Ericsson's (ERIC) RedCap Software Unveils New 5G Use Cases

Ericsson ERIC recently carried out trials in Malaysia for the implementation and validation of the Reduced Capability (RedCap) software in 5G networks. The successful tests, carried out in collaboration with MediaTek, are likely to sow the seeds for new 5G use cases across wearable devices such as smartwatches and industrial sensors by lowering complexity and extending battery life.

Ericsson RedCap is a new radio access network (RAN) software solution that enhances existing 5G usage with reduced device chipset cost, lower complexity and less power consumption features. It offers additional monetization opportunities in both consumer and industrial spaces by enabling carriers to introduce services beyond enhanced mobile broadband by supporting advanced Standalone 5G NR functionalities such as enhanced positioning and network slicing.

The software facilitates the development of small devices with reduced chipsets, long battery life and substantial throughput, making it ideal for mobile consumer applications such as wearables, health monitors, augmented reality (AR) devices and industrial applications such as video surveillance and sensors. RedCap is expected to broaden the connectivity options and expand the 5G ecosystem, generating incremental revenues for Ericsson in the long run.

Ericsson Radio System comprises hardware, software and services for radio, RAN Compute, antenna systems, transport, power and site solutions. It enables smooth and cost-effective migration from 4G to 5G, aiding communication service providers to launch the avant-garde technology and grow 5G coverage fast. The company’s 5G radio access technologies provide the infrastructure to meet the growing demand for high-bandwidth connections and support real-time, high-reliability communication requirements of mission-critical applications.

With the emergence of the smartphone market and the subsequent usage of mobile broadband, user demand for coverage speed and quality has increased exponentially. Further, to maintain performance with increased traffic, there is a continuous need for network tuning and optimization. Ericsson is much in demand among operators to expand network coverage and upgrade networks for higher speed and capacity. The company is reportedly the world’s largest supplier of LTE technology with a significant market share and has established a large number of LTE networks worldwide.

The company focuses on 5G system development and has undertaken many notable endeavors to position itself as a market leader. It believes that the standardization of 5G is the cornerstone for digitizing industries and broadband. Ericsson expects mainstream 4G offerings to give way to 5G technology in the future. It currently has 152 live 5G networks across the globe, spanning 65 countries.

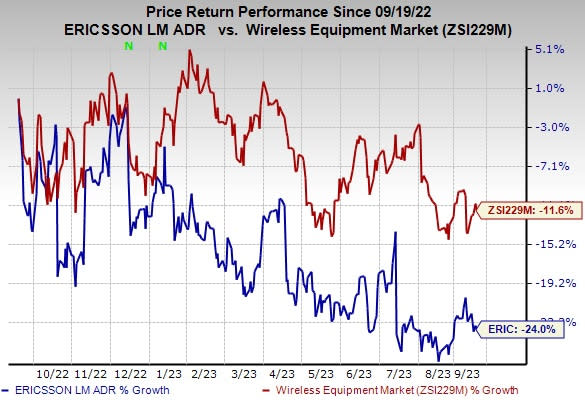

The stock has lost 24% over the past year compared with the industry’s decline of 11.6%.

Image Source: Zacks Investment Research

Ericsson currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 18.7% and delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC is a Zacks Rank #2 stock. It has a long-term earnings growth expectation of 4.3% and delivered an earnings surprise of 2.2%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2, delivered an earnings surprise of 5.62%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 5.58%.

Motorola provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ericsson (ERIC) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report