Pound swings on no-deal Brexit fears

The pound see-sawed as no-deal Brexit fears returned to stalk the markets.

The EU's confirmation that it would launch legal action against the UK over the Internal Market Bill sent sterling lower before it rebounded on an FT report that both sides were close to a "landing zone" on state aid rules in trade talks.

This was later shot down by an unnamed EU official, who denied the talks were near an agreement – sending the currency lower again.

03:52 PMThat's a wrap

That's a wrap

That's it for today. Thanks for following along on another whip-saw day for the pound, proving that Brexit fears are back on the markets.

03:47 PMFTSE closes up – just

FTSE closes up – just

The FTSE 100 closed up 0.2pc at 5,879.45. The pound is still down around 0.15pc against the dollar at $1.2901

03:35 PMAfternoon round-up

Afternoon round-up

Here's a handful more stories to catch you up on this afternoon:

- Businesses should step up hiring and investment to boost their own prospects and that of the wider economy, the Bank of England's Andy Haldane has urged. “The missing ingredient in the recovery both globally and locally in the UK has been spending by companies,” Mr Haldane said. Read more here.

- Boris Johnson has ceded control of the delayed Crossrail project to Sadiq Khan as talks with Westminster begin on a major bailout of the debt-ridden finances of the capital’s transport network. More here.

- US shares edged higher amid signs of tentative progress in Washington toward a fresh fiscal-stimulus package but came off their highs of the day amid concern there won’t be an accord. The S&P 500 pared its advance by more than half following a report that House leader Nancy Pelosi was sceptical about reaching a deal.

- Goldman Sachs is embarking on a plan to eliminate about 1pc of its workforce, or roughly 400 positions, Bloomberg reported.

03:09 PMLondon's gold hits another record

London's gold hits another record

Here's a stat for you: as at the end of August, there were a record 8,955 tonnes of gold held in London vaults.

That amounts to $563bn in gold, and marks the fourth consecutive monthly increase in the amount of the yellow stuff held in London.

The LBMA records the gold held by seven security firms and the Bank of England. It also reported today that silver hit a record in London too, with stocks worth $29.4bn.

Meanwhile gold spot prices were up 1pc today, at $1,905.3 an ounce.

02:55 PMTech bosses called before Congress

Tech bosses called before Congress

Grab some popcorn, this could be interesting. The US Senate Commerce Committee has voted to approve a plan to subpoena the chief executives of Twitter, Alphabet's Google and Facebook for a hearing on a prized legal immunity enjoyed by internet companies.

The hearing is likely to discuss reforming Section 230 of the Communications Decency Act, which offers tech companies protection from liability over content posted by users, Reuters reports.

Here's a reminder of how it looked the last time Silicon Valley bosses beamed into Washington:

02:49 PMOil prices slide

Oil prices slide

Oil prices have slumped, with Brent falling more than 4pc to $40.34 a barrel, and WTI down more than 5pc to $38.10.

Prices have been hit by reports that a stimulus package in the US has been delayed, with Libya's crude output has jumped.

02:21 PMUS airlines to lay off 32,000 staff

US airlines to lay off 32,000 staff

Two of America’s biggest airlines have started to lay off more than 32,000 workers as hopes of a last-ditch government rescue deal faded on Thursday.

American Airlines and United Airlines told staff that they were ready to reverse the decision, which will affect around 13pc of their workforces, if a deal can still be reached.

The latest round of redundancies will take the total number of jobs lost at America's four largest US airlines to 150,000. Many employees have taken unpaid leave or left voluntarily.

Read more in Ed Clowes' report here.

02:01 PMSterling retraces steps

Sterling retraces steps

There goes the pound again. It's down about 0.24pc against the dollar at $1.2889 after an EU official was reported as saying there were "no landing zones" yet in EU-UK trade talks.

Sterling had shot higher after tweets from an FT reporter indicated some progress had been made on state aid rules in a deal.

The pound had initially dropped after the EU launched its legal action against the UK over the Internal Market Bill.

