First Mover Americas: It’s Time to Come Clean About Those Crypto Losses

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

872

+19.5 ▲ 2.3%

$17,253

+439.3 ▲ 2.6%

$1,286

+48.9 ▲ 4.0%

S&P 500 futures

3,989.00

+23.3 ▲ 0.6%

FTSE 100

7,475.08

+2.9 ▲ 0.0%

Treasury Yield 10 Years

3.49%

▲ 0.1

BTC/ETH prices per CoinDesk Indices, as of 7 a.m. ET (11 a.m. UTC)

Top Stories

The U.S. Securities and Exchange Commission is warning publicly traded companies to disclose any crypto damage. The SEC issued letters to companies flagging the need to disclose any potential impact from the mayhem in the crypto markets. “Recent bankruptcies and financial distress among crypto asset market participants have caused widespread disruption in those markets,” the agency’s Division of Corporation Finance said in a sample letter to companies, published Thursday.

Grayscale Bitcoin Trust's (GBTC) discount has widened to a record high near 50%. Bearish sentiment surrounding the trust deepened over the last few weeks as fears surfaced that crypto trading firm Genesis Global Trading, which is owned by Grayscale’s parent company, Digital Currency Group (DCG), could file for bankruptcy. DCG is also CoinDesk's parent company. Shares of the world’s largest bitcoin fund, GBTC, hit a record-high discount rate of 47.3% on Thursday, according to data from crypto index provider TradeBlock.

Crypto trading firm Amber Group has ditched its $25 million Chelsea FC sponsorship deal and is laying off staff. Amber Group, which is backed by Singapore's investment fund, Temasek. and Sequoia Capital, is terminating its sponsorship deal with the soccer team, according to a Bloomberg report. The company is also laying off about 300 employees to slash its workforce to fewer than 400. At one point, Amber Group employed more than 1,100.

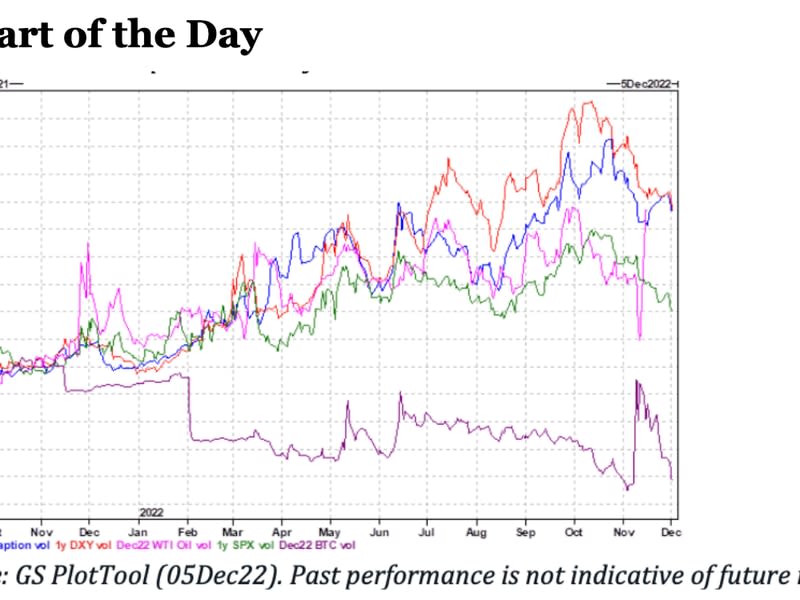

Chart of the Day

The chart compares bitcoin's implied volatility with the dollar index, WTI crude, swaps and the S&P 500 going back to September 2021.

Bitcoin’s implied volatility (shown in deep purple at the bottom of the chart), which represents investors’ expectations for price turbulence, has drifted lower this year despite the collapse of several crypto industry leaders, including Terra, FTX and BlockFi.

"The cryptocurrency's volatility is likely to drop significantly next year – either because all the major risk events are out of the way or speculators lose interest to put on leveraged positions," Matrixport said.

– Omkar Godbole