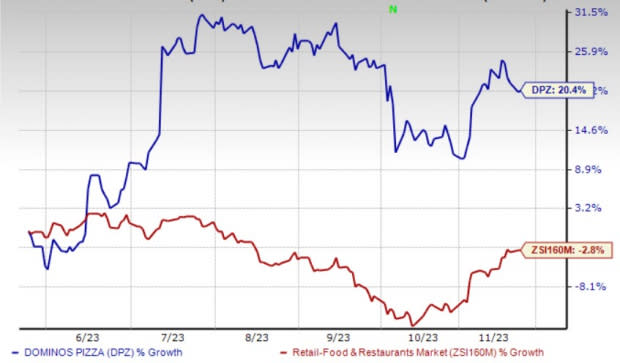

Domino's (DPZ) Stock Up 20% in 6 Months: Will the Gain Last?

Shares of Domino's Pizza, Inc. DPZ have appreciated 20.4% in the past six months against the industry’s decline of 2.8%. Strong global expansion, robust comps growth, effective sales-boosting initiatives, innovative menu offerings and advancements in digital technology resulted in this uptick.

In the past 30 days, earnings estimates for this Zacks Rank #3 (Hold) company have witnessed an upward revision of 0.5% to $14.48 per share. However, headwinds related to staffing challenges and inflationary pressures persist.

Growth Drivers

DPZ remains steadfast in its commitment to expanding its presence in high-growth international markets as a strategy to enhance its business. Meanwhile, it continues to experience robust and diversified international growth, thanks to exceptional unit-level economics.

In the fiscal third quarter, it successfully incorporated 27 net new stores in the United States, bringing the total U.S. system store count to 6,762 stores. Additionally, the international segment added 190 net new stores during the same period. While DPZ anticipates its annual global net store growth to either align with or slightly fall below the low end of 5-7% two-to-three-year outlook, the trend in store growth is expected to be beneficial in the upcoming period.

The company is gaining from robust comparable sales growth. During the fiscal third quarter, global retail sales (including total franchise and company-owned units) rose 5.3% on a year-over-year basis. The upside was driven by higher international store sales (up 9.8% year over year) and global net store growth.

Meanwhile, U.S. store sales inched up 1.7% year over year. Without foreign-currency adjustments, global retail sales increased 5.1% from the prior-year levels.

Comps at international stores, excluding foreign currency translation, improved 3.3% year over year. In the prior-year quarter, the metric inched down 1.8%. For the fiscal fourth quarter, our model predicts comps at US company-owned and franchise stores to be 2.9% and 1% compared with the prior year’s respective figures of 3.4% and 0.8%. Also, we expect international comps to be 3.3% compared with 2.6% a year ago.

To drive sales, Domino's entered into a global agreement with Uber Technologies. This partnership permits U.S. customers to order Domino's products with the help of Uber Eats and Postmates apps. The company rolled out this initiative integration and has witnessed a notable response since.

Both Domino's and Uber Eats have 27 international markets in common. Domino’s believed this collaboration could help increase orders from Uber Eats to 70% of its stores around the globe. Domino’s expects ordering through Postmates and Uber Eats apps to be available nationwide by 2023 end.

Image Source: Zacks Investment Research

Concerns

Lower supply-chain revenues (owing to a decline in market basket pricing and lower order volumes) and lower U.S. company-owned store revenues remain concerns. Going forward, the company anticipates headwinds related to staffing challenges and inflationary pressures to affect operations for some time.

Inflationary pressures in commodity and labor costs continue to hurt Domino’s. The company has been witnessing labor challenges in a handful of markets.

During the fiscal third quarter, management witnessed increased general and administrative expenses driven by higher labor costs and the negative impact of changes in foreign currency exchange rates. It anticipates high inflationary environment for food and labor to persist for some time.

Key Picks

Below we present some better-ranked stocks from the Zacks Retail-Wholesale sector.

Wingstop Inc. WING sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 28.9%, on average. The stock has risen 45.8% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for WING’s 2024 sales and EPS suggests a rise of 15.6% and 17.2%, respectively, from a year ago.

Brinker International, Inc. EAT flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 223.6%, on average. Shares of EAT have climbed 3.7% in the past year.

The Zacks Consensus Estimate for EAT’s fiscal 2024 sales and EPS indicates 5% and 26.2% growth, respectively, from the prior-year levels.

FAT Brands Inc. FAT currently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 36.6%, on average. The stock has fallen 11% in the past year.

The Zacks Consensus Estimate for FAT Brands’ 2024 sales and EPS implies an improvement of 35.6% and 27.4%, respectively, from the year-earlier levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

FAT Brands Inc. (FAT) : Free Stock Analysis Report