Freelance writer duped by online service, advises victims to contact Ombudsman for Financial Services for help

Jimmy Tan is one of the most careful people I know. He always double-checks online transactions, but last September, he fell victim to a scam that cost him RM14,070.

Tan, a freelance writer, is coming forward to share his story after exhausting all avenues for appeal.

It started when Tan wanted home-cooked meals delivered to his wife’s grandparents. He saw an advertisement on Facebook offering a 20-day food delivery package priced at RM430. It included RM100 for a tiffin deposit.

Enticed by the advertisement, he contacted the WhatsApp number for more details about the service.

Believing the offer to be reasonable, and attracted by the flexibility to select his delivery days, Tan made payment by transferring money to an Affin Bank account under the name of an individual.

“After the payment, I was instructed to download an online mobile application, and create an account to manage the order and monitor the delivery,” said Tan.

“I was given a link to download a mobile application from the Google Play Store. I had a near-identical experience with another caterer, so I didn’t find it suspicious.”

Upon registering on the mobile application, he was asked to pay a nominal RM1 service fee to schedule the first delivery.

Tan provided his credit card details, but moments later, he received three one-time password (OTP) notifications within a minute, each requesting authorisation for payments of RM4,545 to a Touch ‘n Go eWallet account.

“That was when it hit me – I had been duped! I suspect the scammer had intercepted my SMS notifications to acquire the OTPs to make the transfers,” said Tan.

Panicked, he reached out to the credit card issuer. The bank officer confirmed the three transactions of RM4,545 each, amounting to RM13,635. Including payment for the non-existent meals, Tan’s total losses came up to RM14,070.

“I was baffled as to why the bank didn’t alert me about three identical payments within a minute. Shouldn’t such rapid, repeated transactions raise red flags?” asked Tan.

