Deutsche Bank (DB) Q2 Net Revenues Increase Y/Y, Expenses Rise

Deutsche Bank DB reported a second-quarter 2023 profit attributable to its shareholders of €763 million ($831 million), down 27% from the year-ago quarter. The Germany-based lender reported a profit before tax of €1.41 billion ($1.53 billion), down 9% year over year.

Results were largely driven by higher net revenues and strong capital position. However, higher provisions for credit losses and a rise in operating expenses were an offsetting factor.

Revenues, Costs & Provisions Rise

The bank generated net revenues of €7.41 billion ($8.06 billion), up 11% year over year. This upside primarily resulted from higher revenues in all segments except Investment Bank and Asset Management. Our estimate for net revenues was €7 billion.

Non-interest expenses of €5.60 billion ($6.10 billion) increased 15% from the prior-year quarter. Our estimate for non-interest expenses was €5.15 billion.

Provision for credit losses was €401 million ($436 million), up 72% from the prior-year quarter. Our estimate for the metric was €401.8 million.

Segmental Performance

Net revenues of €1.94 billion ($2.11 billion) at the Corporate Bank division increased 25% year over year. The rise was mainly driven by an increase in net interest income. Our estimate for the same was €1.67 billion.

Investment Bank’s net revenues totaled €2.36 billion ($2.57 billion), down 11% year over year. This highlights a decline in Fixed Income, Currency Sales & Trading revenues. Our estimate for the metric was €2.23 billion.

Private Bank reported net revenues of €2.40 billion ($2.61 billion), up 11% year over year. Higher revenues from deposit products, driven by higher net interest margins led to the increase. Our estimate for the metric was €2.25 billion.

Asset Management generated net revenues of €620 million ($674.9 million), down 6% year over year. Declines in management fees, as well as higher allocated funding charges, led to the fall. Our estimate for the metric was €590 million.

Corporate & Other reported net revenues of €85 million ($92.5 million), which improved from negative revenues of €363 million in the prior-year period.

Capital Position Strong

Deutsche Bank’s Common Equity Tier 1 capital ratio was 13.8% as of Jun 30, 2023, up from the year-ago quarter’s 13%. Risk-weighted assets were €359 billion ($390.5 billion), down 3% year over year.

The leverage ratio on a fully-loaded basis was 4.7%, up from the year-ago quarter's 4.3%.

Share Repurchase Update

On Jul 25, Deutsche Bank received supervisory approvals for its share repurchases of up to €450 million by 2023-end.

Our Viewpoint

Deutsche Bank’s financial performance seems encouraging. The performance improved due to the Corporate Bank, Private Bank segments and Corporate & Other over the prior-year quarter. An increase in net revenues is expected to drive earnings growth in the near term.

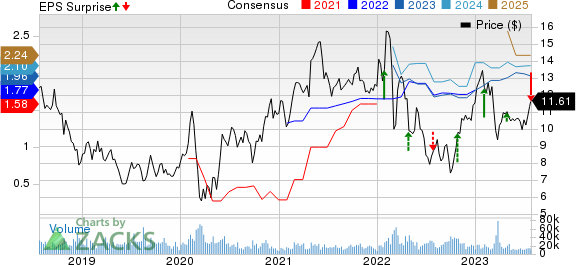

Deutsche Bank Aktiengesellschaft Price, Consensus and EPS Surprise

Deutsche Bank Aktiengesellschaft price-consensus-eps-surprise-chart | Deutsche Bank Aktiengesellschaft Quote

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Dates of Other Foreign Banks

Barclays BCS is scheduled to announce its second-quarter 2023 numbers on Jul 27.

Over the past 30 days, the Zacks Consensus Estimate for Barclays’ quarterly earnings has decreased 4.3% to 45 cents, suggesting a 40.6% rise from the prior-year reported number.

HSBC Holdings plc HSBC is slated to announce its second-quarter 2023 numbers on Aug 7.

Over the past seven days, the Zacks Consensus Estimate for HSBC’s quarterly earnings has remained unchanged at $1.50, implying an 11.1% jump from the prior-year reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barclays PLC (BCS) : Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report