What are we to make of all this? Here's Neil Wilson of Markets.com:

Sterling is on the hook to some wild price swings on headlines, which we knew would be the case. No one wants to try $1.30 unless there are more concrete rumours from ‘sources’. Talks wrap up tomorrow – more market-moving headlines to come.

He adds:

It does seem like there are tentative signs of ‘progress’ despite all the chuntering around the internal market bill, which looks increasingly like a sideshow to the main event of trade talks.

01:45 PMMandatory paternity leave

Mandatory paternity leave

Japan is considering making it mandatory for companies to recommend employees take paternity leave, the Nikkei said on Thursday, as the government looks to boost the birthrate by making it easier for families to balance work and child-rearing.

Although Japan has one of the most generous parental leave policies in the world, just 7pc of eligible fathers take childcare leave, according to government data, far short of a national target of 30pc by 2025, Reuters reports.

Under the plan, companies would be obliged to inform their employees that men can take paternity leave if they wish to, the Nikkei said. Managers would confirm in person whether employees want to, it said.

01:40 PMWall Street jumps at open

Wall Street jumps at open

Wall Street's main indexes jumped at the open as investors bet on more fiscal stimulus after data showed a recovery in the labor market was cooling.

The Dow Jones Industrial Average rose 158.93 points, or 0.57pc, at the open to 27,940.63.

The S&P 500 opened higher by 22.87 points, or 0.68pc, at 3,385.87, while the Nasdaq Composite gained 124.49 points, or 1.11%, to 11,291.99 at the opening bell.

01:16 PMH&M store closures: could more follow?

H&M store closures: could more follow?

We reported earlier on H&M axing 250 shops worldwide, despite reporting better-than-expected third-quarter profits.

But does the retailer need to go further? Sofie Willmott of GlobalData has this to say:

The retailer has been and will continue to be hindered by its excessive store estate comprised of over 5,000 branches globally and although it plans to trim this down, it will have to consider accelerating closures.With 130 branches planned to open this year and 180 closing, 50 net store closures accounts for just 1pc of its estate. It plans to close 250 stores next year but this is still just 6pc of its locations and considering that apparel online penetration is set to remain high, at between 30-40pc in key markets including the UK and US, H&M should make more significant changes.

12:57 PMSterling recovers

Sterling recovers

The pound has clawed back its earlier losses – it's up 0.4pc against the dollar at $1.2978, after a Financial Times report said Britain and the European Union may have reached an agreement on state aid after Brexit. Sterling also rose 0.1pc against the euro.

Despite the EU launching legal proceedings against the UK over the internal market bill, officials in London are increasingly optimistic a Brexit deal.

— Sebastian Payne (@SebastianEPayne) October 1, 2020

“We’ve gone from about 30% chance of a deal to the other way around. I think it’s almost certain we’ll enter the tunnel.”

12:44 PMUS jobless claims drop

US jobless claims drop

Fewer Americans than expected sought unemployment benefits last week, fresh figures have shown.

Initial jobless claims in regular state programmes decreased by 36,000 to 837,000 in the week ended Sept 26, Labor Department figures showed on Thursday. Continuing claims, the total pool of Americans on state benefit rolls, fell to 11.8 million in the week ended Sept 19.

Economists expected initial claims to fall to 850,000 and for continuing claims of 12.2 million, according to median estimates in a Bloomberg survey.

12:40 PMRolls shares extend losses

Rolls shares extend losses

Rolls-Royce shares keep plumbing new depths, now down around 11.7pc at 114.75p, after outlining plans to raise £5bn this morning. The stock has lost 83pc of its value this year, so tied is its fortunes to aviation, which has been clobbered by Covid.

Our daily City Intelligence newsletter by chief City commentator Ben Marlow goes out shortly. Here's a sneak preview of his take:

£5bn will go some way to repairing the balance sheet, but once that is through the door some serious soul-searching is needed. The board will have to think long and hard about how the company can decouple itself from the old economy and apply its expertise to the new.

Three quarters of its annual turnover is tied to the fortunes of the airline industry. Another lockdown would mean further restrictions on air travel and could leave Rolls scrabbling around for cash again.

