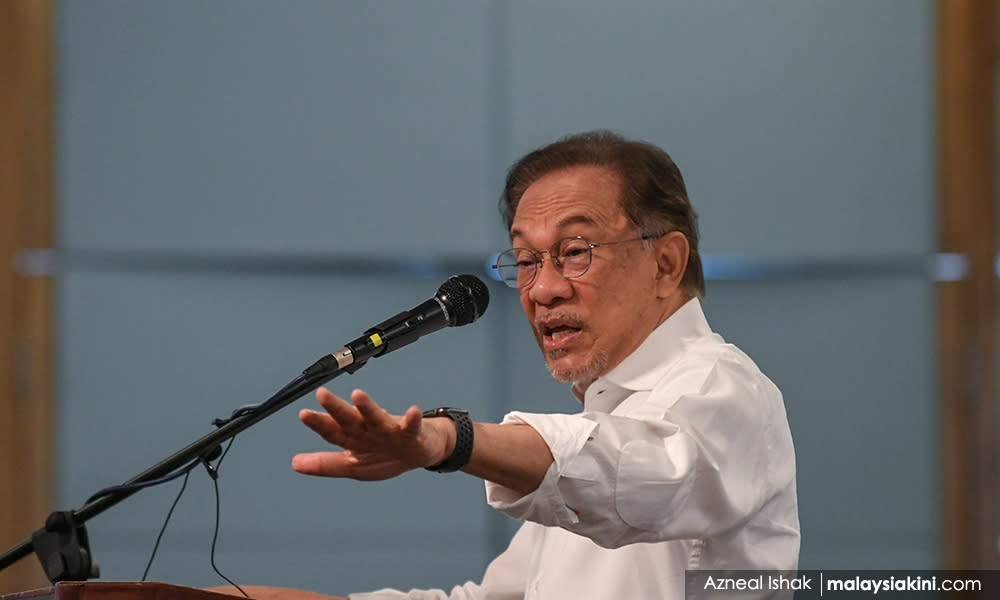

On eve of loan moratorium deadline, Anwar urges govt for review

Opposition leader Anwar Ibrahim has urged Putrajaya to review the figures for targeted loan moratoriums, claiming that too few borrowers had been surveyed.

Anwar said banks only contacted 17 percent of the estimated 8.3 million borrowers in the country, a figure which he described as "uninspiring".

Given that only 380,000 of the 1.4 million contacted had informed that they needed help, Anwar said there were probably many more borrowers who were not reached.

"It is indicative that the government and the banks are still in the dark regarding the overall borrowers' sentiment," said the Port Dickson MP and PKR president.

A review, said Anwar, should focus on implementing a more targeted loan moratorium, focusing on the borrowings by those from low-income households and small businesses.

"These classes of borrowings should be targeted for a moratorium as we have yet to see neither meaningful recovery of the salaries of lower-income families nor steady revenues for small businesses in Malaysia," he said.

The Department of Statistics, in its Malaysia Economic Statistic Review Vol 5/2020, had predicted that wages would likely be suppressed in the near future because unemployment was still above pre-pandemic levels.

Anwar also said it was alarming that the total number of Covid-19 patients under treatment had breached the 1,000 mark for the first time since mid-June.

"We could be witnessing the start of a second wave, with at least 20 active clusters nationwide. This does not bode well for the economy in the short term and it means that we must continue to actively support lower-income individuals and families who will be disproportionately affected," he said.

Putrajaya implemented a six-month blanket loan moratorium in April which expires tomorrow.

Following this, Putrajaya had convinced banks toextend the loan moratorium for another three months for borrowers who losttheir income source or rework loans for those with reduced incomes.