Equifax (EFX) Beats on Q1 Earnings & Revenues, Ups '21 View

Equifax Inc. EFX reported better-than-expected first-quarter 2021 results.

Adjusted earnings of $1.97 per share beat the Zacks Consensus Estimate by 29.6% and improved on a year-over-year basis. The reported figure exceeded the guided range of $1.45-$1.55.

Revenues of $1.21 billion outpaced the consensus estimate by 7.9% and improved 26.6% year over year on a reported basis as well as on a local-currency basis. The reported figure exceeded the guided range of $1.11 -$1.13 billion.

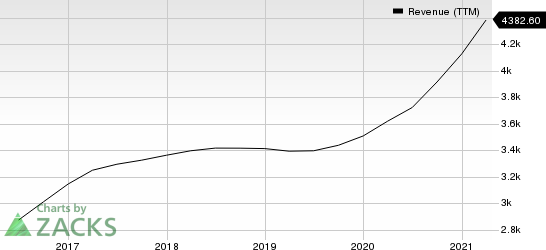

Equifax, Inc. Revenue (TTM)

Equifax, Inc. revenue-ttm | Equifax, Inc. Quote

The company reported its fifth consecutive quarter of solid double-digit revenue growth. The uptick was driven by strength across the company’s Workforce Solutions and U.S. Information Solutions (“USIS”) segments - both delivering a combined 38% revenue increase on the back of solid growth across both mortgage and non-mortgage businesses. The company has been executing its EFX2023 strategy, leveraging the EFX Cloud to drive new products, innovation and growth. The company has completed five acquisitions – Kount, HIREtech, i2Verify, AccountScore and CreditWorks.

Over the past year, shares of Equifax have gained 58.1%, outperforming the 31.3% surge of the industry it belongs to and 50.7% rally of the Zacks S&P 500 composite.

Let’s check out the numbers in detail.

Segmental Revenues

Revenues in the U.S. Information Solutions division came in at $409.4 million, up 19% from the year-ago quarter. Within the division, Online Information Solutions’ revenues of $302 million were up 19% year over year. Mortgage Solutions’ revenues of $54.1 million improved 27% year over year. Financial Marketing Services’ revenues came in at $53.3 million, up 12% year over year.

Revenues in the International division totaled $241.3 million, up 12% year over year on a reported and 3% on a local-currency basis. Asia Pacific revenues of $86.9 million grew 25% year over year on a reported basis and 7% on a local-currency basis. Revenues from Europe came in at $68.7 million, up 3% year over year on a reported basis but down 5% on a local-currency basis. Latin Americarevenues of $41.6 million declined 4% year over year on a reported basis but were up 1% on a local-currency basis. Canadarevenues of $44.1 million improved 20% year over year on a reported basis and 13% on a local-currency basis.

Revenues in the Workforce Solutions segment totaled $480.9 million, up 59% from the year-ago quarter’s figure. Within the segment, Verification Services’ revenues of $385.2 million were up 75% year over year. Employer Services revenues of $95.7 million were up 17% year over year.

Revenues in the Global Consumer Solutions segment amounted to $81.4 million, down 16% year over year on a reported basis and 17% on a local-currency basis.

Operating Results

Adjusted EBITDA in the first quarter of 2021 came in at $431.3 million compared with $316.5 million in the year-ago quarter. Adjusted EBITDA margin rose to 35.6% from 33% in the year-ago quarter.

Adjusted EBITDA margin for USIS was 42.9% compared with 44.7% in the year-ago quarter. Adjusted EBITDA margin for the International segment was 28.2% compared with 27.9% in the prior-year quarter. Workforce Solutions’ adjusted EBITDA margin was 59.3% compared with 51.5% a year ago. Adjusted EBITDA margin for Global Consumer Solutions was 24.6% compared with 23.1% in the year-ago quarter.

Equifax, Inc. Price, Consensus and EPS Surprise

Equifax, Inc. price-consensus-eps-surprise-chart | Equifax, Inc. Quote

Balance Sheet and Cash Flow

Equifax exited first-quarter 2021 with cash and cash equivalents of $765.9 million compared with $1.68 billion at the end of the prior quarter. Long-term debt was $3.28 billion, flat sequentially.

The company generated $143.4 million of cash from operating activities and capex was $113 million. Also, Equifax paid out dividends of $47.5 million to shareholders in the reported quarter.

Second-Quarter and Full-Year 2021 Guidance

For the second quarter of 2021, Equifax expects revenues between $1.14 and $1.16 billion. The Zacks Consensus Estimate of $1.07 billion lies below the guidance.

Adjusted EPS is anticipated in the range of $1.60-$1.70. The Zacks Consensus Estimate of $1.52 lies below the guidance.

For full-year 2021, revenues are expected between $4.58 and $4.68 billion compared with the prior guidance of $4.35-$4.45 billion. The Zacks Consensus Estimate of $4.45 billion lies below the guidance.

Adjusted EPS is anticipated in the range of $6.75-$7.05 compared with the prior guidance of $6.20-$6.50. The Zacks Consensus Estimate of $6.42 lies below the guidance.

Currently, Equifax carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Investors interested in the broader Zacks Business Services sector are keenly awaiting first-quarter 2021 earnings of key players like Waste Connections WCN, Waste Management WM and Republic Services RSG. While Waste Connections will release its earnings on Apr 28, Waste Management and Republic Services will report the same on Apr 27 and May 5, respectively.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Waste Connections, Inc. (WCN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research