Ministers need to take a serious look in the mirror too. If the Treasury is loath to take a direct stake in Rolls through its rights issue, then there is plenty more it can do to help on the policy front by stimulating demand.

You can sign up to Ben's daily lunchtime newsletter here.

Ratings agency Moody also reckons Rolls' cash call "will substantially improve liquidity headroom to manage through a potentially slow and delayed recovery in engine flying hours".

But Martin Hallmark of Moody’s adds:

The package is credit positive, however upward pressure on ratings is unlikely until there is greater certainty over recovery prospects and over the delivery of material positive free cash flow.

12:13 PMRight to home working enshrined in law

Right to home working enshrined in law

This is fascinating: Germany will introduce new legislation giving all employees the right to work from home in the wake of the coronavirus pandemic.

A draft of the new law will be published within weeks, employment minister Hubertus Heil said on Thursday.

It will guarantee the right to work from home wherever possible, and regulate home office work, including limiting working hours.

Could we see similar in the UK? Seems unlikely given the government was so keen to have workers return to offices not so long ago. And it wouldn't be popular with Britain's commercial property landlords...

Justin Huggler's full report from Berlin is here.

12:08 PM'Stingy' Sunak keeps his powder dry

'Stingy' Sunak keeps his powder dry

How does the UK's financial plans compare to European neighbours? UK fiscal policy seems to be stuck in crisis rather than recovery mode, writes Tom Rees.

The Budget has been scrapped and Rishi Sunak appears to be playing his economic plans by ear. Economists estimate the Winter Economy Plan unveiled last week was worth just £4bn - a measly 0.2pc of GDP even as a second wave strikes. Is the UK going it alone by keeping its powder dry?

Tom's analysis is well worth a read.

11:46 AMOcado hit by lawsuit

Ocado hit by lawsuit

Eh-up. Trouble at robot warehouse. Ocado is being sued by Norwegian rival AutoStore over claims that the online grocery business breached patents for its warehouse technology.

The FTSE 100 firm must stop selling its technology and may damages, according to court documents filed in the US and UK, PA reports.

Karl Johan Lier, chief executive and president of AutoStore, on his decision to sue Ocado, said: "Since 1996, AutoStore has developed and pioneered technology that has revolutionised retail storage and order fulfilment, and is driving the growth of online retail.

"Our ownership of the technology at the heart of Ocado's warehousing system is clear. We will not tolerate Ocado's continued infringement of our intellectual property rights in its effort to boost its growth and attempt to transform itself into a global technology company."

Ocado shares are down 3pc, having initially fallen more than 6pc. More on this as we get it.

11:29 AMLunchtime round-up: pound, manufacturing, US stimulus hopes

Lunchtime round-up: pound, manufacturing, US stimulus hopes

Time for a lunchtime catch-up:

- The EU's promised legal action against the UK over the Internal Market Bill has knocked the pound.

- Rolls-Royce shares are down around 10pc after its rights issue call; Halford shares are flying after strong trading.

- US stock market futures rose as investors remained hopeful of a new coronavirus fiscal aid package; jobless claims are out at 13:30 UK time.

- The UK's manufacturing sector posted strong numbers in September, though job cuts continued.

- German government bond yields edged higher after European manufacturing survey data came broadly in line with expectations.

- Unemployment crept higher in the Eurozone for the fifth month running, rising from 7.9pc to 8.1pc in August

- Continued strength in the euro could hurt the eurozone's economic recovery and make the task of boosting inflation more difficult for the European Central Bank, the European Commission said in a paper.

11:18 AMPound loses steam

Pound loses steam

The pound is now down around 0.66pc against the dollar, at $1.283, and down 0.89pc against the euro, at €1.0926, after the EU warned it would take legal action against the UK over the Internal Market Bill.

Brussels had set Britain an end of month deadline to withdraw clauses in the Bill relating to Northern Ireland, which it said broke the Withdrawal Agreement and international law

Ursula von der Leyen, the president of the European Commission, said: "We had invited our British friends to remove the problematic parts of their draft Internal Market Bill, by the end of September.

