Can Eli Lilly's (LLY) Continue its Ride on Obesity Drug Wave?

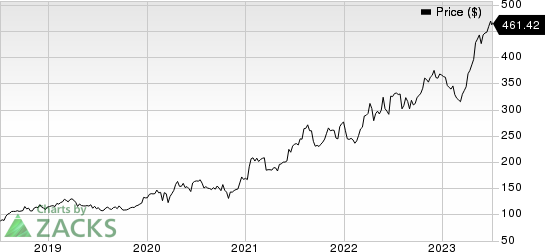

Year to date, shares of Eli Lilly LLY have surged 26.1% compared with the industry’s 0.4% growth.

Image Source: Zacks Investment Research

This upside can be attributed to the company’s progress with its pipeline candidates for treating obesity. Lilly is running multiple comprehensive clinical development programs evaluating different drugs for treating obesity in patients, with or without diabetes, which can be administered orally or by injections.

Last month, Lilly announced new results from a phase II study that evaluated retatrutide, its investigational triple GIP/GLP-1/glucagon injectable molecule for treating obesity or overweight in patients without diabetes. Data from the study showed that treatment with retatrutide achieved met one of its secondary endpoints, exhibiting a mean weight reduction of up to 24.2% at the end of a 48-week treatment duration. The study also met its primary endpoint of percent change in weight from baseline at 24 weeks, exhibiting a mean weight reduction of up to 17.5%.

Management also announced new data from another mid-stage study evaluating its investigational oral once-daily GLP-1 receptor agonist (“GLP-1-RA”) drug, orforglipron. The drug achieved a mean weight reduction up to 14.7%, following a 36-week treatment period in adults with obesity or overweight without diabetes.

Though the above results are still early and yet to be dose-optimized for managing side-effects, they also exhibit their potential for chronic weight management in people living with obesity. A continued potential success in late-stage clinical studies could help the company dominate this untapped target market in the long-run. Both retatrutide and orforglipron are currently being evaluated across multiple separate phase III studies for treating various types of patients with obesity.

Recently, Lilly announced that it has completed the regulatory submission seeking label expansion for its dual GIP/GLP-1-RA drug tirzepatide to treat obesity or overweight in adults. A final decision is expected by 2023-end. While data from one late-stage study (SURMOUNT-1) released last year showed that treatment with tirzepatide led to mean weight reduction up to 22.5% in patients without diabetes, data from a second late-stage study (SURMOUNT-2) showed that tirzepatide treatment achieved mean reduction up to 15.7% in patients with type 2 diabetes (“T2D”).

Tirzepatide was approved in May 2022 for treating adults with type 2 diabetes mellitus (“T2DM”) and is being marketed under the brand name Mounjaro. Since its launch, Mounjaro has showed an impressive initial uptake, recording $568.5 million in revenues in first-quarter 2023.An expansion in the obesity indication would help Lilly rake in billions of dollars from Mounjaro sales.

The above developments have helped Lilly dethrone Johnson & Johnson JNJ to become the world’s most valuable pharmaceutical company in terms of market capitalization. As of Jul 3, Lilly was valued at $438.0 billion compared to J&J’s market cap of $424.5 billion.

Currently, Novo Nordisk NVO is a key player in the diabetes and obesity space.Novo Nordisk’s semaglutide was initially approved by the FDA in 2017 to treat type 2 diabetes and is being marketed under the trade name Ozempic. In 2021, Novo Nordisk received label expansion in the United States for once-weekly semaglutide injections to treat obesity or overweight in adults. Following the label approval, semaglutide became the first drug to receive approval for chronic weight management in adults with general obesity or overweight since 2014. Novo Nordisk markets semaglutide for obesity indication under the brand name Wegovy.

Since its launch, sales of Wegovy have been gaining momentum. Wegovy sales were up 124% in first-quarter 2023. Based on the upside, the company raised full-year 2023 sales outlook and profit expectations. To further boost the top line, it is also evaluating a once-daily oral formulation of semaglutide for obesity indication in late-stage studies, with a potential FDA filing expected later this year.

Like Lilly, Pfizer PFE is also evaluating pipeline candidates for obesity. Currently, Pfizer is lagging behind Lilly in terms of development for obesity treatments. Last week, Pfizer reported a major setback in its obesity pipeline when it announced its decision to discontinue development of a once-daily oral obesity drug lotiglipron in favor of a twice-daily orally administered danuglipron. This decision was based on data from multiple phase I drug-drug-interaction studies and an ongoing phase II study wherein study participants treated with lotiglipron were shown to have elevated levels of liver enzymes.

Pfizer is currently evaluating danuglipron in a phase II study in patients with obesity and T2DM. If this study is successful, management plans to start phase III studies by the year-end.

Eli Lilly and Company Price

Eli Lilly and Company price | Eli Lilly and Company Quote

Zacks Rank

Eli Lilly currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report