FS KKR Capital (FSK) Q4 Earnings Beat on Lower Expenses

FS KKR Capital Corp.’s FSK fourth-quarter 2020 net investment income (NII) of 72 cents per share beat the Zacks Consensus Estimate of 69 cents. However, the bottom line compared unfavorably with 84 cents in the year-ago quarter.

Lower expenses and decent portfolio activity during the quarter were tailwinds. However, results were hurt by fall in total investment income.

NII (GAAP Basis) in the fourth quarter was $78 million, down 22% from the prior-year quarter.

In 2020, the company reported NII of $331 million or $2.66 per share, down from $410 million or $3.16 in 2019.

Total Investment Income & Expenses Decline

Total investment income was $163 million, down 12.4% year over year. The fall was mainly due to lower interest income and fee income. However, the figure surpassed the Zacks Consensus Estimate of $150.4 million.

In 2020, the company reported total investment income of $639 million, down 18% year over year. The figure, however, surpassed the consensus estimate of $626.4 million.

Total operating expenses fell 6.3% year over year to $75 million. Lower management fees and the absence of subordinated income incentive fees were the main reasons for the decline.

Total Portfolio Value & Balance Sheet

The fair value of FS KKR Capital’s total investment portfolio was $6.78 billion as of Dec 31, 2020.

As of Dec 31, 2020, FS KKR Capital’s net asset value was $25.02 per share compared with $30.54 on Dec 31, 2019.

The company had $7.24 billion in total assets and $3.1 billion in total stockholders’ equity at the end of the quarter.

Our Take

Decent origination volumes are expected to support FS KKR Capital’s profitability. However, a tough operating backdrop poses a concern.

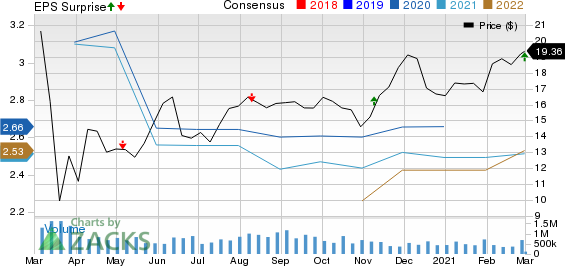

FS KKR Capital Corp. Price, Consensus and EPS Surprise

FS KKR Capital Corp. price-consensus-eps-surprise-chart | FS KKR Capital Corp. Quote

Currently, FS KKR Capital carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

LendingTree TREE reported fourth-quarter 2020 adjusted net income per share of 13 cents per share in the quarter, down 88% from $1.12 reported in the prior-year quarter. The Zacks Consensus Estimate was pegged at a loss of 69 cents.

Main Street Capital Corporation’s MAIN fourth-quarter 2020 net investment income of 59 cents per share surpassed the Zacks Consensus Estimate of 50 cents. However, the bottom line fell 4.8% from the year-ago figure.

Hercules Capital Inc.’s HTGC fourth-quarter 2020 net investment income of 37 cents per share surpassed the Zacks Consensus Estimate of 33 cents. However, the bottom line declined 2.6% from the year-ago reported figure.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

AccessZacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

LendingTree, Inc. (TREE) : Free Stock Analysis Report

Main Street Capital Corporation (MAIN) : Free Stock Analysis Report

FS KKR Capital Corp. (FSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research