"This draft bill is by its very nature, a breach of the obligation of good faith, laid down in the Withdrawal Agreement. Moreover, if adopted as is it will be in full contradiction to the Protocol on Ireland and Northern Ireland." James Crisp has more in his story here.

Timothy Graf at State Street Global Markets, tells Reuters: "It's challenged the prevailing market consensus that had been built up over the last couple of weeks, rightly or wrongly, that they were getting closer to a deal."

10:58 AMUS futures rise

US futures rise

Hopes of a US stimulus package keep swirling. US futures are currently on the rise, with the Dow Jones tipped to open up 0.79pc, the S&P 500 up 0.88pc and the Nasdaq up 1.28pc.

The Trump administration has proposed a new stimulus bill to House Democrats worth more than $1.5 trillion that includes a $20bn extension in aid for the battered airline industry.

10:51 AMHalfords: on yer bike

Halfords: on yer bike

One clear winner on the London market today is bicycle purveyor and car mechanic Halfords.

Its shares soared by a fifth after strong summer sales of bikes and camping gear continued into September, prompting the retailer to raise its profit expectations.

Like-for-like sales jumped 22pc over the five weeks to Sept 25, with cycling up 46pc and the auto centres and motoring businesses also exceeding expectations.

Pre-tax profit is now expected to exceed £55m for the first half of the year, up from previous guidance of £35m to £40m. Halfords, of course, was one of the lucky few retailers that didn't have to shut up shop during lockdown.

Read Ben Gartside's report here.

10:46 AMDriverless car lab opens in Oxford

Driverless car lab opens in Oxford

Citizens of Oxford – keep your eyes and ears open from today. A new driverless car lab is opening in the city today in a move that propels the UK closer to putting the vehicles on the roads.

The lab, which has been backed by telecom giant O2 and the European Space Agency, will allow companies to trial connected and autonomous vehicles using both 5G and satellite communications.

They will be able to trial their ideas using Renault electric cars which have been fitted with laser sensors known as Lidar, to allow the vehicles to detect how they are moving, and transformed into "connected" vehicles to send data back to the teams.

Read more in Hannah Boland's story here.

10:25 AMFirst day in the office

First day in the office

Always tricky starting a new job, even more so in a pandemic, and when you're stepping into some big shoes at the top of the UK's biggest retailer.

Spare a thought then for Ken Murphy, the new chief executive of Tesco, who starts today.

Here are four things in his in-tray, plus a look back on the six-year reign of his predecessor Dave Lewis, by Laura Onita and yours truly.

10:16 AMManufacturers lead the bounce back

Manufacturers lead the bounce back

Here's more reaction to the strong data on the UK's manufacturing sector.

Manufacturers are leading the UK’s post-Covid bounce after surging exports helped the industry registered its fourth successive month of growth in September, writes our economics editor Russell Lynch.

The latest snapshot of activity from the Chartered Institute of Purchasing and Supply - where a score over 50 signals growth - registered 54.1 last month, albeit a slight slowdown on August's pace.

The more upbeat news comes a day after the Bank of England’s chief economist Andy Haldane warned against “Chicken Licken economics” by ignoring positive signals over the strength of the recovery.

Manufacturers are more optimistic over future prospects despite rising uncertainty over the path of Covid-19 and the impact of Brexit when the transition period ends in December.

Read his full report here.

10:13 AMThe Tab changes hands

The Tab changes hands

Away from the economy for the moment, here's some media news: Rupert Murdoch has called time on his investment in The Tab after the student news website was snapped up by Digitalbox for £750,000, writes my colleague Ben Woods.

The owner of celebrity gossip website Entertainment Daily and satirical news platform The Daily Mash has seized control of the loss-making business through a cash deal.

Mr Murdoch's News Corp was the lead investor behind a £4.6m fund raise for The Tab three years ago, with Sunday Times editor Emma Tucker taking a seat on its board.

