G4S tells investors to reject ‘desperate’ GardaWorld bid

G4S bosses have told investors to ignore GardaWorld’s £3bn hostile bid, saying the Canadian suitor “desperately needs G4S” and is seeking to remedy its own weaknesses at their expense.

The response comes after GardaWorld’s offer document almost a fortnight ago set out terms of its 190p-a-share hostile offer.

G4S chairman John Connolly told investors that GardaWorld, which is backed by BC Partners, “desperately needs access to G4S’s balance sheet and strong cash flows in order to finance this acquisition, and their acquisition-fuelled growth strategy”.

He also warned investors that GardaWorld “lacks global scale and coverage and acquiring G4S at a discount to fair value would allow them to own a clear leader in global security - at your expense”.

Chief executive Ashley Almanza also weighed in, calling the bid "completely opportunistic", taking advantage of depressed equity markets and coming at a time "where we have done all the heavy lifting" to turn the business around.

He added that GardaWorld, which he said was "loss-making, has a stretched balance sheet, high leverage and is not particularly cash generative", is seeking a tie-up to mask these issues.

G4S , Mr Almanza said, "is the only option they have" as other big security companies do not have a big enough free float of shares or have cornerstone investors.

Mr Connolly also took a swipe at GardaWorld by questioning whether it could handle a takeover.

He said the smaller suitor had “quite simply failed to articulate why your company’s employees and stakeholders should support an acquisition that would be over 10 times the size of GardaWorld’s largest acquisition to date”.

He also raised the prospect of job losses among G4S’s more than 500,000 staff worldwide.

Mr Connolly said: “In all its communications, GardaWorld has been conspicuously non-committal about the future of G4S’s non-UK employees, who represent 95pc of our workforce.”

GardaWorld has launched a string of attacks on G4S since going public with its offer in September, having had two private approaches at 140p and 153p over the summer knocked back.

The privately held Canadian business has claimed there are “serious issues” with G4S, resulting in it losing market share.

It has also questioned the size of the liabilities of the UK-listed company’s pension scheme and the potential for future costly legal battles.

Mr Connolly has hit back about GardaWorld’s tactic to repeatedly criticise his company.

G4S dwarfs its suitor, with three times the annual revenues at more than £7bn and operations in more than 80 countries. GardaWorld is a much smaller, with only about 100,000 staff.

G4S also used the letter to investors to upgrade it financial targets, with a goal of 4pc to 6pc revenue growth per year, and a 7pc profit margin.

Stephan Crétier, GardaWorld chief executive, said: “The idea that a management team which has failed to deliver for the last seven years is now asking shareholders to wait another five years for ‘Vision 2025’ defies rational analysis. The empty promises and, in G4S’s own words, ‘aspirational targets’ show that this management team has lost track of reality.”

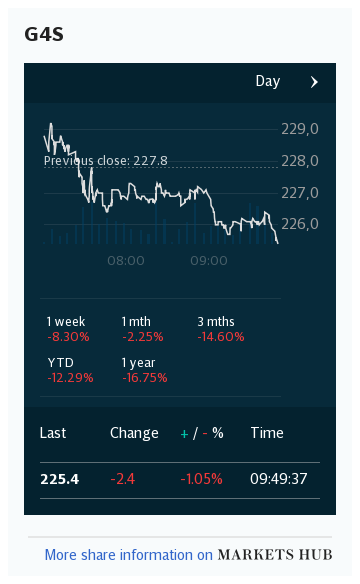

Shares fell 0.3pc to 204.9p.