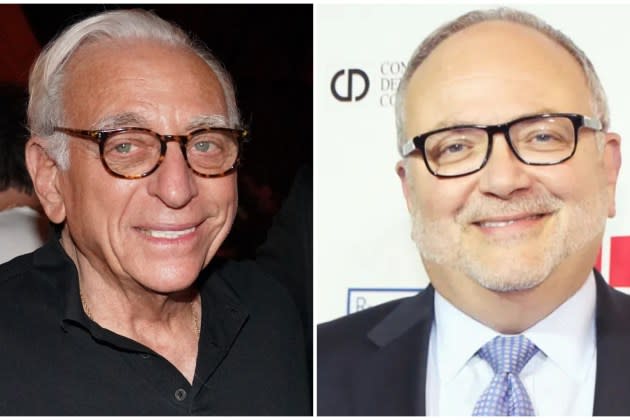

In Disney Board Fight, Nelson Peltz Will Nominate Himself and Ex-Disney CFO Jay Rasulo as Director Candidates

Activist investor Nelson Peltz, who’s looking to shake up Disney’s board, plans to nominate two directors as candidates for directors of the Mouse House’s board: Peltz himself, and former Disney CFO Jay Rasulo.

Peltz’s Trian Fund Management said Thursday it submitted a notice of its intention to nominate the two independent director candidates at Disney’s 2024 annual shareholders meeting, expected to be held next spring.

More from Variety

“Disney is one of the most iconic companies in the world with unrivaled scale, unparalleled customer loyalty, irreplaceable intellectual property (IP) and an enviable commercial flywheel. However, Disney has woefully underperformed its peers and its potential,” Trian said in a statement.

Disney confirmed that Trian provided notice of its intent to nominate Peltz and Rasulo as directors. The company said the board’s governance and nominating committee, which evaluates director nominations, “will review the proposed Trian nominees and provide a recommendation to the board as part of its governance process.”

Responding to Trian, Disney said the company “has an experienced, diverse and highly qualified board that is focused on the long-term performance of the company, strategic growth initiatives including the ongoing transformation of its businesses, the succession planning process, and increasing shareholder value.”

Last month, Peltz’s Trian Fund Management renewed its proxy fight to get its directors on the Disney board. That came a day after Disney named Morgan Stanley CEO James Gorman and former Sky chief Jeremy Darroch as new directors, with terms starting in early 2024. Trian, which controls about $3 billion in Disney stock, said that after the media conglomerate’s board rejected its request for board seats that it would “take our case for change directly to shareholders.”

In a response Nov. 30, Disney noted that 78% of the shares claimed to be beneficially owned by Trian are owned by former Marvel Entertainment chairman Ike Perlmutter. Disney said Perlmutter “was terminated from his employment by Disney earlier this year and has voiced his longstanding personal agenda against Disney’s CEO, Robert A. Iger, which may be different than that of all other shareholders.”

Rasulo, who served as Disney’s CFO from 2010-15, said in a statement provided by Trian, “The Disney I know and love has lost its way. As independent voices in the boardroom, Nelson and I are confident that the combination of my decades of experience at Disney, Nelson’s significant boardroom skills and history of driving positive strategic change, and our combined consumer brands expertise and financial acumen, will be additive to the Disney board. With a shareholder mandate, Nelson and I look forward to helping the board and management reorient the company towards delighting its consumers again and driving significant value for its owners.”

Before being appointed CFO, Rasulo was chairman of Walt Disney Parks and Resorts Worldwide from 2005-09 and president of Walt Disney Parks and Resorts from 2002-05. When Rasulo left the company in 2015, Disney CEO Bob Iger praised his “strategic acumen and savvy insight” and said the exec had been “a vital contributor to Disney’s success.”

Peltz asserts that Disney stock has underperformed its media-industry peers and the broader market over the last decade — and even before that, shares languished since Iger was first appointed CEO in 2005. Trian claims “Disney shareholders were once over $200 billion wealthier than they are now,” referencing the cumulative market value lost between Disney’s all-time high closing stock price on March 8, 2021 and Oct. 6.

“Mr. Iger has sold the vast majority of his ownership stake built up primarily through share-based compensation — more than $1 billion of Disney stock – leaving shareholders alone to face the daunting reality of a complex turnaround in a rapidly evolving industry,” Trian said in its Dec. 14 statement.

Key problems for Disney, according to Trian, are that Wall Street consensus earnings-per-share estimates for the company’s fiscal years 2024 and 2025 have “fallen meaningfully, even as the company claims to be cutting billions of costs,” while “studio content continues to disappoint consumers, slowing the speed of the flywheel and threatening future earnings growth.”

Trian continued, “The root cause of Disney’s underperformance, in our view, is a board that is too closely connected to a long-tenured CEO and too disconnected from shareholders’ interests.”

“To resolve the malaise and crisis of confidence among Disney shareholders, the Board needs fresh perspectives from truly independent directors selected by the shareholders themselves,” Peltz said in Trian’s announcement Thursday. “Jay and I have the strategic, operating, financial and governance expertise to help Disney and are committed to working with the other members of the Board and management team to address the fundamental issues underlying the Company’s continued poor performance. There is much that can be done to revive Disney and restore the confidence of Disney shareholders, and Trian looks forward to discussing these opportunities with our fellow shareholders over the coming months.”

On Nov. 30, the day Peltz announced the proxy fight, Disney adopted new bylaws covering the nomination of directors, apparently in part to require Peltz to disclose details of Perlmutter’s involvement in the proxy fight. And, seeking to woo shareholders amid the brewing battle, Disney announced its first cash dividend payments to investors in more than three years.

Pictured above: Nelson Peltz (left), Jay Rasulo

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.