The Tab has a national website covering student culture and a further 32 sub-sites focused on different universities across the UK.

09:52 AMEU threat of legal action knocks pound

EU threat of legal action knocks pound

The pound is down around 0.66pc against the dollar this morning after the EU indicated it would start legal proceedings against the UK over Boris Johnson’s plan to breach terms of its Brexit divorce deal and break international law.

Sterling was trading at $1.2835 in late morning.

09:46 AMOctober will be 'crucial month' for Britain's manufacturers

October will be 'crucial month' for Britain's manufacturers

A little more reaction to those manufacturing PMIs earlier. Simon Jonsson, head of industrial products at KPMG UK, says the report is "clearly really encouraging for the UK’s makers as it provides evidence that confidence in manufacturing is improving". He adds:

Given the ongoing uncertainty of Brexit, this is a very important starting point, as Brexit headwinds will test the resilience of the UK’s manufacturing sector as we head towards the end of the year.October, however, will be a crucial month which will test the sector’s confidence as we’ll begin to see whether individual manufacturers make furloughed employees redundant or bring them back into the business.

09:31 AMMillions of workers still furloughed

Millions of workers still furloughed

Fresh data from the Office for National Statistics sheds some light on the jobs cliff edge facing furloughed workers.

More than one in 10 employees is still on furlough even as the scheme enters its final weeks, meaning more than two million workers face a question mark over their jobs at the end of the month, writes my colleague Tim Wallace.

Businesses said 11pc of their staff were on full or partial furlough in the days up to Sept 20, according to the ONS.

At the same time more workers are staying at home instead of commuting, indicating an important part of the reopening of the economy, including city centres, is going into reverse.

09:25 AM'Clearly a slowdown'

'Clearly a slowdown'

Manufacturing trade body Make UK has this to say on the latest snapshot of the sector. Fhaheen Khan, Make UK's economist, says manufacturers are "continuing to benefit from the easing of restrictions and the return of some staff from furlough". An increase in orders from East Asia has helped the industry. However:

There is clearly a slowdown in the rate of expansion, indicating the quick recovery was a result of pent up demand which is now beginning to fade.

As this demand peters out, with little sign of orders returning and job losses rising even before the job retention scheme expires this month, the uphill struggle for manufacturers starts now.

We must forge a long-term plan for recovery starting with a revitalised Industrial Strategy that places manufacturing on the forefront and provides extra support to those key strategic industries that are still vulnerable.

09:14 AMManufacturing still laying off staff

Manufacturing still laying off staff

It's not all positive in today's manufacturing PMI report.

Job losses were registered for the eighth consecutive month in September, although the rate of reduction eased to its lowest since February, IHS Markit/CIPS say. They add: "A decline in work-in-hand signalled that sufficient capacity remained to cope with the needs of new and existing contracts."

The report notes that input cost inflation accelerated to a 21-month high in September, leading manufacturers to raise selling prices again. This was a result of "higher raw material costs, rising competition and demand for inputs and the resulting supply shortages".

UK manufacturing #PMI dipped to 54.1 in September, but still buoyant and higher than anywhere in the euro area except Germany (56.4, benefiting more than most from the global recovery).

— Julian Jessop (@julianHjessop) October 1, 2020

PS. final composite PMIs next week should show UK service sector doing relatively well too. pic.twitter.com/RyxFLJzyV4

However, hopes of continued recovery meant that "manufacturers maintained a positive outlook for the year ahead, with 60pc expecting output to be higher 12 months from now".

Duncan Brook of CIPS adds: “In spite of these difficulties, the sector’s glass remained half full, and optimism for the year ahead was sustained.

08:49 AM'Solid progress'

'Solid progress'

Manufacturers are leading the UK’s post-Covid bounce after a fourth successive month of growth in September, writes our economics editor Russell Lynch.

The latest snapshot of activity from the Chartered Institute of Purchasing and Supply - where a score over 50 signals growth, registered 54.1 last month - albeit a slight slowdown on August’s pace.

CIPS director Duncan Brock said manufacturers “made solid progress towards recovery” but also warned that firms had cut jobs for the eighth month in a row.

