Ericsson (ERIC) Partners With TOMRA to Drive Circular Economy

Ericsson ERIC and TOMRA are embarking on a transformative collaboration to enhance transparency, traceability and optimization of waste streams, aligning with their shared mission to reduce litter and promote circularity in waste management.

TOMRA Collection, renowned for its reverse vending machines (RVMs), plays a pivotal role in the circular economy by collecting, sorting and processing used beverage containers for reuse and recycling. With around 85,000 installations across 60 markets, TOMRA's RVMs capture more than 46 billion used bottles and cans annually, significantly reducing the reliance on raw materials and minimizing waste in landfills, oceans and streets.

Ericsson Connected Recycling (“ECR”), a SaaS platform, enhances traceability and facilitates the trading of waste materials, ensuring that those are repurposed into new products. By integrating their cutting-edge technologies, Ericsson and TOMRA aim to demonstrate how waste can be monetized as a valuable resource, encouraging circularity over traditional waste disposal methods.

ECR, powered by an HPE private cloud solution, transforms waste into circular recycled raw materials, integrating these into enterprise ecosystems. The partnership showcases the potential of combining connectivity with innovative recycling technologies to drive circularity and create a more sustainable future.

This partnership brings numerous benefits to the table:

• Enhanced Circularity: The combined technologies promote the continuous reuse of materials, reducing the environmental impacts and reliance on raw resources.

• Increased Transparency & Traceability: With precise data collection and management, producers and retailers can monitor waste streams more effectively, ensuring materials are properly recycled and reused.

• Economic Incentives: By turning waste into a valuable resource, companies can monetize their waste, transforming a cost center into a revenue stream.

• Sustainability & Environmental Impact: This initiative supports global sustainability goals by reducing waste, lowering carbon footprints and fostering environmentally friendly practices.

For Ericsson, the collaboration not only aligns with its sustainability objectives but also enhances its market presence in the growing field of digitalized waste management solutions. By leveraging its expertise in connectivity and digitalization, Ericsson stands to benefit from business opportunities within the waste management industry.

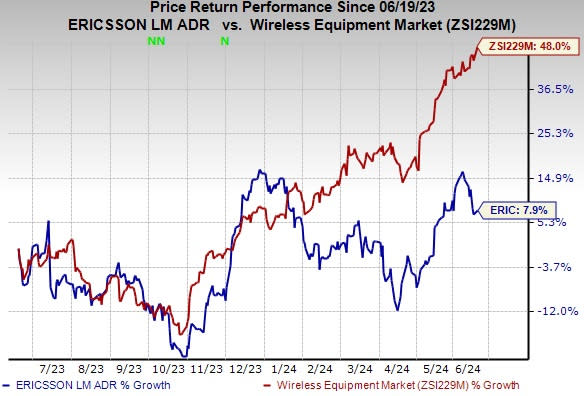

The ERIC stock has gained 7.9% over the past year compared with the industry’s rise of 48%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Ericsson currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, sporting a Zacks Rank #1 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.7%. It delivered an earnings surprise of 15.4%, on average, in the trailing four quarters.

ANET holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products. The company has been well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Harmonic Inc. HLIT, currently carrying a Zacks Rank #2 (Buy), is another key pick in the broader industry. Headquartered in San Jose, CA, the company provides video delivery software, products, system solutions and services worldwide.

With more than three decades of experience, HLIT has revolutionized cable access networking via the industry's first virtualized cable access solution, enabling cable operators to more flexibly deploy gigabit Internet service to consumers' homes and mobile devices. Harmonic delivered an earnings surprise of 5.6%, on average, in the trailing four quarters.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 at present, delivered an earnings surprise of 7.5%, on average, in the trailing four quarters. The company has a long-term earnings growth expectation of 9.5%.

MSI provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. The company develops and services both analog and digital two-way radio, voice and data communications products, and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ericsson (ERIC) : Free Stock Analysis Report

Harmonic Inc. (HLIT) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report