First Mover Americas: Bankrupt BlockFi Asks US Court to Greenlight Withdrawals

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Top Stories

Bankrupt crypto lender BlockFi has asked a U.S. court to greenlight customer withdrawals that are locked up in the platform, court filings show. Crypto held in BlockFi wallets belongs to customers and the company has “no legal or equitable interest” in funds that were frozen when the platform halted operations on Nov. 10, a motion filed on Monday with the U.S. Bankruptcy Court for the District of New Jersey said.

Collapsed crypto exchange FTX will attempt to recoup voluntary payments made to third parties prior to its collapse, pursuing them in court if necessary. These payments may include founder and former CEO Sam Bankman-Fried's political donations in recent years. FTX said Monday it had been "approached by a number of recipients of contributions or other payments" looking to return what they had received from Bankman-Fried or other FTX executives. FTX did not immediately respond to CoinDesk's request for clarity on this point.

FTX’s Sam Bankman-Fried gave ex-Jane Street traders who formed Modulo Capital $400 million. Modulo was founded in early 2022 and operated out of the same luxury Bahamian condominium community where Bankman-Fried and other FTX employees lived. Though this amounted to one of Bankman-Fried’s largest venture capital bets, Modulo’s identity was a mystery, giving rise to plenty of speculation.

Chart of the Day

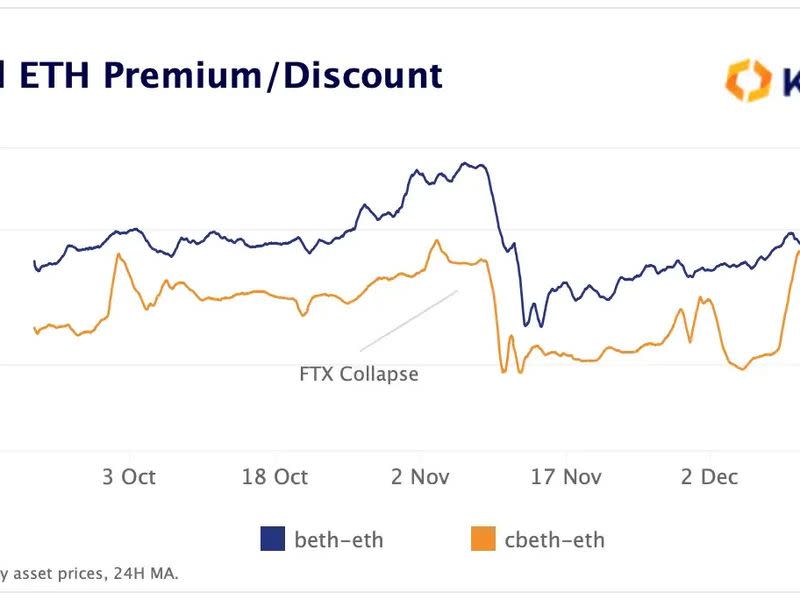

The chart compares the price of BETH, a tokenized version of staked ether on Binance, with Coinbase's wrapped ether token cbETH.

BETH is trading at the widest discount to ether's price in six months, while the discount in cbETH has narrowed to levels last seen in August.

The discount in BETH shows investors are pricing in risk on the Binance-issued token.

Fears of Binance's insolvency recently reached a fever pitch after the exchange's proof-of-reserves report did not provide details about the exchange's internal controls in Binance's margin and loan products.