UK manufacturing sector saw a further boost to output in September, although growth slowed from August as the #PMI fell to 54.1. Firms reported an increase in new orders from domestic and overseas markets, but job losses were again noted. Read more: https://t.co/wRAgyJzRq2 pic.twitter.com/G3LeYkAMuI

— IHS Markit PMI™ (@IHSMarkitPMI) October 1, 2020

08:46 AMUK manufacturing recovery continues in September

UK manufacturing recovery continues in September

The UK's manufacturing recovery extended to its fourth straight month, according to the closely watched PMI survey. It recorded 54.1 in September, above the 50 level needed for growth.

08:38 AMRolls shares sink further

Rolls shares sink further

Rolls-Royce shares continue to trough, down about 10pc after its fundraising announcement.

DCC is down more than 6pc.

Bottling company Coca-Cola HBC was the biggest riser on the FTSE 100, up more than 3pc, after a note from Goldman Sachs upgrading it to a buy.

Telegraph columnist Russ Mould of AJ Bell says "investors were hungry for a broad mixture of stocks on the UK market on Thursday". On Rolls he adds:

The equity component of the new fundraise equates to a theoretical ex-rights price of 54.6p. It was only two years ago that Rolls-Royce was trading above £10, illustrating a massive fall from grace.Investors taking part in the share and bond issue need to have considerable faith in the aviation industry getting back on its feet.

Handing over money now to back Rolls-Royce would also require considerable patience as this is unlikely to be a rapid recovery story.

There are two factors to consider - the first is how long it will take for demand to return for plane travel. Airlines need to see sales improve to restrengthen their balance sheets. And that leads to the second factor - in general they can’t think about ordering new planes, and therefore engines, until they are in a much stronger position financially.

08:12 AMEurozone manufacturing growth 'strongest for over two years'

Eurozone manufacturing growth 'strongest for over two years'

The final PMI reading for manufacturing across the eurozone is out. The number was 53.7, unchanged from its initial estimate. Remember, anything over 50 in this survey means growth.

Output and new orders were both up sharply, supported by resurgence in export trade, according to IHS Markit. The German manufacturing powerhouse was the biggest driver, it adds.

The Eurozone Manufacturing #PMI jumped up to 53.7 in September (Aug - 51.7) to signal the strongest monthly growth in operating conditions for 2 years. The region was led by a sharp improvement at German factories. Read more: https://t.co/uNqjgvrdw1 pic.twitter.com/uSbvCSYKVt

— IHS Markit PMI™ (@IHSMarkitPMI) October 1, 2020

Chris Williamson, Chief Business Economist at IHS Markit said:

The eurozone’s manufacturing recovery gained further momentum in September, rounding off the largest quarterly rise in production since the opening months of 2018. Order book growth and exports also accelerated, indicating a welcome strengthening of demand. Job losses consequently eased as firms grew more upbeat about prospects for the year ahead, with optimism returning to the highs seen before the trade war escalation in early 2018.

The recovery would have been far more modest without Germany, however, where output has surged especially sharply to account for around half of the region’s overall expansion in September. Germany’s performance contrasted markedly with modest production growth in Spain, slowdowns in Italy and Austria, plus a particularly worrying return to contraction in Ireland. Excluding Germany, output growth would have weakened to the lowest since June.

#PMIs showed improved, expanding #manufacturing activity in September in most #Eurozone countries: #Germany (56.4) #Italy (53.2) #Netherlands (52.5) #Austria (51.7) #France (51.2) #Spain (50.8). Activity flat in #Greece (50.0) & #Ireland (50.0) https://t.co/2Zd08VbiJn

— Howard Archer (@HowardArcherUK) October 1, 2020

07:56 AMItaly's manufacturing activity rises

Italy's manufacturing activity rises

Stand by for a flurry of economic reports on manufacturing across the eurozone. The closely watched PMI survey for Italy improved to a 27-month high, according to IHS Markit. It registered 53.2 in September, up from 53.1 the month before. Anything above 50 indicates growth.

