EMCOR (EME) Beats on Q3 Earnings, Lifts View, Stock Up

EMCOR Group Inc. EME shares jumped 3.7% on Oct 29 in response to impressive third-quarter 2020 earnings. Adjusted earnings surpassed the Zacks Consensus Estimate, mainly driven by cost discipline amid the COVID-19 pandemic. Notably, the company has also raised its earnings and revenue guidance for the full year given its year-to-date performance and the continuation of current positive market trends.

Tony Guzzi, Chairman, President and Chief Executive Officer of EMCOR, said, “While impacts related to the COVID-19 pandemic are ongoing, we are cautiously optimistic about demand recovery as our remaining performance obligations increased 12.3% year-over-year, underscoring the resiliency of our business and the markets in which we operate.”

Earnings & Revenues

The company reported adjusted earnings of $1.76 per share, which topped the consensus mark of $1.28 by 37.5% and increased 21.4% from the year-ago quarter.

Revenues totaled $2,201.7 million, beating the consensus mark by 3.8%. However, revenues declined 3.8% year over year mainly due to tepid performance of U.S. Industrial Services segment.

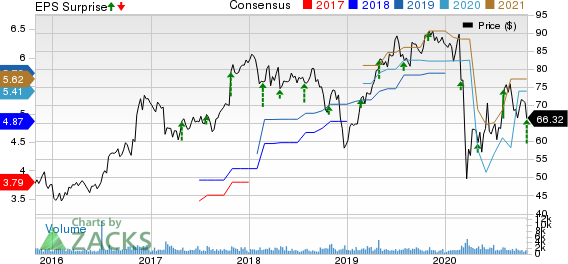

EMCOR Group, Inc. Price, Consensus and EPS Surprise

EMCOR Group, Inc. price-consensus-eps-surprise-chart | EMCOR Group, Inc. Quote

Segment Details

The U.S. Construction segment’s revenues decreased 1.6% year over year to $1.4 billion. Segment operating margin improved 240 basis points (bps), supported by solid cost structure and productivity levels.

Within the U.S. Construction umbrella, the U.S. Electrical Construction and facilities services segment revenues decreased 8.3% year over year to $508.9 million. Operating margin expanded 310 bps year over year. The U.S. Mechanical Construction and Facilities Services segment revenues grew 2.6% to $891.5 million. Its operating margin improved 200 bps.

Revenues in the U.S. Building Services segment grew 3.7% driven by strong performance in commercial and government site-based services businesses and sustained strength in mobile mechanical services business. Operating margin of 6.9% was up 30 bps from the prior year.

The U.S. Industrial Services unit’s revenues declined 40.3% year over year to $139.7 million. The segment was significantly impacted by volatility in crude oil prices resulting from geopolitical tensions between OPEC and Russia, as well as a dramatic reduction in demand for refined oil products due to COVID-19-related restrictions. This business reported operating margin of negative 7% versus operating margin of 2.4% a year ago due to above-mentioned headwinds and pricing pressure.

The U.K. Building Services segment’s revenues increased 12.7% but operating margin declined 10 bps year over year. The revenue growth was backed by proper execution across the company’s diversified customer base.

Operating Highlights

Selling, general and administrative expenses — as a percentage of revenues — were 10.3%, which increased 70 bps from the prior-year period.

Adjusted operating margin of 6.2% was up 110 bps, supported by strong cost containment measures.

Liquidity & Cash Flow

As of Sep 30, 2020, the company had cash and cash equivalents of $679.3 million compared with $358.8 million at 2019-end. Long-term debt and finance lease obligations totaled $272.2 million, up from $244.1 million recorded on Dec 31, 2019.

In the first nine months of 2020, EMCOR provided $546.8 million cash to operating activities compared with $176.9 million in the year-ago period.

2020 Guidance Raised

Backed by quarterly performance, current operating conditions and visibility into the remainder of the year, EMCOR now expects revenues to be $8.7 billion versus $8.6-$8.7 billion expected earlier. It estimates adjusted earnings per share of $5.90-$6.10 versus $5.00-$5.50 expected earlier. In 2019, the company registered revenues of $9.17 billion and adjusted earnings of $5.75 per share.

Zacks Rank

EMCOR — which shares space with Dycom Industries, Inc. DY, MasTec, Inc. MTZ and Great Lakes Dredge & Dock Corporation GLDD in the Zacks Building Products - Heavy Construction industry — currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Great Lakes Dredge Dock Corporation (GLDD) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

MasTec, Inc. (MTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research