First in Malaysia, Alliance Bank launches virtual credit card with dynamic numbers

KUALA LUMPUR, April 5 — Alliance Bank Malaysia today launched a virtual credit card with the country’s first “dynamic card number” feature, offering enhanced security for online transactions at a time of worsening scams and cybersecurity threats.

The new Alliance Bank Visa Virtual Credit Card will let users generate an unlimited number of digital cards for online transactions, including on e-commerce websites and online services that require subscriptions.

The virtual cards will let users transact online without exposing their primary account number, adding an extra layer of security when dealing with dubious websites or data theft when legitimate website are compromised.

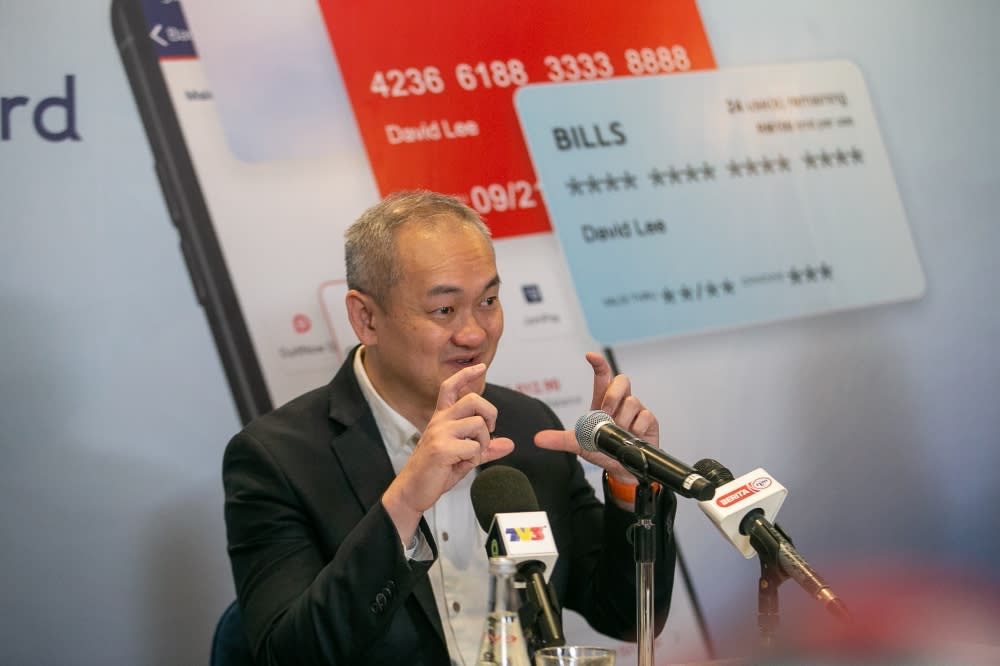

Alliance Bank group chief executive officer Kellee Kam said that for a seamless experience, all processes involved would be done through the bank’s mobile application, including registration for the virtual credit card.

“We believe that this is eventually going to be the way that credit card transactions are conducted,” he said at the product launch held at the Aurum Theatre at the Gardens Mall here today.

Users will have two options when creating the virtual card numbers, one for a disposable single-use, and the other for recurring payments or subscriptions — which will then present as separate virtual credit cards on the Alliance Bank app.

Users will also be able to set individual limits on the number of transactions and transaction amounts on the subscription-based virtual credit cards, as well have the choice to freeze or unfreeze these cards separately with just a few clicks in the app.

Kam said that the dynamic card number feature creates an additional layer of protection for users and they can worry less about data breaches on websites where they provide credit card information, as the one-time use card numbers will no longer be functioning while the recurring-use card numbers will have limits on them.

He also said that the system removes the need to call the bank when a card needs to be freezed, as well as that the move is environmentally friendly because physical cards do not have to be manufactured.

Siew Yuen Tuck, co-founder of Jirnexu that is behind financial website ringgitplus.com, said that the dynamic card number system was like a “vaccine” to the never-ending “disease” of cyber-crime.

RinggitPlus is the exclusive acquisition partner for the launch of the product.

As part of their introductory promotion, Alliance Bank will offer a RM15.90 cashback for each recurring payment set through their virtual credit card from April 5 to September 30 this year — with the amount doubled (up to five subscriptions) for the first 12,000 RinggitPlus customers that get approved to use the virtual card.

Alliance Bank will also offer a zero per cent interest Flexi Payment Plan for 12 months with a minimum transaction amount of RM500.