Lewis Cooper, economist at IHS Markit, said: "September PMI data signalled an ongoing recovery in the Italian manufacturing sector, with the headline figure the highest for 27 months and indicative of a moderate improvement in overall conditions.

"Improved client demand, both domestically and abroad, provided a further boost to the sector, leading to sustained and solid growth of both output and total new orders."

07:46 AMH&M shutting stores

H&M shutting stores

Fashion giant H&M has said it plans to shut 250 of its stores globally next year after the pandemic moved more shoppers online.

However, the Swedish company said it has seen sales continue to recover in September, although sales remained 5pc lower than the same month last year.

It came as the retailer reported that its pre-tax profits fell to 2.37 billion Swedish krona (£210m) for the nine months to August 31, topping analyst expectations.

07:39 AMUS stimulus hopes drive markets higher

US stimulus hopes drive markets higher

Could US politicians be about to agree a new stimulus package? Positive noises overnight have certainly given markets a lift.

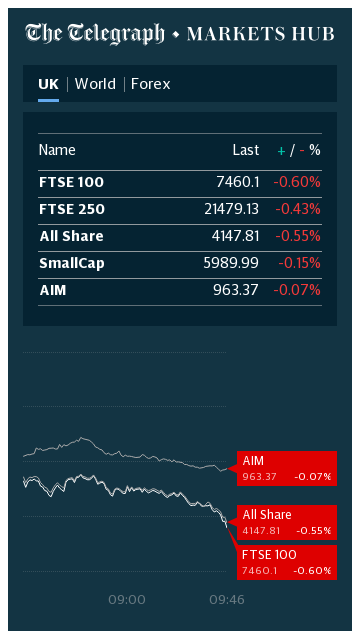

The FTSE 100 is up around 0.64pc now at 5,902.54, having cooled a little since the open.

In the eurozone, Frankfurt's DAX 30 index added 0.3pc and the Paris CAC 40 jumped 1.2pc.

"Hopes that a US fiscal stimulus package could be just around the corner, in addition to upbeat US data, is driving demand for riskier assets as trading kicks off in Europe," says City Index analyst Fiona Cincottam, via AFP.

"US Treasury Secretary Steve Mnuchin said that (stimulus plan) talks are progressing very well," she noted.

House Speaker Nancy Pelosi and Mnuchin have held a series of talks this week aimed at breaking the impasse and both have said they were "hopeful".

Reports out of Washington say the two sides were looking at an "escalator" compromise in which the new stimulus starts at $1.5 trillion - around what Republicans are open to - and rises closer to the Democrats' $2.2 trillion plan if the pandemic persists.

07:33 AM'Least worst option' for Rolls

'Least worst option' for Rolls

Rolls-Royce shares are down about 2pc in morning trade, having initially fallen more. It's still hovering at around a 16-year low.

Rolls going cap in head to shareholders for £2bn is the "least worst option to help it deal with the crushing impact the pandemic has inflicted on its core business", says Susannah Streeter of Hargreaves Lansdown. She adds:

The aircraft [engine] manufacturer is in a bleak position given the collapse in international air travel. There is little end in sight for the falling demand for new planes and it’s already shed assets and announced mass job losses.

It had considered getting a cash injection from sovereign wealth funds in Singapore and Kuwait, but withdrew from those talks. It will instead raise another £1 billion through the corporate bond market...

This should all give Rolls Royce a lot more room for manoeuvre to help it navigate the Covid crisis.

07:26 AMThis morning's updates

This morning's updates

What's happening on the London market this morning?

- Halfords said it expects to surpass profit targets after strong summer sales momentum driven by demand for cycling and staycations continued into September. It now expects to post pre-tax profits above £55m for the first half of the year.

- FTSE 100 medical device manufacturer Smith & Nephew says underlying revenue for its third quarter fell 4pc, an improvement on the 29pc slump it recorded in the second.

- Southend Airport owner Stobart Group is "managing" its costs. It warned its airline, Stobart Air, is "operating below the scenarios" set out at the time of its £100m capital raise in June "due to the continued quarantine arrangements in Ireland, with limited flights operating".

