F5 Networks (FFIV) Q1 Earnings Top Estimates, Outlook Impressive

F5 Networks FFIV reported better-than-expected first-quarter fiscal 2021 results. The company posted fiscal first-quarter non-GAAP earnings per share of $2.59, beating the Zacks Consensus Estimate of $2.50.

Moreover, the quarterly earnings came in higher than management’s guidance of $2.26-$2.38 per share. Also, non-GAAP earnings inched up 1.6% from the year-ago quarter mainly on solid revenues, partially offset by elevated operating expenses.

Non-GAAP revenues increased 10% year over year to $626 million, surpassing the Zacks Consensus Estimate of $625.2 million on solid software growth. The top-line figure also comes in higher than the company’s guided range of $595-$615 million.

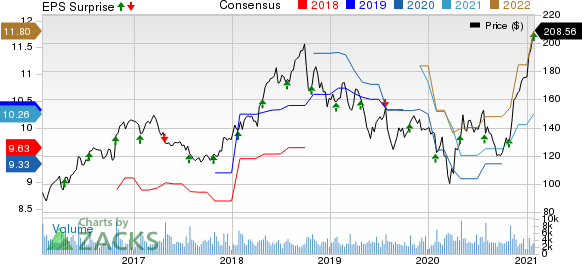

F5 Networks, Inc. Price, Consensus and EPS Surprise

F5 Networks, Inc. price-consensus-eps-surprise-chart | F5 Networks, Inc. Quote

Revenue Details

Product revenues (46% of total revenues) during the fiscal first quarter totaled $289 million, up 23% year on year. Software sales surged 70% year over year to $111 million, accounting for approximately 38% of the total Product revenues.

This upside in Software sales can be attributed to the revenue contribution from the recently-acquired Shape Security business as well as the growing adoption of the Enterprise License Agreement (ELA) and annual subscriptions among customers. Excluding revenue contribution from Shape Security, Software sales grew 35% year over year.

Service revenues (54% of total revenues) increased 1% to $337 million.

Margins

GAAP gross margin contracted 280 basis points (bps) to 81.6%. Non-GAAP gross margin shrunk 200 bps to 84%.

GAAP operating expenses flared up 9.5% year on year to $392 million, while non-GAAP operating expenses rose 8.4% to $322 million. As a result of lower gross margin and higher operating expenses, the company’s non-GAAP operating margin shrunk 80 bps to 33%.

Balance Sheet & Cash Flow

F5 Networks exited the October-December quarter with cash and investments of $1.37 billion compared with the prior-year quarter’s $1.21 billion.

During the fiscal first quarter, the company generated $137.4 million of operating cash flow.

Outlook

The company issued an encouraging business outlook for the second quarter of fiscal 2021.

For the fiscal second quarter, F5 Networks projects non-GAAP revenues of $625-$645 million. The Zacks Consensus Estimate for revenues is pegged at $623 million.

The company anticipates non-GAAP earnings per share in the $2.32-$2.44 band. The Zacks Consensus Estimate is pinned at $2.46.

We believe surging demand for multi-cloud application services will be a key growth driver during the fiscal second quarter. Furthermore, solid demand for software solutions is a tailwind. Rising traction from subscription and ELA offerings is another driving factor.

Additionally, F5 Networks and NGINX’s first combined solution, Controller 3.0, will likely increase the total addressable market and deal sizes by spending more use cases across DevOps and Super-NetOps customer profiles.

Zacks Rank and Key Picks

F5 Networks currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include Square SQ, Micron MU and NetApp NTAP, all flaunting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Square, Micron and NetApp is currently pegged at 33%, 12.7% and 11.9%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

F5 Networks, Inc. (FFIV) : Free Stock Analysis Report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

Square, Inc. (SQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research