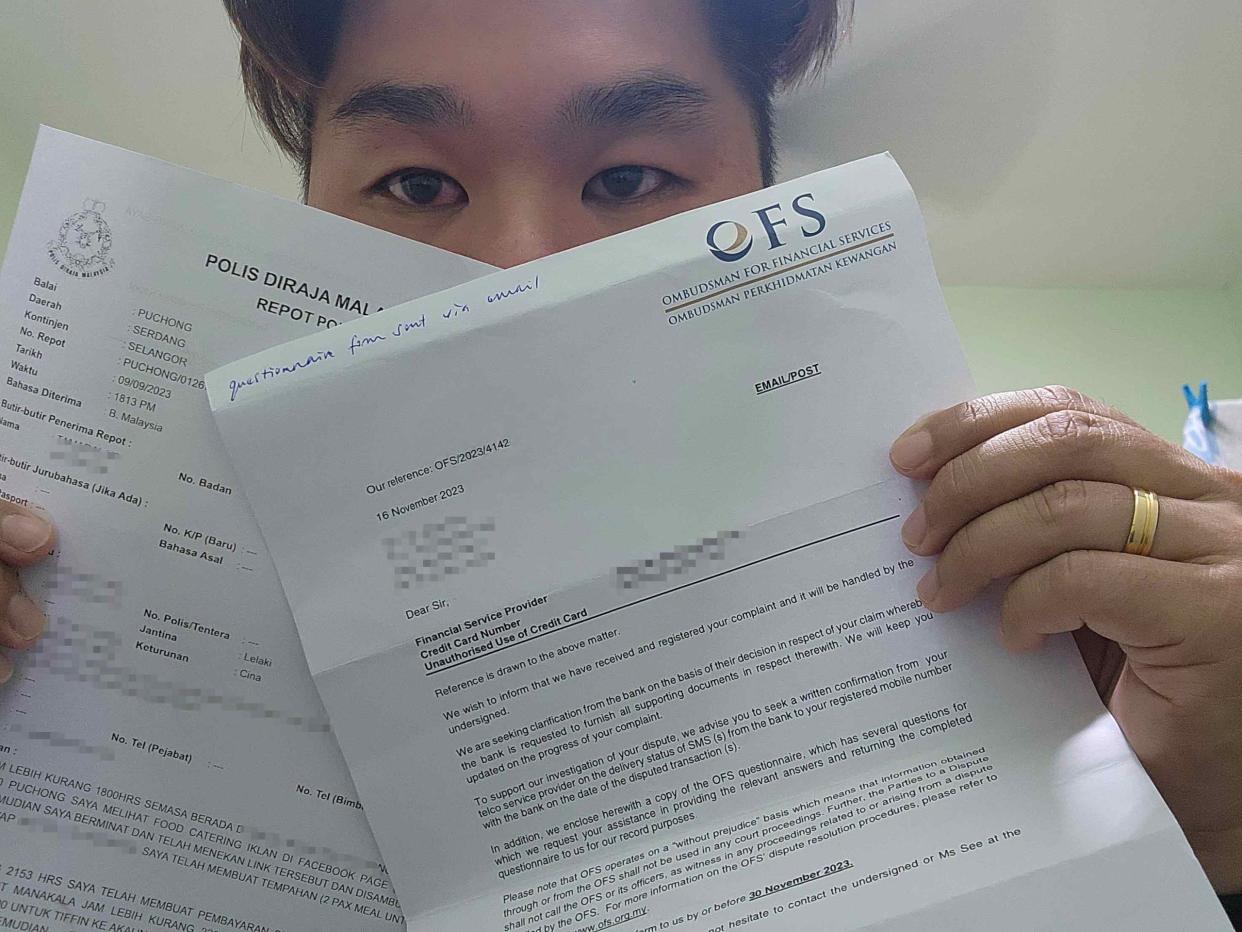

Following the incident, Tan lodged a police report at the Puchong Jaya police station and filed a complaint with the MCA Public Complaints and Services Bureau.

He also appealed to his bank to waive the charges, but the bank rejected his request because the transactions were “online secure code-verified transactions where the MSOS code was successfully sent to the complainant’s mobile phone.”

The case manager handling the dispute recommended that Tan be liable for the first two transactions, and that the bank waive the third transaction.

Frustrated, Tan filed a complaint with the Ombudsman for Financial Services (OFS).

For the record, OFS, formerly known as the Financial Mediation Bureau, is the operator of the Financial Ombudsman Scheme approved by Bank Negara Malaysia under the Financial Services Act 2013 and the Islamic Financial Services Act 2013.

OFS is a non-profit organisation and functions as an alternative dispute resolution channel to resolve disputes between its members, which are the financial services providers licensed or approved by BNM, and financial consumers.

“After a six-month investigation, I received a letter from OFS on April 8, stating it agreed with my bank’s findings. I was liable for the first two charges,” said Tan.

“I am speaking out to raise awareness and to inform the public that if they have any dispute, they should refer their case to OFS.

“Although the outcome was not in my favour, it is important for others to know there is a service that could aid them.”

Tan is negotiating a repayment plan with his bank.

GET READY FOR KL20 SUMMIT

As Malaysia sets its sights on becoming one of the top 20 global start-up ecosystems by 2030, next week’s Kuala Lumpur 20 (KL20) Summit promises to be a pivotal event, catalysing innovation and entrepreneurship throughout the country.

Scheduled for April 22-23, KL20 will be held at the Kuala Lumpur Convention Centre and provides valuable insights into the Malaysian Start-up Ecosystem Roadmap and the Single Window Initiative.

These strategic measures aim to streamline processes, improve funding accessibility, and foster innovation – fundamental pillars for achieving the ambitious goals outlined in Malaysia’s digital transformation roadmap.

RETURN OF THE PHANTOM MENACE

Episode 1 of the Star Wars franchise, ‘The Phantom Menace’, turns 25 this year.

To celebrate the occasion, several cinema chains in Malaysia will have special screenings of the movie on Star Wars Day – May 4 – also known as ‘May the 4th’, a play on the famous ‘May the Force Be With You’ quote from the movie.

Tickets are on sale.

The post Freelance writer duped by online service, advises victims to contact Ombudsman for Financial Services for help appeared first on Twentytwo13.