Frustration for some of Bankman-Fried's victims who hoped for stiffer sentence

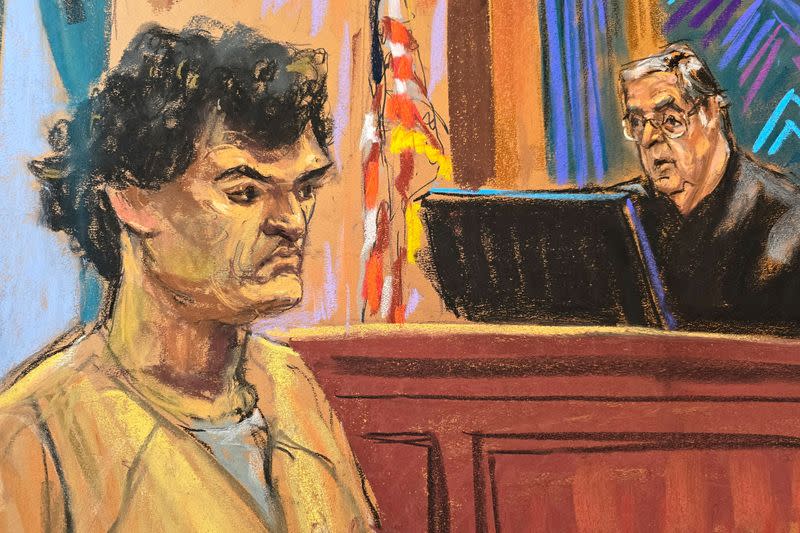

WASHINGTON (Reuters) - Some former FTX customers expressed anger and disappointment on Thursday after Sam Bankman-Fried, the crypto exchange's former billionaire boss, was sentenced to 25 years in prison for stealing $8 billion from customers.

"25 years is a joke," a member of an FTX creditors group with the username Bruno Dixon wrote on messaging app Telegram minutes after the sentence was handed down by a New York judge.

Another member of the same Telegram group, going by Steven, said the sentence was "laughable for such a serious crime."

More than an estimated 1 million customers face potential losses as a result of FTX's sudden November 2022 collapse. Victims say they are still owed more than $19 billion based on current crypto prices.

A New York jury last year found Bankman-Fried guilty of stealing from unsuspecting customers to prop up his hedge fund Alameda Research, buy luxury properties and fund political donations.

Prosecutors sought a sentence of 40 to 50 years for what they say was one of the biggest financial frauds in U.S. history. Bankman-Fried's defense has argued that around five years would be appropriate since customers would likely be made whole.

Some victims on Thursday said the sentence was as expected for a corporate fraud crime.

"White collar guys get treated differently so 25 is probably as good as it was going to get," wrote one of the Telegram group's administrators, adding members should focus on recovering their assets.

But other victims compared it unfavorably to the 150 years handed down to notorious fraudster Bernie Madoff.

"I found 30-40 to be somewhat fair," wrote Tristan, another user of the same Telegram group, which has more than 3,000 members who say they have a combined nearly $700 million in claims.

Bankman-Fried's attorneys said the former FTX boss had overlooked risk management but did not steal customer money. Bankman-Fried has vowed to appeal his conviction and sentence.

Some customers said they thought 25 years was not enough to justify plea deals prosecutors inked with other top FTX executives, which allowed them to avoid stringent punishments in return for acting as witnesses. Many speculated Bankman-Fried would serve significantly less following his promised appeal.

Mark Bini, a former federal prosecutor, said the judge's sentence took into account the magnitude of the crime and the finding that Bankman-Fried lied on the stand.

"While less than the prosecutors' request for 40-50 years, it is a very significant sentence and sends a message that people convicted of crimes in the crypto space will face serious consequences," said Bini, now a partner at law firm Reed Smith.

During the trial, prosecutors called FTX customers to testify and submitted dozens of victim impact statements to the court ahead of the sentencing. Many said they had lost years worth of savings and that their lives had been destroyed.

"I lost my happiness, my ability to get out of bed, my desire to continue living," wrote one FTX customer who said they had a $4 million claim. Names were redacted.

Reuters reported last year that FTX customers have created support groups to help each another navigate the complex bankruptcy claims process.

Administrators now running FTX are still recovering assets. They said in January that they expect to have $13.7 billion to pay $31.4 billion in legitimate claims, including $9.2 billion from customers.

Customers will be paid "in full" but at November 2022 crypto prices, the administrators said, meaning customers will not benefit from a rally in bitcoin and other tokens in recent months. Many FTX customers are fighting that decision.

FTX was one of a string of crypto company bankruptcies in 2022 sparked by a collapse in crypto prices.

(Reporting and writing by Michelle Price; additional reporting by Dietrich Knauth, Mehnaz Yasmin, Elizabeth Howcroft, Luc Cohen and Jody Godoy; Editing by Rosalba O'Brien)