Franco-Nevada (FNV) Earnings Beat Estimates in Q1, View Up

Franco-Nevada Corporation FNV reported adjusted earnings of 84 cents per share in first-quarter 2021, up 47% from the prior-year quarter. Additionally, the bottom line surpassed the Zacks Consensus Estimate of 79 cents.

The company generated revenues of $309 million in the reported quarter, reflecting year-over-year growth of 28%. The top-line figure, however, missed the Zacks Consensus Estimate of $313 million. In the March-end quarter, 85.4% of revenues were sourced from gold and gold equivalents (61.6% gold, 15.4% silver, 6.3% platinum group metals and 2.1% from other mining assets).

The company sold 149,575 Gold Equivalent Ounces (GEOs) in the reported quarter, up from the prior-year quarter’s 134,941 GEOs. Higher contributions from the Hemlo, Cobre Panama, Antapaccay and Antamina mines were partly offset by lower contributions from Sudbury and Guadalupe-Palmarejo.

During the reported quarter, adjusted EBITDA climbed 36% to $263 million, year over year.

In first-quarter 2021, the average gold price was $1,794 per ounce, 13.3% higher than the year-ago quarter. Silver prices averaged $26.26 per ounce in the quarter, up 55.4% year on year. Platinum prices went up 28.5% year over year to $1,161 per ounce, and palladium prices increased 5.3% year on year to $2,405 per ounce.

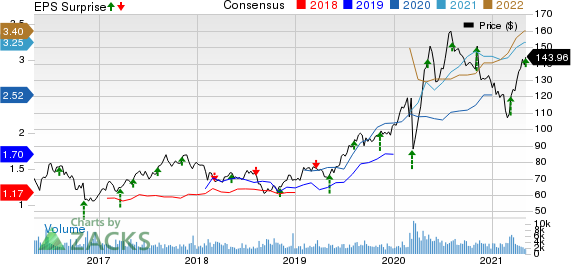

FrancoNevada Corporation Price, Consensus and EPS Surprise

FrancoNevada Corporation price-consensus-eps-surprise-chart | FrancoNevada Corporation Quote

Financial Position

The company had $538.5 million cash in hand at the end of first-quarter 2021, up from the $534 million reported as of the end of 2020. It recorded an operating cash flow of $224.3 million in the first quarter, up from the $195.2 million witnessed in the prior-year quarter.

Franco-Nevada is debt free and uses its free cash flow to expand the company’s portfolio and payout dividends. The company’s board hiked the quarterly dividend by 15.4% to 30 cents per share. This marks the 14th consecutive annual dividend increase. The dividend is payable on Jun 24 to shareholders of record on Jun 10, 2021.

Guidance

The company now expects attributable royalty and stream sales from its mining assets between 580,000 GEOs and 615,000 GEOs for the current year, up from the prior guided range of 555,000 GEOs to 585,000 GEOs. The upbeat guidance reflects acquisition of the Vale S.A’s VALE Royalty Debentures. Franco-Nevada expects to generate additional revenues of $115-$135 million from Energy assets. The WTI oil price and Henry Hub natural gas prices are assumed to average $55 per barrel and $2.50 per mcf, respectively.

Other Updates

On Apr 16, the company acquired 57 million of Vale’s outstanding participating debentures for $538 million. Moreover, Franco-Nevada accrued 9.9% equity investment in Labrador Iron Ore Royalty Corporation. These investments are accretive to the company’s cash flow.

Price Performance

Franco-Nevada’s shares have gained 17.5% over the past three months, as against the industry’s loss of 0.5%.

Zacks Rank & Stocks to Consider

Franco-Nevada currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include ArcelorMittal MT and Celanese Corp. CE. Both of these stocks flaunt a Zacks Rank #1 (Strong Buy), currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

ArcelorMittal has a projected earnings growth rate of 984.7% for the current fiscal year. The company’s shares have soared nearly 179% in the past year.

Celanese has an expected earnings growth rate of 68.3% for the current fiscal year. The company’s shares have rallied around 90% over the past year.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ArcelorMittal (MT) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

FrancoNevada Corporation (FNV) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

To read this article on Zacks.com click here.