General Electric's (GE) Technology Powers Thailand's Plant

General Electric Company GE and Electricity Generating Authority of Thailand (EGAT) recently announced the commencement of commercial operation of the latter’s Bang Pakong Power Plant Block 1 and 2 in Bang Pakong, located in the Chachoengsao Province.

The original Bang Pakong Power Plant complex, which was built in 1977, comprised of five blocks burning natural gas and diesel. The new gas-fired combined cycle blocks retired the old ones and are powered by GE’s equipment. Adding approximately 1,400 Megawatts (MW) of electricity, the new blocks provide sufficient power needed by approximately 3 million Thai homes.

The new blocks of Bang Pakong Power Plant are powered by GE’s two 9HA.02 gas turbines, two advanced STF-A650 steam turbines and two W86 generators. The 9HA.02 gas turbines, when blended with natural gas can burn up to 50% volume of hydrogen.

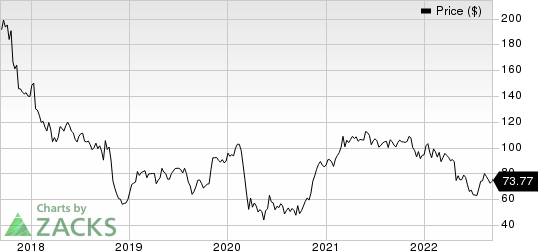

General Electric Company Price

General Electric Company price | General Electric Company Quote

General Electric also signed a long-term services agreement with EGAT to provide parts, repairs and maintenance services for these sites.

Zacks Rank & Stocks to Consider

GE currently carries a Zacks Rank #3 (Hold). Some better-ranked companies are discussed below:

Carlisle Companies CSL sports a Zacks Rank #1 (Strong Buy), currently. CSL pulled off a trailing four-quarter earnings surprise of 28%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

In the past 60 days, Carlisle’s earnings estimates have increased 14.7% for 2022. The stock has rallied 36.5% in the past six months.

Greif, Inc. GEF presently has a Zacks Rank #2 (Buy). GEF delivered a trailing four-quarter earnings surprise of 22.4%, on average.

GEF’s earnings estimates have increased 4.6% for fiscal 2022 (ending October 2022) in the past 60 days. Its shares have risen 15.7% in the past six months.

Valmont Industries, Inc. VMI presently has a Zacks Rank of 2. VMI’s earnings surprise in the last four quarters was 13.7%, on average.

In the past 60 days, Valmont’s earnings estimates have increased 3.8% for 2022. The stock has rallied 24.5% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research