues from the unit outpaced the Zacks Consensus Estimate of $31,556 million. The region’s wholesale vehicle sales of 723,000 units increased from 694,000 units reported in the year-ago quarter. The segment’s operating profit came in at $3,576 million, increasing from $3,141 million witnessed in the year-earlier period. The segmental profit also beat the consensus mark of $2,799 million.

Solid GMNA Performance to Drive Overall Results

General Motors reported a rise of 19% in U.S. vehicle sales in the second quarter of 2023 from the year-ago quarter’s levels. During the second quarter, GM sold 691,978 new vehicles, up from 582,401 vehicles during the second quarter of 2022 and 600,000 vehicles during the first quarter of 2023. All four of GM's brands delivered double-digit year-over-year increases in the second quarter— Chevrolet (17%), Cadillac (15%), Buick (48%) and GMC (18%).

Year-over-year sales volumes were aided by improvement in inventory levels. Additionally, the demand for automobiles remained strong, indicating that the rise in interest rates has not yet significantly affected purchasing decisions. We expect the results of the GMNA segment to be driven by higher-than-expected year-over-year sales volumes and average selling price per unit.

Our projection for GMNA’s second-quarter wholesale vehicle sales is 738,000 units, indicating an increase of 11.5% from the year-ago reported levels. Additionally, we expect revenue per unit of $45,076.7, suggesting a year-over-year increase of 3.8%. As such, our estimate for revenues from the GMNA segment is pegged at $33,283.4 million, calling for a rise from $28,760 million recorded in the second quarter of 2022. Our forecast for the GMNA unit’s operating income is $3,004.8 million, indicating a jump from $2,299 million generated in the year-ago period.

GM’s Overall Earnings & Revenue Projections for Q2

The Zacks Consensus Estimate for General Motors’s second-quarter earnings and revenues is pegged at $1.65 a share and $42.46 billion, respectively.

Investors should note that our model predicts an earnings beat for General Motors this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. GM has an Earnings ESP of +8.60% and a Zacks Rank #2.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

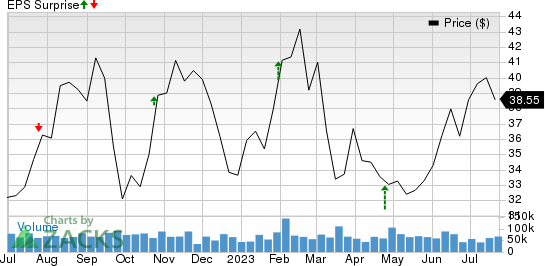

General Motors Company Price and EPS Surprise

General Motors Company price-eps-surprise | General Motors Company Quote

Other Stocks With Favorable Combination

Here are a few other stocks in the auto sector that are worth considering, as these have the right combination of elements to come up with an earnings beat this time around:

PACCAR PCAR has an Earnings ESP of +0.27% and a Zacks Rank #2. The trucking giant is set to report results tomorrow.

The Zacks Consensus Estimate for PCAR’s to-be-reported quarter’s earnings and revenues is pegged at $2.12 per share and $8.21 billion, respectively. PCAR surpassed earnings estimates in the last four quarters, with the average being 16.6%.

Lear Corporation LEA has an Earnings ESP of +3.16% and a Zacks Rank #2. The manufacturer of automotive seating and electronic systems is slated to report results on Aug 1.

The Zacks Consensus Estimate for LEA’s to-be-reported quarter’s earnings and revenues is pegged at $3.05 per share and $5.72 billion, respectively. LEA surpassed earnings estimates in the last four quarters, with the average being 15.5%.

Rivian Automotive RIVN has an Earnings ESP of +6.25% and a Zacks Rank #2. The electric vehicle company is set to report results on Aug 8.

The Zacks Consensus Estimate for RIVN’s to-be-reported quarter’s bottom line and revenues is pegged at a loss of $1.42 per share and $932.3 million, respectively. RIVN surpassed earnings estimates in three of the last four quarters and missed in the other, with the average being 6.08%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report