D.R. Horton (DHI) Beats on Q2 Earnings, Lifts View, Stock Up

D.R. Horton, Inc.’s DHI shares climbed 2.4% in response to solid second-quarter fiscal 2021 results. Its earnings and revenues handily beat the respective Zacks Consensus Estimate given the company’s industry-leading market share, broad geographic footprint and diverse product offerings across multiple brands. The homebuilder also raised its full-year expectations on the back of its performance for the first six months of fiscal 2021.

Donald R. Horton, Chairman of the Board, said, “Housing market conditions remain very robust, and we are focused on maximizing returns and improving capital efficiency in each of our communities while increasing our market share. Our strong balance sheet, liquidity and low leverage provide us with significant financial flexibility. We plan to maintain our disciplined approach to investing capital to enhance the long-term value of our company, including returning capital to our shareholders through both dividends and share repurchases on a consistent basis.”

Earnings & Revenue Discussion

D.R. Horton reported quarterly adjusted earnings of $2.53 per share, which surpassed the Zacks Consensus Estimate of $2.20 by 15% and increased 95% from the year-ago period.

Total revenues (Homebuilding, Forestar and Financial Services) came in at $6.4 billion, up 43% year over year. The reported figure beat the consensus mark by 4.9%.

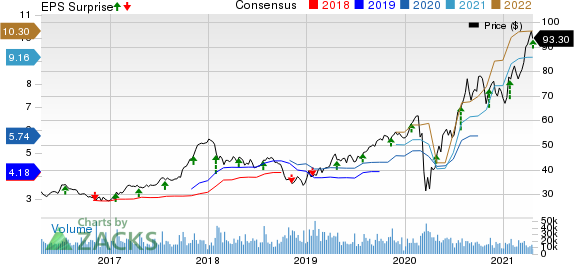

D.R. Horton, Inc. Price, Consensus and EPS Surprise

D.R. Horton, Inc. price-consensus-eps-surprise-chart | D.R. Horton, Inc. Quote

Home Closings and Orders

Homebuilding revenues of $6.19 billion increased 41.3% from the prior-year quarter. Home sales also increased 41.4% to $6.17 billion, aided by higher home deliveries. Land/lot sales and other revenues were $17.3 million, up from $15.5 million a year ago.

Home closings increased 36% from the prior-year quarter to 19,701 homes and 41% in value to $6.2 billion. It recorded growth across all regions, namely East, Midwest, Southeast, South Central, Southwest and West.

Quarterly net sales orders increased 35% year over year to 27,059 homes. Sales orders registered growth in all geographic regions served baring West. Value of net orders also improved 47% to $8.8 billion. The cancellation rate was 15%, lower than 19% a year ago.

Order backlog of homes at the quarter-end was 35,845 homes, up 85% year over year. The value of backlog was up 97% to $11.6 billion.

Revenues from the Financial Services segment increased 115% from the year-ago level to $225.1 million.

Forestar contributed $287.1 million to its total quarterly revenues, reflecting notable improvement from $159.1 million a year ago.

Margins

The company’s consolidated pre-tax margin expanded 450 basis points to 18.3%.

Balance Sheet Details

D.R. Horton’s cash, cash equivalents and restricted cash totaled $2.23 billion as of Mar 31, 2021 compared with $3.04 billion at fiscal 2020-end.

At fiscal second quarter-end, it had $1.9 billion of unrestricted homebuilding cash and $1.8 billion of available capacity. Total homebuilding liquidity was $3.7 billion.

As of Mar 31, 2021, homebuilding debt totaled $2.6 billion, with homebuilding debt to total capital of 16.8%. The trailing 12-month return on equity was 27.1%.

D.R. Horton repurchased 4.5 million shares of common stock for $350.4 million during the fiscal second quarter. The company’s remaining stock repurchase authorization — which has no expiration date — as of Mar 31, 2021 was $115.1 million.

Fiscal 2021 Guidance Raised

Total revenues are now expected in the range of $26.8-$27.5 billion, up from the earlier expectation of $25.2-25.8 billion. Homes closed are expected within 82,500-84,500 units (up from the prior expectation of 80,000-82,000 units). Income tax rate is anticipated to be 22-23% versus 23-23.5% expected earlier.

Zacks Rank

Currently, D.R. Horton, which shares space with PulteGroup Inc. PHM, NVR, Inc. NVR and Lennar Corporation LEN in the Zacks Building Products - Home Builders industry, carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.