- Pre-tax profits fell 15pc at litigation funder Burford Capital in the first half of its year.

07:20 AMFTSE opens higher

FTSE opens higher

The FTSE was up nearly 1pc in early trade, hitting 5,924.06. The FTSE 250 was 0.54pc higher at 17,408.52

06:58 AMTokyo stock exchange loses a day's trading

Tokyo stock exchange loses a day's trading

Here's a bit more on that remarkable story in Tokyo, where the stock exchange lost a day's trading because of a software glitch.

The shutdown frustrated investors looking to buy back shares after the first US presidential debate, and could tarnish the exchange's credibility just as new Prime Minister Yoshihide Suga makes digitalisation a top priority and Tokyo looks to replace Hong Kong as Asia's financial hub, Reuters notes.

The exchange blamed the outage on a hardware problem at its "Arrowhead" trading system, but added that it found no evidence of unauthorised access. It was the worst glitch since the exchange switched to all-electronic trading in 1999, it said.

06:43 AMRolls-Royce to raise £2bn from shareholders

Rolls-Royce to raise £2bn from shareholders

Rolls has unveiled details of its widely expected fundraising this morning.

It will raise £2bn in a rights issue and a further £3bn in loans as it looks to recapitalise its balance sheet in the face of the Covid downturn.

Rolls, which makes jet engines, said that the 10-for-three rights issue was fully underwritten by its banks.

Under the terms of a rights issue, shareholders have to buy newly issued shares or have their stake in the company diluted. The new shares will be priced at 32p and must be approved by investors at a meeting later this month.

06:38 AMFTSE to edge up

FTSE to edge up

Good morning. The FTSE is tipped to edge higher after Asian markets climbed overnight – apart from in Tokyo, where a glitch wiped out an entire day's trading on the stock market. Rolls-Royce is to tap investors for £2bn and seek more loans to shore up its finances.

5 things to start your day

1) Ignore ‘Chicken Licken’ pessimists, says BoE chief economist: Andy Haldane spoke as official figures revealed households saved record amounts in lockdown, giving them spending power for the recovery.

2) Firms wait for payouts as insurers appeal to Supreme Court: Insurers and the City regulator failed to reach an agreement to avoid appealing the High Court's landmark judgment.

3) Government cracks down on "rabbit hutch homes": Homes built using Permitted Development Rights must meet minimum size requirements even if they don't need planning permission.

4) Sleepless nights at family coach firm: Coach companies call for government help as passenger numbers dwindle, despite schools reopening, as holiday-makers stay home.

5) GardaWorld turns hostile in £3bn battle to secure G4S: A transatlantic war of words broke out with the British company saying Gardaworld's approach "significantly undervalues" its shares.

What happened overnight

Asian markets got the new trading quarter off to a stuttering start on Thursday with Tokyo hit by a computer glitch and several others closed for holidays, though there were healthy gains elsewhere in the region on hopes for a fresh US stimulus package.

Buying and selling on Tokyo's stock exchanges was halted at around 8:35 am (2335 GMT) owing to "glitches linked to the delivery of market information", operator Japan Exchange Group said in a statement.

The precise nature of the glitch, the worst in 13 years, was not explained further, but it meant the country's top indexes - the Nikkei 225 and the Topix - were unable to open at the start of the trading day. Trade was halted for the entire day.

The issue was also affecting trade on several other exchanges, including in Nagoya and Sapporo, though the Osaka exchange was functioning normally though.

There was also no trade in Hong Kong, Shanghai, Seoul and Taipei owing to public holidays.

Australia's S&P/ASX 200 gained 1.6pc by midday to 5,909.40 and Singapore rallied more than one percent while there were also gains in Jakarta and Wellington as investors picked up the baton from US traders.

Coming up today

-

Results: ( Interims) Burford Capital

-

Economics: Manufacturing PMI final reading (UK, Japan, Germany, France, Italy, Spain, eurozone, US), jobless claims (US)