DXC Technology (DXC) Stock Plunges 6% on Q1 Earnings Miss

DXC Technology Company DXC shares plunged 5.8% in Wednesday’s extended trading session following the IT services provider’s report of lower-than-expected earnings results for the first quarter of fiscal 2023. The company reported first-quarter non-GAAP earnings of 75 cents per share, missing the Zacks Consensus Estimate of earnings of 82 cents.

The bottom line also declined 10.7% from the prior-year quarter’s earnings of 84 cents per share, primarily due to reduced revenues, higher direct costs, increased investments in growth initiatives, unfavorable currency fluctuations and an increased tax rate. The aforementioned negative factors were partially offset by lower interest expenses and outstanding shares.

DXC reported revenues of $3.71 billion, which matched the consensus mark but declined 10.5% year over year. The top line was negatively impacted by unfavorable currency exchange rates. The company’s closure of operations in Russia impacted the top line unfavorably.

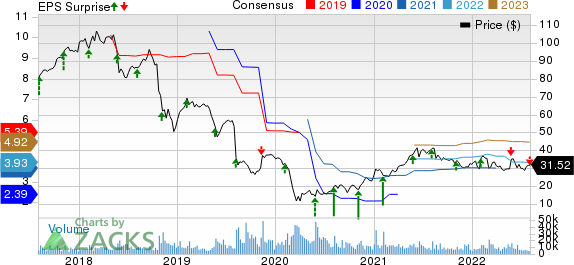

DXC Technology Company. Price, Consensus and EPS Surprise

DXC Technology Company. price-consensus-eps-surprise-chart | DXC Technology Company. Quote

Quarterly Details

DXC’s bookings for the fiscal first quarter were $3.22 billion, reflecting the book-to-bill ratio of 1.06.

Segment-wise, revenues from Global Business Services decreased 6.8% on a year-over-year basis to $1.76 billion. On an organic basis, the division’s revenues improved 2.8% year over year. The upside was primarily aided by the strong performance of Analytics and Engineering offerings, partially offset by softness in the Applications business.

Global Infrastructure Services revenues were $1.95 billion in the fiscal first quarter, down 13.5% year over year. On an organic basis, the division’s revenues decreased 7.2% year over year.

The adjusted EBIT margin was 7%, contracting 100 basis points (bps) year over year and contracting 150 bps sequentially. Margins were primarily hurt by higher direct costs, increased investments in growth initiatives and slower efforts toward cost optimization during the quarter.

On its earnings call, the company stated that it would accelerate its cost-optimization initiative to achieve a target of reducing the cost by $500 million in the ongoing fiscal. Under its ongoing cost-optimization initiatives, the company is focusing on four cost levers – contractor conversion, scaling its global innovation and delivery centers, real estate and automation through Platform X.

Balance Sheet and Cash Flow

DXC exited the fiscal first quarter with $2.21 billion in cash and cash equivalents compared with the $2.67 billion witnessed in the previous quarter. The long-term debt balance (net of current maturities) declined to $3.87 billion as of Jun 30, 2022 from $4.24 billion as of Mar 31, 2022.

In the first quarter, DXC generated operating cash flow of $163 million while having negative free cash flow of $12 million. On the earnings call, the company noted that cash flows were seasonally impacted, including software vendor payments and incentive payments.

In the first quarter, the company repurchased shares worth $266 million and completed $500 million of its total commitment of repurchasing $1 billion worth of common stock this year.

Guidance

The company lowered its fiscal 2023 guidance. DXC now estimates revenues in the band of $14.6-$14.75 billion, down from its earlier guidance range of $14.9-$15.05 billion. It now projects adjusted earnings between $3.45 and $3.75 per share, down from the previous range of $3.85-$4.15 per share.

For the second quarter of fiscal 2023, the company anticipates revenues between $3.55 billion and $3.58 billion. The adjusted EBIT margin is expected in the range of 7%-7.5%. DXC projects adjusted earnings between 70 cents and 75 cents per share.

Zacks Rank & Stocks to Consider

Currently, DXC carries a Zacks Rank #4 (Sell). Shares of DXC have declined 2.1% year to date (“YTD”).

Some better-ranked stocks worth considering from the broader technology sector are 8x8, Inc. EGHT, Cadence Design Systems CDNS and Manhattan Associates MANH, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for 8x8's second-quarter fiscal 2023 earnings has been revised upward by a penny to four cents per share over the past seven days. For fiscal 2023, the Zacks Consensus Estimate for 8x8's earnings has moved north by 13 cents to 26 cents per share in the past seven days.

8x8's earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while matching the same in one, the average surprise being 175%. Shares of EGHT have plunged 66.5% YTD.

The Zacks Consensus Estimate for Cadence Design Systems' third-quarter 2022 earnings has been revised upward by nine cents to 97 cents per share over the past 30 days. For 2022, earnings estimates have moved north by 5.7% to $4.11 per share in the past 30 days.

Cadence Design Systems' earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 9.8%. Shares of CDNS have decreased 2.3% YTD.

The Zacks Consensus Estimate for Manhattan Associates' third-quarter 2022 earnings has been revised upward by a penny to 57 cents per share in the past 30 days. For 2022, earnings estimates have moved south by 18 cents to $2.38 per share in the past 30 days.

Manhattan Associates' earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 30.3%. Shares of MANH have plunged 6.7% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

8x8 Inc (EGHT) : Free Stock Analysis Report

DXC Technology Company. (DXC) : Free Stock Analysis Report

To read this article on Zacks.com click here.